A new wave of startup investment

By MG News | July 09, 2021 at 12:24 PM GMT+05:00

July 9, 2021 (MLN): A new wave of sizeable investment of around $125million has been witnessed by Pakistan’s startups in the first half of 2021, depicting a more than two-fold increase what the country’s startups had raised in all 2020.

It began in January, raising $13.5mn. then Fintech joined in, leading to a fruitful spring that witnessed seven raises from February to April, three of them for Fintech startups. The total funding raised during this period was $42.6mn.

In May, the startup hit $24.6mn, with three of which are Fintech startups. Then June had eight deals that unveiled $44.6mn. Of these, three were Fintech startups, and four were e-commerce companies, recent research by Forbes Middle East revealed.

The E-commerce sector tops the chart with a cumulative raising of $47.1mn, followed by Fintech with $44.1mn so far.

There has also been a number of successful, singular startup milestones. TAG, a digital payments startup, raised the largest pre-seed round ever in MENAP when it raised $5.5mn from a group of international investors. Jabberwock Ventures raised $20mn in April for its startups in Transportation and logistics. Tajir, a B2B e-commerce platform brought in a $17mn series A round, funded by one of the leading American VC firms Kleiner Perkins.

This new wave of funding is different because it is almost exclusively generated from the local market. There are powerful implications for future investors as they could reap the benefits by unlocking the country’s potential as a digital economy.

The opportunities available for investors in Pakistan become clearer when they get familiar with the investment environment in the country. "When one startup starts solving real problems that an average individual faces on a day-to-day basis, various sub-avenues open up," says Rabeel Warraich, Founder and CEO at Sarmayacar, a Pakistan-focused VC fund. "The Pakistan opportunity has now been bought into."

"We think that countries like Pakistan are reaching critical mass," James Lang, Managing Director of Liberty City Ventures, a seed-stage fund headquartered in New York City also an investor buying into Pakistan explained. "Emerging markets benefit from the lessons learned in mature markets allowing entrepreneurs to avoid mistakes and skip intermediate steps in development."

Pakistan's potential was never in doubt. The question was how to unlock the level of personalization. This wave of funding shows that investors are confident that the founder teams have begun to crack the code on execution. This new crop of startup founders has mature market experience. They are also benefiting from the qualifying data and the lessons learned from the earlier startups, Habibullah Khan, the founder of Penumbra, wrote.

"We have been very excited to see the potential and energy of Pakistani founders and to have built one more bridge between Pakistan and the rest of the global startup ecosystem," says Jeng Yang Chia, Principal at Saison Capital, the venture arm of Credit Saison. Saison made its first investments into Vietnam and the Philippines in 2021 and is now looking to do the same in Pakistan, the report added.

Investors seem to prefer founders who have the local market knowledge and past market so they can identify product-market fits. "Generally, we've backed founders who have seen or worked at great companies in the US and built products customized and optimized for the unique nature of the Pakistani market," says David Greenbaum, Partner at Quiet Capital, which led TAG's pre-seed round. Lang agrees. "Local knowledge is key. Beyond being a visionary, we look for founders who have a track record of execution and the capacity to build a team around them," he says.

Nevertheless, others in the local start-up scene point to challenges that need to be overcome. "Absence of an identity stack is the weakest link," says Ammar Habib Khan, Chief Risk Officer at Karandaaz, a nonprofit focused on digital access to finance. "The true potential of the Fintech space can only be unlocked through a robust identity stack enabling access to financial services for a largely underbanked and underinvested population."

Last year, Pakistan was the fourth biggest mover in the World Bank's Ease of Doing Business Index, which has not gone unnoticed by investors. The report is of view that that policy intervention will now be the key to preserve the startup investment momentum.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 129,757.45 141.10M |

1.22% 1558.02 |

| ALLSHR | 80,738.75 388.43M |

1.19% 951.13 |

| KSE30 | 39,707.93 56.53M |

1.54% 602.93 |

| KMI30 | 188,792.39 48.04M |

1.00% 1876.78 |

| KMIALLSHR | 54,600.90 173.55M |

0.74% 399.02 |

| BKTi | 34,695.41 27.97M |

3.64% 1218.73 |

| OGTi | 28,051.81 3.19M |

0.32% 89.23 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 106,915.00 | 106,930.00 105,440.00 |

1165.00 1.10% |

| BRENT CRUDE | 67.24 | 67.29 67.05 |

0.13 0.19% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 97.50 97.50 |

0.70 0.72% |

| ROTTERDAM COAL MONTHLY | 103.80 | 103.80 103.80 |

-3.45 -3.22% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.53 | 65.65 65.34 |

0.08 0.12% |

| SUGAR #11 WORLD | 15.70 | 16.21 15.55 |

-0.50 -3.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

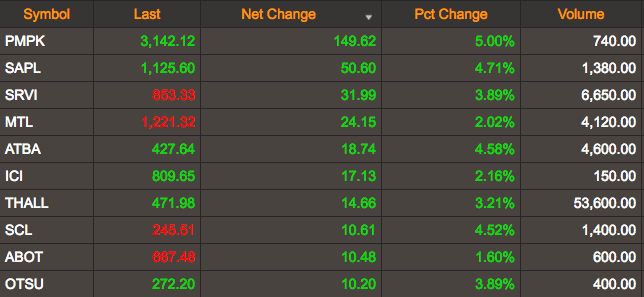

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI