Weekly Market Roundup

MG News | November 02, 2025 at 05:58 PM GMT+05:00

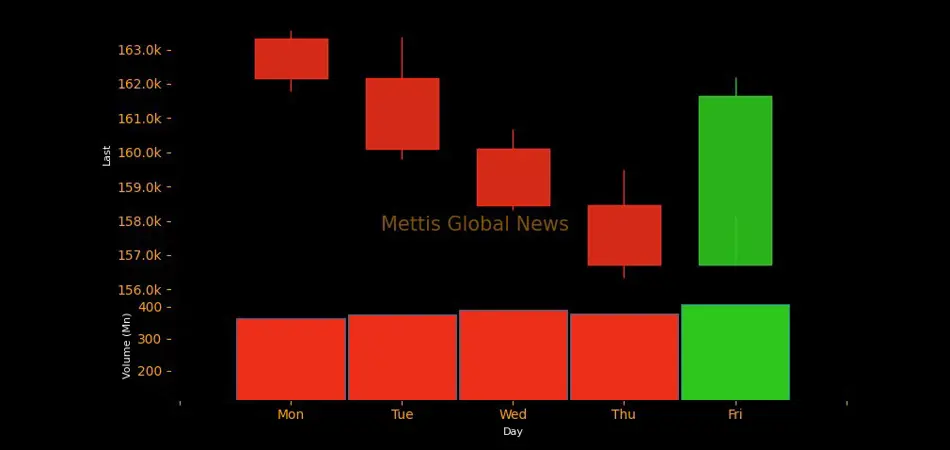

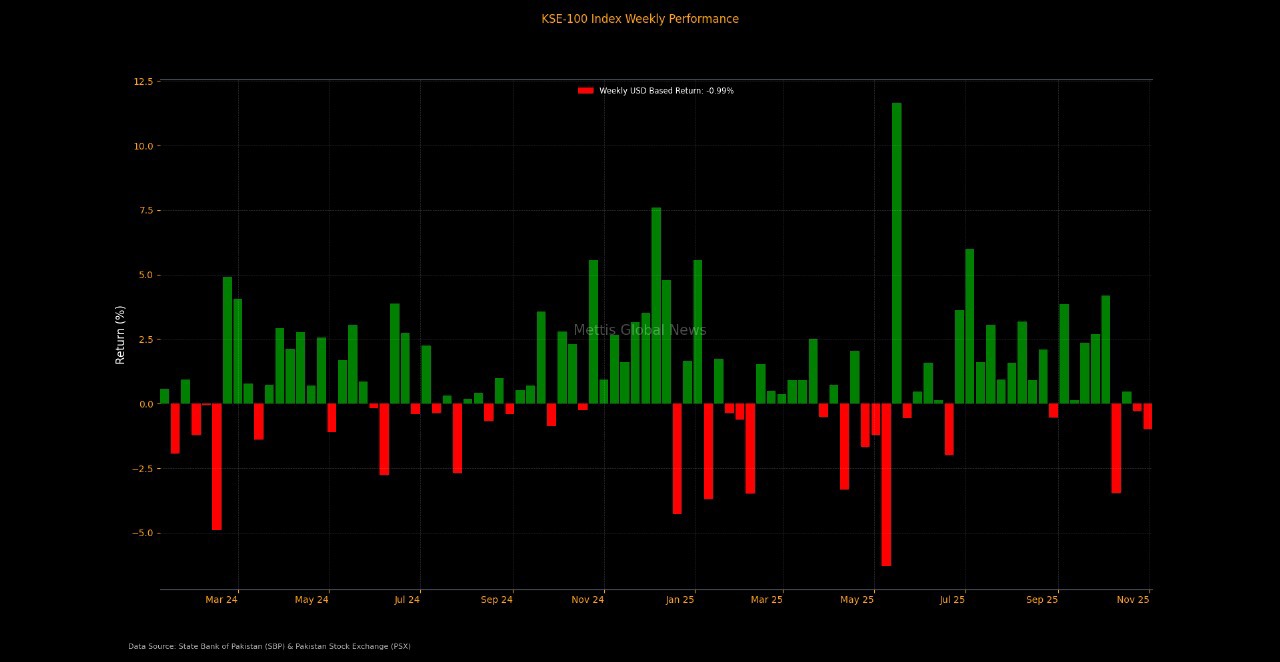

November 02, 2025 (MLN): The Pakistan Stock Exchange rode a roller-coaster this week: the KSE-100 closed at 161,631.73, down from 163,304.13 last week.

Early-week jitters over border tensions with Afghanistan sent markets into a tailspin, but a late-week twist, news of a potential ceasefire, sparked a dramatic 4,900-point rebound in the final session, proving sentiment here can flip faster than a coin.

_20251102120359738_23efd1.jpeg)

Despite the jaw-dropping intraday moves, the market’s balance sheet told a cautious story. Market cap eased to Rs4.772 trillion ($16.988 billion) from Rs4.833tr ($17.2005bn) last week._20251102120334172_a8a35b.jpeg)

On a dollar basis, investors felt the pinch more acutely; USD returns slid -0.98% this week, a steeper fall from -0.27% recorded last week.

During the week, the SBP left the policy rate at 11% for a fourth straight meeting.

Consumer sentiment crept up too, with the CCI rising to 40 in October from 37.7 in September, and bank deposits climbed 2.2% MoM to Rs 35.21 trillion.

Bank deposits swelled by 2.2% MoM to reach Rs 35.21 trillion by September-end.

On the external front, the SBP’s net FX purchases stood at $189 million in July, still active but at a slower pace than previous months.

Meanwhile, the central bank successfully mobilized Rs 1.34 trillion through MTB and PIB-FR auctions, underscoring healthy participation in the government debt market.

The rupee held its ground, closing around PKR 280.91 per USD, offering a sliver of stability.

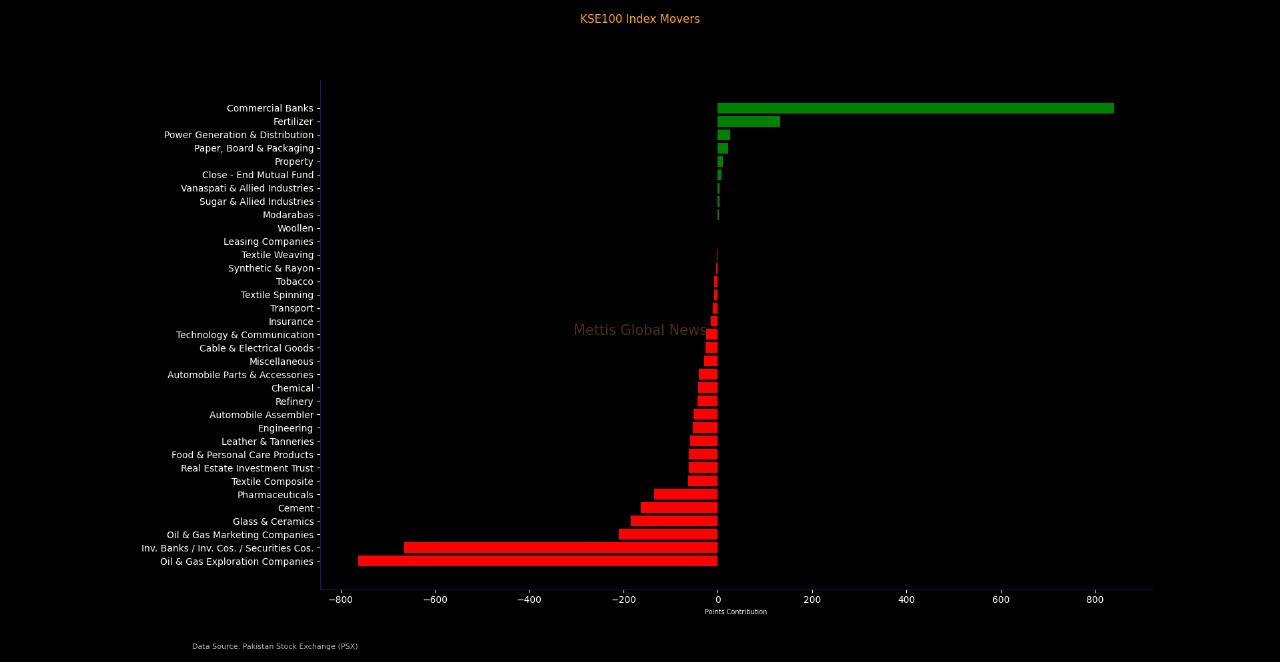

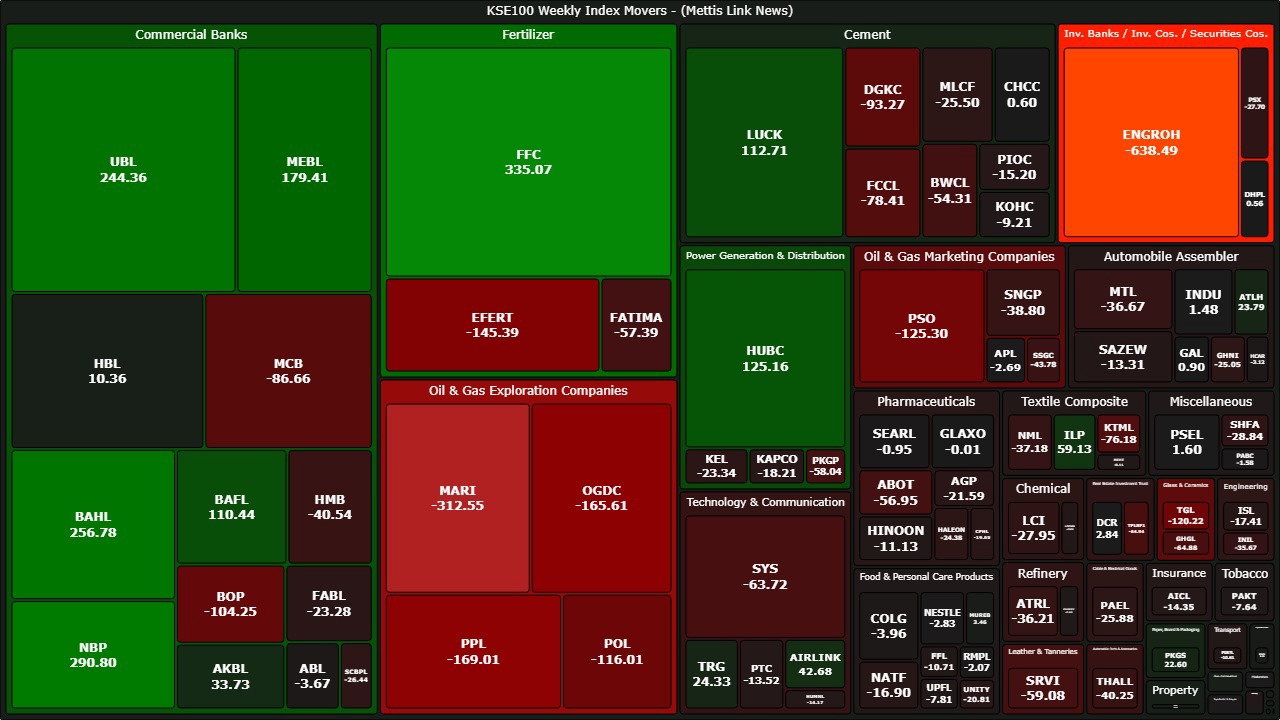

Index Movers

Sector-wise, it was a tale of two halves. The Oil & Gas Exploration sector bore the brunt of the selloff, dragging the index down by 763 points, followed closely by investment companies and oil marketing firms.

In contrast, Commercial Banks turned out to be the white knights of the week, contributing 841 points to the index, while Fertilizers and Power chipped in modest gains.

Banking heavyweights, including NBP, UBL, BAHL, and MEBL helped cushion the overall fall, while FFC led the charge from the fertilizer pack.

Among individual performers, FFC (+335 pts), NBP (+291 pts), and BAHL (+257 pts) emerged as major saviors, while the energy giants ENGROH (-638 pts), MARI (-313 pts), and PPL (-169 pts) dragged the index down.

The oil and gas sector remained under pressure amid profit-taking and global commodity uncertainties.

FIPI/LIPI:

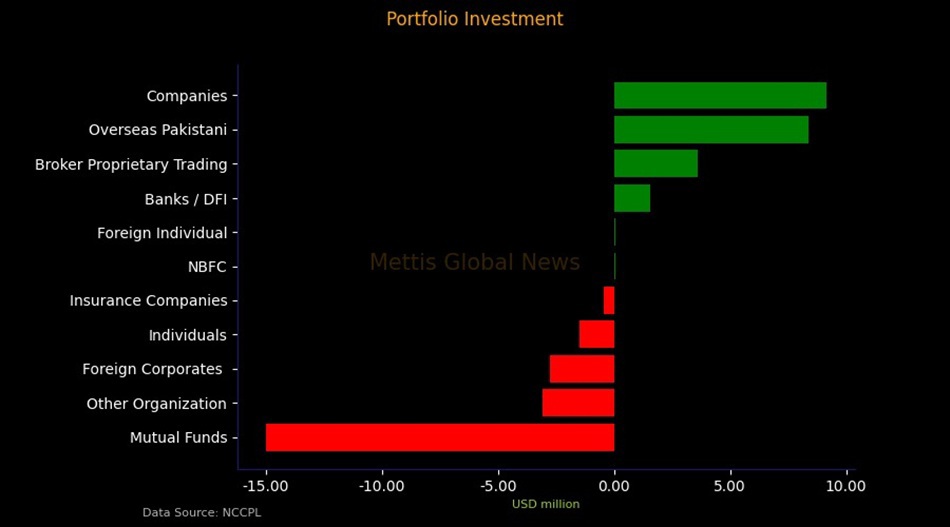

Foreign investors finally showed some appetite, posting a net inflow of $5.65 million, driven largely by overseas Pakistanis.

On the flip side, mutual funds and insurance companies offloaded over $15 million worth of shares, taking some profit off the table after recent rallies.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 188,202.86 341.59M | -0.20% -384.80 |

| ALLSHR | 112,423.22 745.46M | -0.07% -79.96 |

| KSE30 | 57,956.48 141.89M | -0.12% -70.41 |

| KMI30 | 267,375.33 135.18M | -0.39% -1043.48 |

| KMIALLSHR | 72,363.20 391.84M | -0.20% -146.78 |

| BKTi | 53,485.97 53.11M | 0.26% 139.85 |

| OGTi | 38,916.61 17.01M | 0.72% 278.13 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 87,690.00 | 88,985.00 87,550.00 | 105.00 0.12% |

| BRENT CRUDE | 66.17 | 66.78 65.00 | 0.58 0.88% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -2.65 -2.96% |

| ROTTERDAM COAL MONTHLY | 99.00 | 0.00 0.00 | 0.30 0.30% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.22 | 61.86 60.14 | 0.59 0.97% |

| SUGAR #11 WORLD | 14.93 | 14.98 14.74 | 0.14 0.95% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png?width=280&height=140&format=Webp)

SBP Interventions in Interbank FX Market

SBP Interventions in Interbank FX Market