Trade relief fuels oil price surge

MG News | July 28, 2025 at 10:59 AM GMT+05:00

July 28, 2025 (MLN): Oil prices climbed on Monday as the U.S. finalized a trade agreement with the European Union and signaled a possible extension of its tariff pause with China, easing fears that elevated tariffs could dampen economic activity and curb fuel demand.

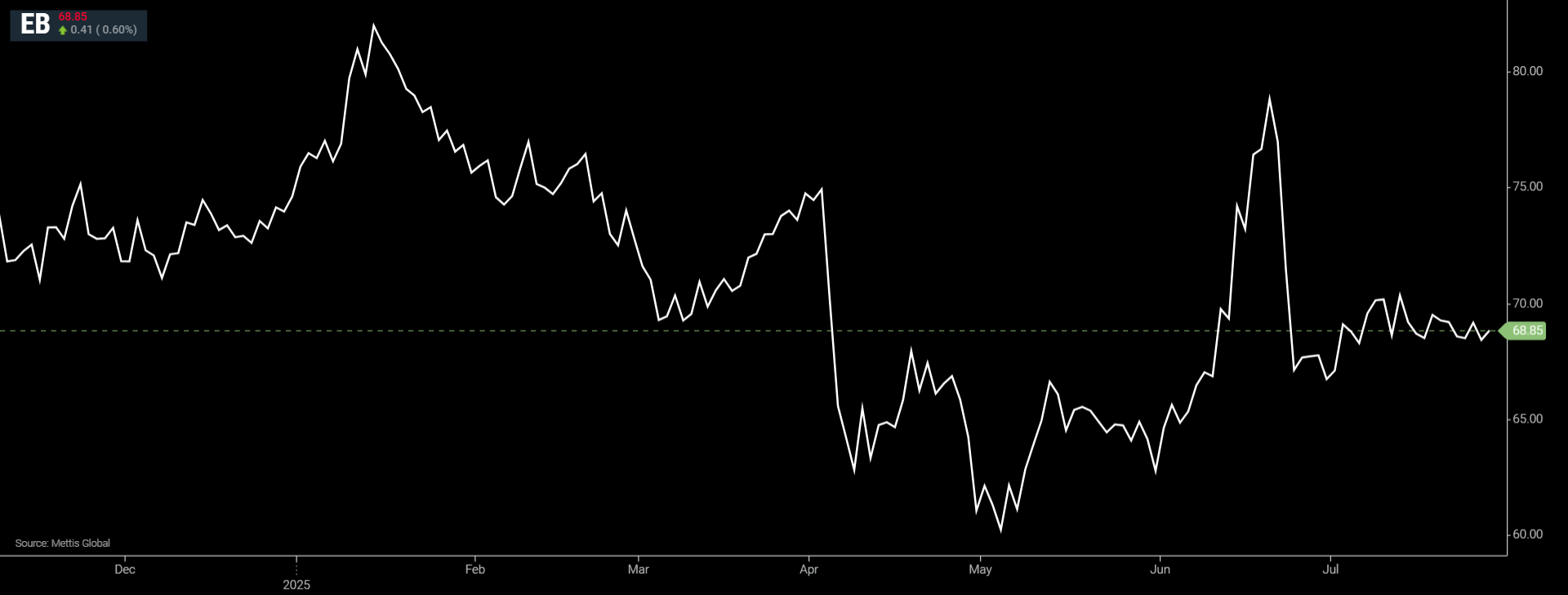

Brent crude futures increased by $0.41, or 0.6%, to $68.85 per

barrel.

West Texas Intermediate (WTI) crude futures rose by $0.39, or 0.6%, to $65.55 per barrel by [11:00 am] PST.

Investor sentiment was buoyed after the United States and European Union reached a framework trade agreement on Sunday, imposing a 15% tariff on most EU goods, half the rate previously threatened.

The deal helped avert a major trade war between the two allies, who together account for nearly one-third of global trade.

Analysts believe this outcome could support fuel

demand by reducing uncertainty in the global economy.

Adding to the optimism, senior U.S. and Chinese trade negotiators are set to meet in Stockholm later on Monday to discuss extending the current tariff truce ahead of the August 12 deadline.

Tony Sycamore,

analyst at IG Markets, noted that both the U.S.-EU deal and the potential

extension of the U.S.-China tariff pause are helping to lift global financial

markets and oil prices.

However, oil’s upward movement remains capped by supply-side developments, as CNBC reported

Prices had closed at a three-week low on Friday due to concerns over rising global supply and economic headwinds.

Venezuela’s state-owned oil company, PDVSA, is preparing to resume joint venture operations under a renewed framework.

This follows expectations that President Donald Trump will reinstate

licenses allowing partners to operate and export oil via swaps, reminiscent of

the Biden-era policy.

Meanwhile, the OPEC+ alliance is closely watching market dynamics.

A panel meeting scheduled for 1200 GMT Monday is not expected to recommend changes to the existing plan, which allows eight member countries to increase output by 548,000 barrels per day in August, according to OPEC+ sources.

One source noted it may still be too early to decide on future adjustments.

The group is focused on reclaiming market share, aided by robust

summer demand.

JP Morgan analysts reported that global oil demand rose by

600,000 barrels per day (bpd) in July year-on-year, while inventories increased

by 1.6 million bpd.

In geopolitical developments, Yemen’s Houthi rebels escalated threats, warning they would target any vessels operated by companies doing business with Israeli ports, regardless of nationality.

The statement

marks what they called the “fourth phase” of their military operations against

Israel amid the ongoing Gaza conflict.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 157,132.10 429.92M | 3.39% 5159.10 |

| ALLSHR | 93,566.86 763.32M | 2.62% 2388.00 |

| KSE30 | 48,302.97 218.66M | 4.27% 1976.50 |

| KMI30 | 220,798.52 207.58M | 4.07% 8628.34 |

| KMIALLSHR | 59,988.53 433.51M | 2.75% 1606.15 |

| BKTi | 46,193.08 61.76M | 4.26% 1887.06 |

| OGTi | 30,193.10 21.94M | 3.73% 1086.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,370.00 | 69,740.00 66,530.00 | -2110.00 -3.04% |

| BRENT CRUDE | 83.37 | 85.12 78.38 | 5.63 7.24% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -7.85 -7.32% |

| ROTTERDAM COAL MONTHLY | 139.05 | 139.50 129.00 | 20.25 17.05% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.27 | 77.58 70.41 | 5.04 7.08% |

| SUGAR #11 WORLD | 14.13 | 14.20 13.94 | 0.22 1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance