PSX Closing Bell: From Clouds to Stars

MG News | September 30, 2025 at 04:54 PM GMT+05:00

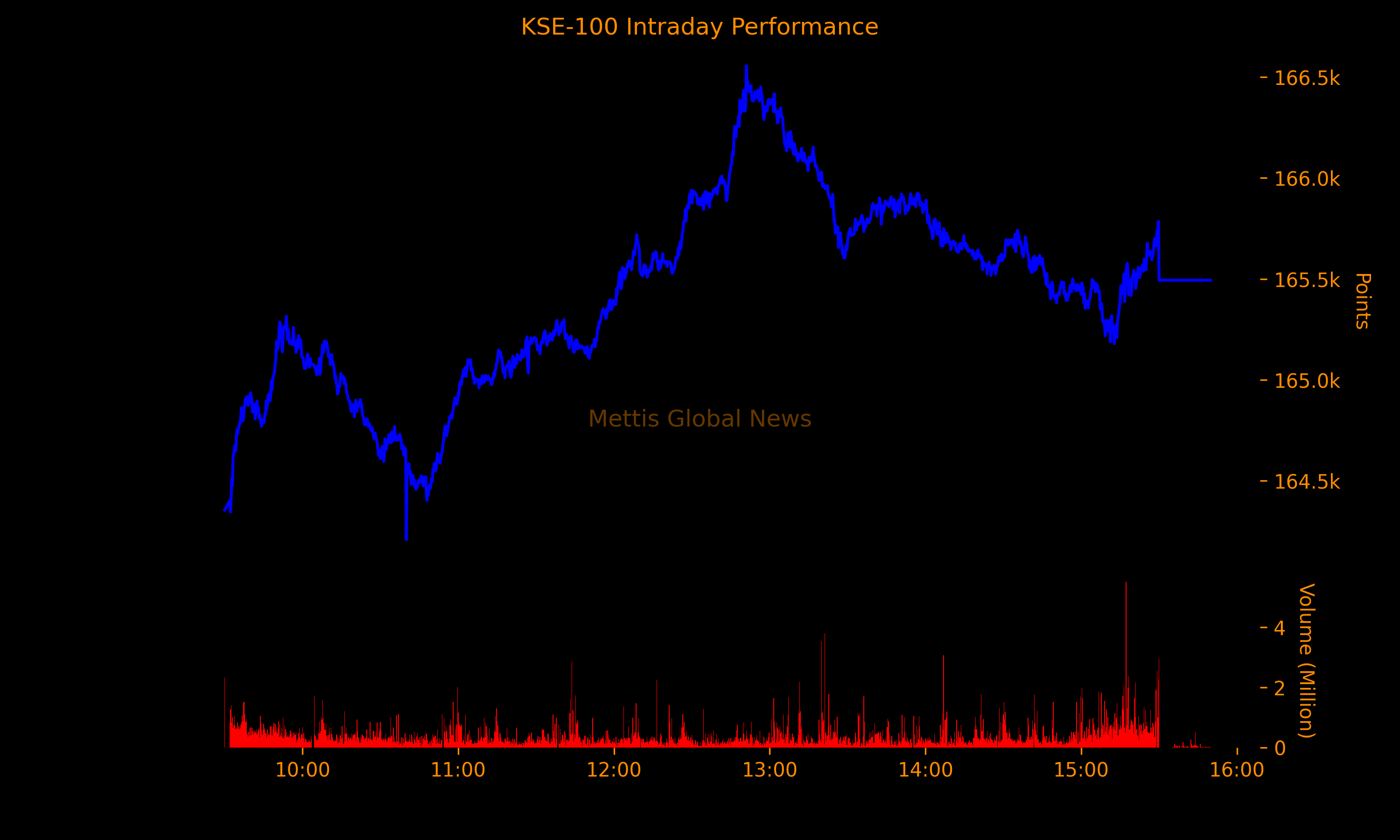

September 30, 2025 (MLN): Extending its bullish momentum, the benchmark KSE-100 Index closed Tuesday’s session at 165,493.58, marking a gain of 1,645.90 points or 1.00%.

The index traded positively throughout the day, hitting an intraday high of 166,556.29 (+2,708.61) points and a low of 164,208.33 (+360.65) points.

The rally was fueled by upbeat sentiments following the Asian Development Outlook (ADO) September 2025 report, released by the Asian Development Bank (ADB).

The report projected that Pakistan’s growth trajectory will continue in the medium term, with GDP growth forecast at 3.0% for FY2026, underpinned by macroeconomic stability and sustained reforms addressing structural vulnerabilities.

ADB acknowledged that economic reforms have advanced significantly under the IMF Extended Fund Facility (EFF) that commenced in October 2024.

However, it stressed that policy consistency and climate resilience remain critical to sustaining momentum, cautioning that downside risks persist.

“Pakistan’s growth prospects remain positive,” said Emma Fan, ADB Country Director for Pakistan. “But the country continues to face structural challenges, compounded by recurring disasters such as the recent floods.

In this context, consistent reforms and policy implementation are essential for reinforcing policy credibility, sustaining economic momentum, and enhancing resilience, she added.

Looking ahead, ADB expects economic activity to strengthen in FY2026, aided by improved external buffers and renewed business confidence, particularly following the US-Pakistan trade agreement.

The total volume of the KSE-100 Index was 629.99 million shares.

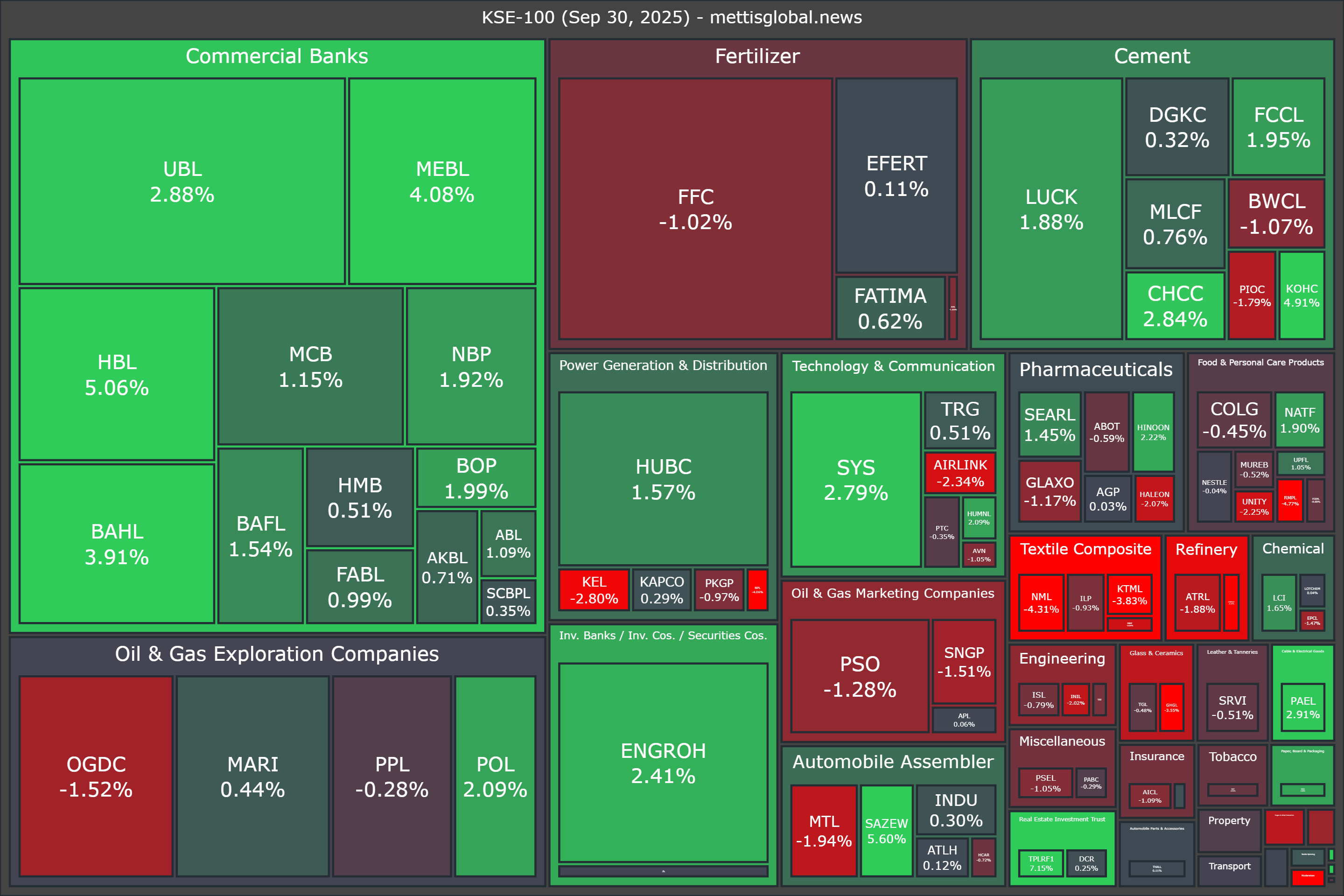

Of the 100 index companies 49 closed up, 50 closed down, while 1 were unchanged.

Top gainers during the day were YOUW (+7.31%), TPLRF1 (+7.15%), POML (+6.89%), SAZEW (+5.60%), and HBL (+5.06%).

On the other hand, top losers were FHAM (-4.92%), RMPL (-4.77%), CNERGY (-4.47%), NML (-4.31%), and NPL (-4.06%).

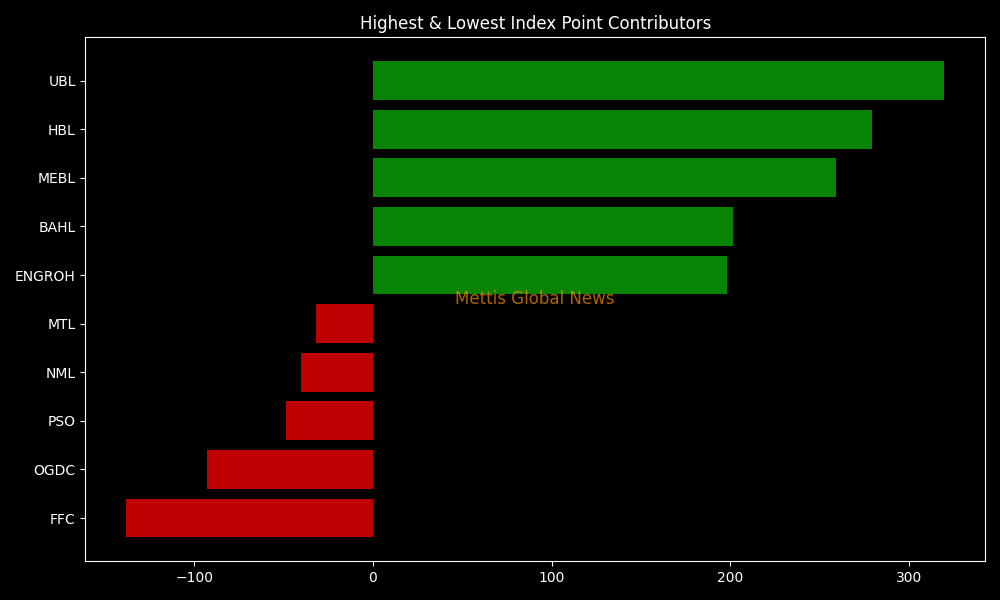

In terms of index-point contributions, companies that propped up the index were UBL (+319.59pts), HBL (+278.98pts), MEBL (+259.28pts), BAHL (+201.39pts), and ENGROH (+198.26pts).

Meanwhile, companies that dragged the index lower were FFC (-137.93pts), OGDC (-93.09pts), PSO (-48.78pts), NML (-39.99pts), and MTL (-31.80pts).

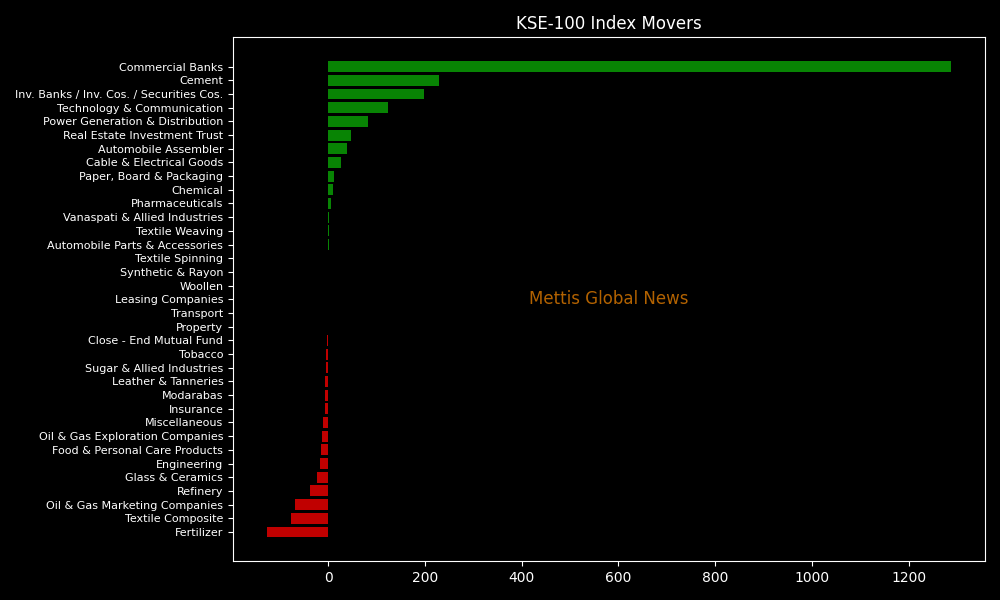

Sector-wise, KSE-100 Index was supported by Commercial Banks (+1287.37pts), Cement (+229.40pts), Inv. Banks / Inv. Cos. / Securities Cos. (+198.10pts), Technology & Communication (+123.50pts), and Power Generation & Distribution (+82.63pts).

While the index was let down by Fertilizer (-126.11pts), Textile Composite (-77.56pts), Oil & Gas Marketing Companies (-68.99pts), Refinery (-37.34pts), and Glass & Ceramics (-22.75pts).

In the broader market, the All-Share Index closed at 52,878.09 with a net gain of 518.99 points or 0.99%.

Total market volume was 1,349.80 million shares compared to 1,285.64m from the previous session while traded value was recorded at Rs76.77 billion showing an increase of Rs11.01bn.

There were 544,476 trades reported in 488 companies with 176 closing up, 288 closing down, and 24 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| WTL | 1.74 | -4.40% | 113,573,124 |

| PAEL | 56.68 | 2.91% | 110,391,976 |

| BOP | 27.15 | 1.99% | 94,026,621 |

| KEL | 6.95 | -2.80% | 87,989,628 |

| TREET | 31.85 | 5.57% | 73,560,380 |

| CNERGY | 8.33 | -4.47% | 45,604,005 |

| FCCL | 61.05 | 1.95% | 30,026,511 |

| PACE | 14.01 | 9.97% | 29,269,096 |

| DCL | 15.22 | 0.86% | 26,939,983 |

| TELE | 9.23 | -1.81% | 24,873,142 |

To note, the KSE-100 has gained 39,866 points or 31.73% during the fiscal year, whereas it has increased 50,367 points or 43.75% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,480.15 378.01M | -6.99% -11015.95 |

| ALLSHR | 88,401.15 613.63M | -6.18% -5825.86 |

| KSE30 | 44,996.51 162.61M | -6.90% -3333.70 |

| KMI30 | 210,039.41 136.40M | -6.52% -14647.92 |

| KMIALLSHR | 57,315.72 369.31M | -5.79% -3523.37 |

| BKTi | 42,364.50 67.24M | -6.87% -3125.46 |

| OGTi | 31,480.49 21.12M | -1.88% -602.98 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 68,155.00 | 68,625.00 65,685.00 | -140.00 -0.21% |

| BRENT CRUDE | 104.38 | 119.50 99.00 | 11.69 12.61% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 101.58 | 119.48 96.25 | 10.68 11.75% |

| SUGAR #11 WORLD | 14.32 | 14.48 14.25 | 0.22 1.56% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260126121902577_b63c19.webp?width=280&height=140&format=Webp)