PSO set to hit Rs645/Share

MG News | October 08, 2025 at 05:24 PM GMT+05:00

October 08, 2025 (MLN): Pakistan State Oil

(PSX:PSO) is set to hit a target price of Rs645.1/share in June 2026,

offering an upside of 36.5% from the last closing of Rs472.6/share.

Arif Habib Ltd has issued a BUY recommendation, supported by improving liquidity dynamics, market leadership, and the anticipated uplift from overdue OMC margin revisions.

After years of liquidity strain driven by circular debt in the RLNG and power sectors, PSO’s financial position is showing a marked turnaround.

With substantial progress achieved on power

sector circular debt resolution, the company’s working capital constraints

have eased significantly, while gas circular debt resolution is emerging

as the next key re-rating catalyst.

PSO currently maintains an over

100% receivable rate from SNGP which shows improved recoveries and enhanced

operational discipline.

Arif Habib Ltd projects earnings

per share (EPS) to reach Rs79.71 in FY26e and Rs90.95 in FY27f, driven by

lower finance costs, recovering fuel demand, and margin enhancement.

At current levels, PSO trades at 5.9x and 5.2x FY26/27 P/E, below historical and sector averages, highlighting attractive valuations relative to its improving fundamentals.

|

Metric |

3M |

6M |

12M |

|

Return (%) |

23 |

19.4 |

165.9 |

|

Avg. Volume (mn) |

5.7 |

4.9 |

5.3 |

|

ADTV (mn) - PKR |

2452.5 |

1992.3 |

1924.7 |

|

ADTV (000) - USD |

8697 |

7065.1 |

6862.9 |

|

High Price - PKR |

486.6 |

486.6 |

486.6 |

|

Low Price - PKR |

375.9 |

311.6 |

177.8 |

SOURCE: PSX, AHL Research

Following the government’s energy

sector reforms which incorporated diverted

RLNG costs into gas pricing PSO’s

liquidity position has improved sharply.

Trade debts declined from Rs400bn in

Dec’23 to Rs310bn in Jun’25, while short-term

borrowings were reduced from Rs445bn to Rs356bn over the same period, according

to the brokerage.

Supported by debt repayments and lower

interest rates, finance costs fell to Rs34bn in FY25 (vs. Rs52bn in FY24)

and are expected to decline further to Rs23bn and Rs18bn in FY26/27,

respectively.

The resolution of power sector

circular debt alone is estimated to add around Rs 100/share to PSO’s

valuation.

As payments from CPPA-G to RLNG-based

power plants (NPPMCL, QATPL, and Nandipur) flow through SNGP, PSO is expected

to benefit directly though with some lag

in cash realization.

Meanwhile, the revision in OMC

margins remains a critical profitability lever.

OGRA has proposed a Rs1.13/litre

increase in MS and HSD margins, lower than industry expectations but still

supportive for PSO’s earnings.

Arif Habib Ltd assumes margins of Rs8.53/litre

effective 3QFY26, with future adjustments expected in line with inflation.

As a result, gross margins are projected to improve to 3.02% in FY26 and

3.22% in FY27, up from 3.07% in FY25.

The petroleum sector posted a strong

rebound in FY25, with total offtake up 7% YoY to 16.3mn tons, and

continued momentum in 1QFY26 (+6% YoY to 3.9mn tons) despite adverse weather.

PSO remains the market leader with a 41% share in MS and 46% in HSD,

positioning it to capture the recovery in volumes.

Further liquidity gains are expected

from the settlement of legacy claims, including Rs14.8bn received

under HUBC’s settlement and recovery of nearly all Price Differential

Claims (PDCs).

Outstanding PDCs of Rs2.2bn as of

Jun’25 are expected to be recovered soon.

Additionally, the government has approved a Rs1.87/litre

increase in IFEM to address PSO’s Rs74bn sales tax refund backlog,

ensuring liquidity continuity.

While the short-term outlook remains

strong, certain medium-term challenges persist. The gas circular debt

buildup is unlikely to accelerate during the IMF program but may resurface

afterward, given Pakistan’s rising reliance on imported RLNG a structure that appears increasingly

unsustainable.

A price reopener for RLNG volumes

scheduled in Feb’26 could bring some relief, but a sharp reduction in PSO’s

contracted RLNG volumes appears unlikely due to Pakistan’s strategic ties

with Qatar, declining domestic gas reserves, and PSO’s favorable

long-term supply contracts.

Competition is also intensifying, with Gas & Oil Pakistan (GO) capturing part of PSO’s market through Aramco-backed discounted supplies, and WAFI Energy’s acquisition of Shell Pakistan including its outlets, lubricant plant, and 26% PAPCO stake adding further pressure.

However, with

improved liquidity and reduced leverage, PSO is well-positioned to strengthen

its retail network and protect market share.

Meanwhile, OMCs continue to argue that OGRA’s proposed Rs1.13/litre increase remains inadequate given rising business costs, posing potential downside risk if inflation accelerates.

On the

receivables side, recovery from GENCO (Rs68bn) remains uncertain despite

ongoing asset swap discussions, while dues from PIA (Rs14bn) also

appear doubtful.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

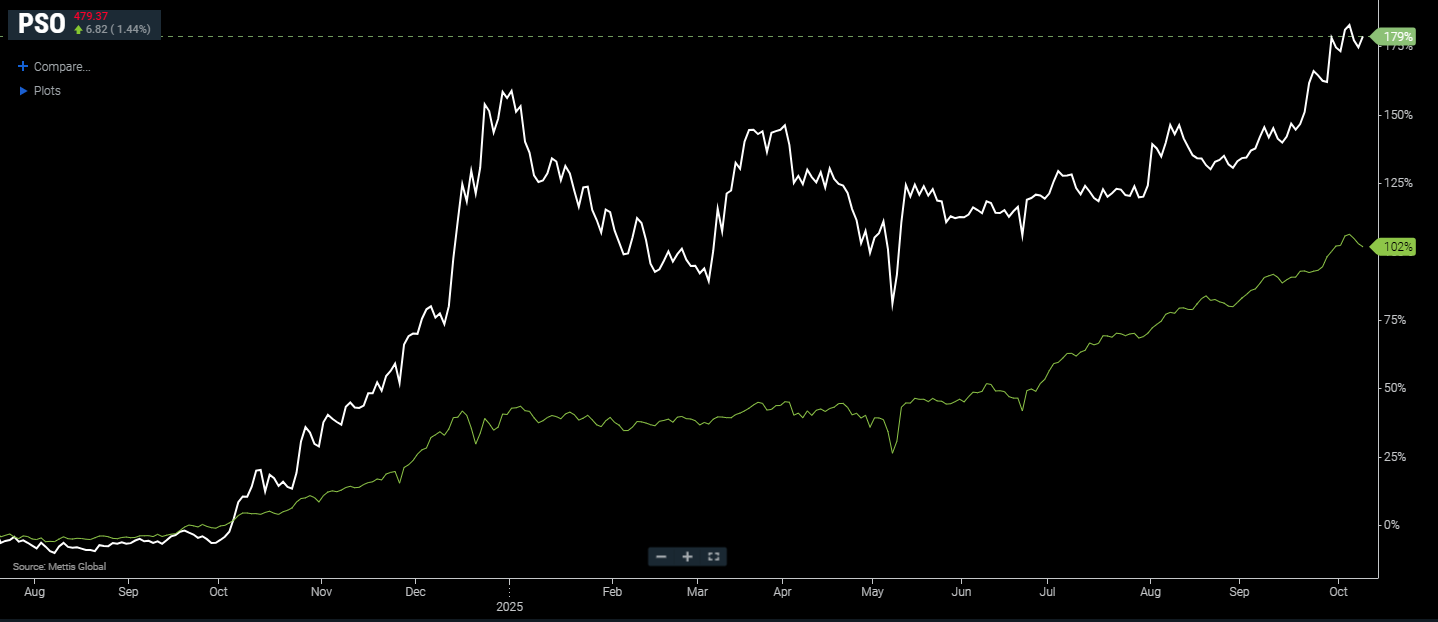

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes