PRL sees a turnaround in yearly earnings

MG News | August 16, 2021 at 05:36 PM GMT+05:00

Aug 16, 2021 (MLN): The local bourse retreated on Monday as investors closely watched geo political implications of Afghan Taliban’s taking over their control in Afghanistan. This situation has pushed the investors’ interest into panic selling.

However, recovery was seen in the last hours where the index found support from the major technical levels. On the news front, LSM marked a growth of 14.85% in FY21 (16-year high) and APG has improved Pakistan’s rating after fulfilling 35 out of 40 recommendations of FATF against money laundering, terror financing and others, market closing note by Pearl Securities noted.

Accordingly, the Benchmark KSE100 index ended the trading session on Monday with a 257.05 point or 0.54 percent decline to close at 46,912.79.

The Index remained negative throughout the session touched an intraday low of 46,673.55

The Benchmark KSE100 index ended the trading session on Monday with a 257.05 point or 0.54 percent decline to close at 46,912.79.

The Index remained negative throughout the session touching an intraday low of 46,673.55

Of the 97 traded companies in the KSE100 Index 24 closed up 72 closed down, while 1 remained unchanged. Total volume traded for the index was 88.22 million shares.

Sector wise, the index was let down by Cement with 66 points, Power Generation & Distribution with 28 points, Textile Composite with 28 points, Commercial Banks with 19 points and Oil & Gas Exploration Companies with 19 points.

The most points taken off the index was by LUCK which stripped the index of 28 points followed by HUBC with 17 points, PPL with 15 points, CHCC with 14 points and ANL with 13 points.

Sectors propping up the index were Fertilizer with 7 points, Paper & Board with 3 points, Engineering with 2 points, Glass & Ceramics with 1 points and Real Estate Investment Trust with 1 points.

The most points added to the index was by EFERT which contributed 12 points followed by BAHL with 8 points, ENGRO with 5 points, POL with 5 points and UNITY with 5 points.

All Share Volume increased by 38.44 Million to 251.81 Million Shares. Market Cap decreased by Rs.55.15 Billion.

Total companies traded were 470 compared to 452 from the previous session. Of the scrips traded 120 closed up, 329 closed down while 21 remained unchanged.

Total trades increased by 14,455 to 103,266.

Value Traded increased by 0.87 Billion to Rs.10.15 Billion

| Company | Volume |

|---|---|

| Worldcall Telecom | 22,213,000 |

| Telecard | 19,384,500 |

| TRG Pakistan | 13,723,222 |

| Azgard Nine | 13,289,500 |

| Treet Corporation | 12,620,500 |

| Byco Petroleum Pakistan | 10,043,000 |

| Image Pak Ltd(R) | 8,172,000 |

| TPL Corp | 6,417,500 |

| Silkbank | 6,317,000 |

| Unity Foods | 6,012,964 |

| Sector | Volume |

|---|---|

| Technology & Communication | 74,057,622 |

| Food & Personal Care Products | 31,816,384 |

| Textile Composite | 16,691,650 |

| Refinery | 13,434,849 |

| Commercial Banks | 12,909,137 |

| Cement | 10,872,765 |

| Power Generation & Distribution | 9,181,303 |

| Synthetic & Rayon | 8,878,800 |

| Chemical | 8,757,490 |

| Engineering | 8,736,793 |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

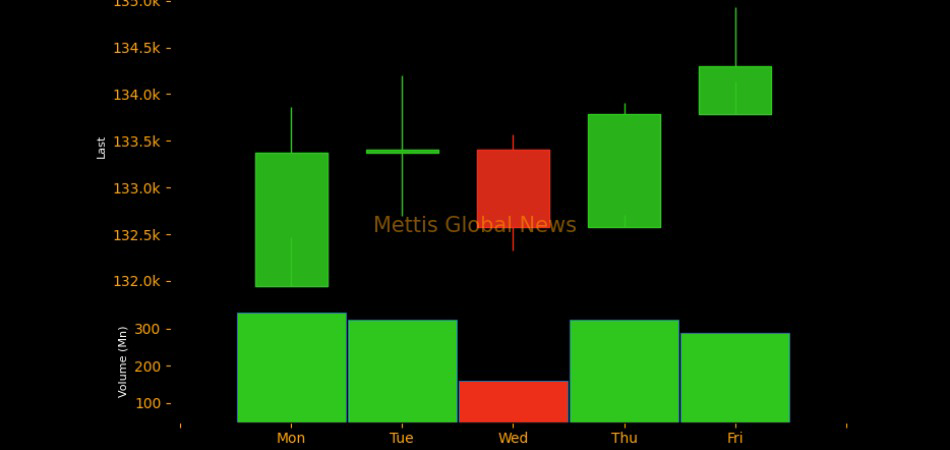

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|