Oil slips as Russia restarts exports; Ukraine strikes keep risks high

MG News | November 17, 2025 at 05:46 PM GMT+05:00

November 17, 2025 (MLN): Oil prices eased as trading opened on Monday after Russia resumed crude loadings at the Novorossiysk export terminal, ending a two-day halt caused by a Ukrainian drone strike on the Black Sea facility.

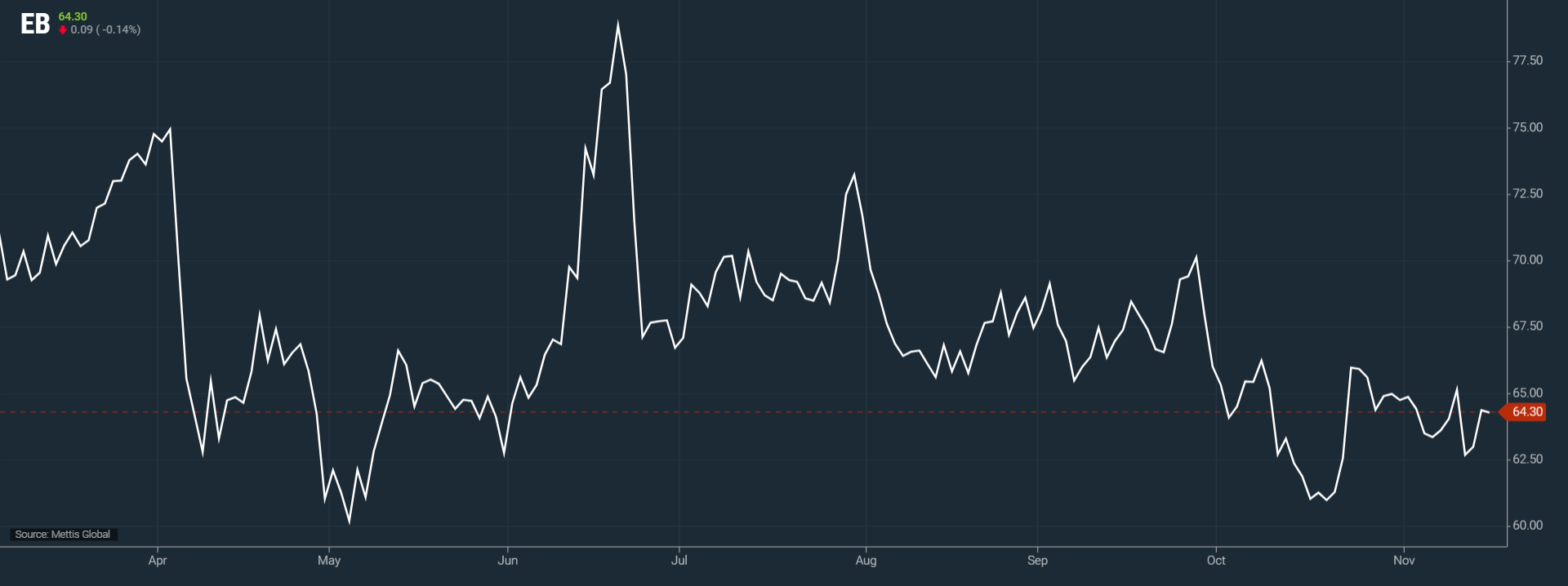

Brent crude futures went down by $0.09, or 0.14%, to $64.30

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.27, or 0.16, to $59.93 per barrel by [1:05 pm] PST.

The brief suspension along with disruptions at a nearby

Caspian Pipeline Consortium terminal had pushed both Brent and WTI up more than

2% on Friday, helping them finish the week slightly higher. The shutdown

affected nearly 2% of global crude supply.

Industry sources and LSEG shipping data confirmed that

operations at Novorossiysk restarted on Sunday. Still, markets remain on edge

as Ukraine continues to target Russian energy sites.

Over the weekend, Ukraine’s military reported hitting

Russia’s Ryazan refinery, while Kyiv’s General Staff said another strike

damaged the Novokuibyshevsk plant in the Samara region. Analysts say these

attacks could influence Russia’s export outlook in the months ahead.

“Investors are assessing how repeated Ukrainian strikes

might impact Russia’s crude flows in the long run,” said Toshitaka Tazawa,

analyst at Fujitomi Securities.

Western sanctions are another major factor shaping

expectations. The United States has imposed restrictions barring transactions

with Russian oil giants Lukoil and Rosneft after November 21, aiming to

pressure Moscow toward negotiations over the Ukraine conflict.

President Donald Trump also signaled on Sunday that Republicans are drafting

legislation to penalize any country conducting business with Russia and

suggested Iran may be included in future sanctions.

Meanwhile, OPEC+ recently confirmed that its December

production target will rise by 137,000 barrels per day, mirroring the increases

for October and November. The alliance plans to pause further hikes in the

first quarter of 2026.

In a new outlook, ING said the oil market is likely to stay in a substantial surplus through 2026. However, it cautioned that supply risks are intensifying due to drone attacks on Russian energy infrastructure and geopolitical tensions in the Middle East.

The bank highlighted Iran’s

seizure of a vessel in the Gulf of Oman a critical passage for roughly 20

million bpd of global oil shipments.

Positioning data shows speculators boosted net long ICE Brent holdings by 12,636 lots last week, bringing the total to 164,867 lots as of Tuesday. ING noted the increase was largely driven by short-covering, showing traders’ reluctance to bet against crude amid growing uncertainties around supply and sanctions.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,735.26 129.45M | 0.39% 649.68 |

| ALLSHR | 101,691.25 343.52M | 0.46% 470.53 |

| KSE30 | 50,933.17 53.14M | 0.32% 161.15 |

| KMI30 | 241,103.27 64.15M | 0.49% 1179.93 |

| KMIALLSHR | 66,385.16 186.40M | 0.52% 342.36 |

| BKTi | 45,094.44 4.53M | -0.03% -11.95 |

| OGTi | 33,790.94 10.15M | 0.62% 207.89 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,750.00 | 92,045.00 89,800.00 | 2150.00 2.40% |

| BRENT CRUDE | 63.90 | 63.94 63.63 | 0.15 0.24% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.23 | 60.29 59.97 | 0.15 0.25% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|