Oil slips amid global growth fears triggered by fresh U.S. tariff

MG News | August 08, 2025 at 03:16 PM GMT+05:00

August 08, 2025 (MLN): Oil prices held steady during early Asian trading on Friday but remained on track for their sharpest weekly decline since late June, as newly imposed tariffs on Thursday raised investor concerns about potential damage to the global economy.

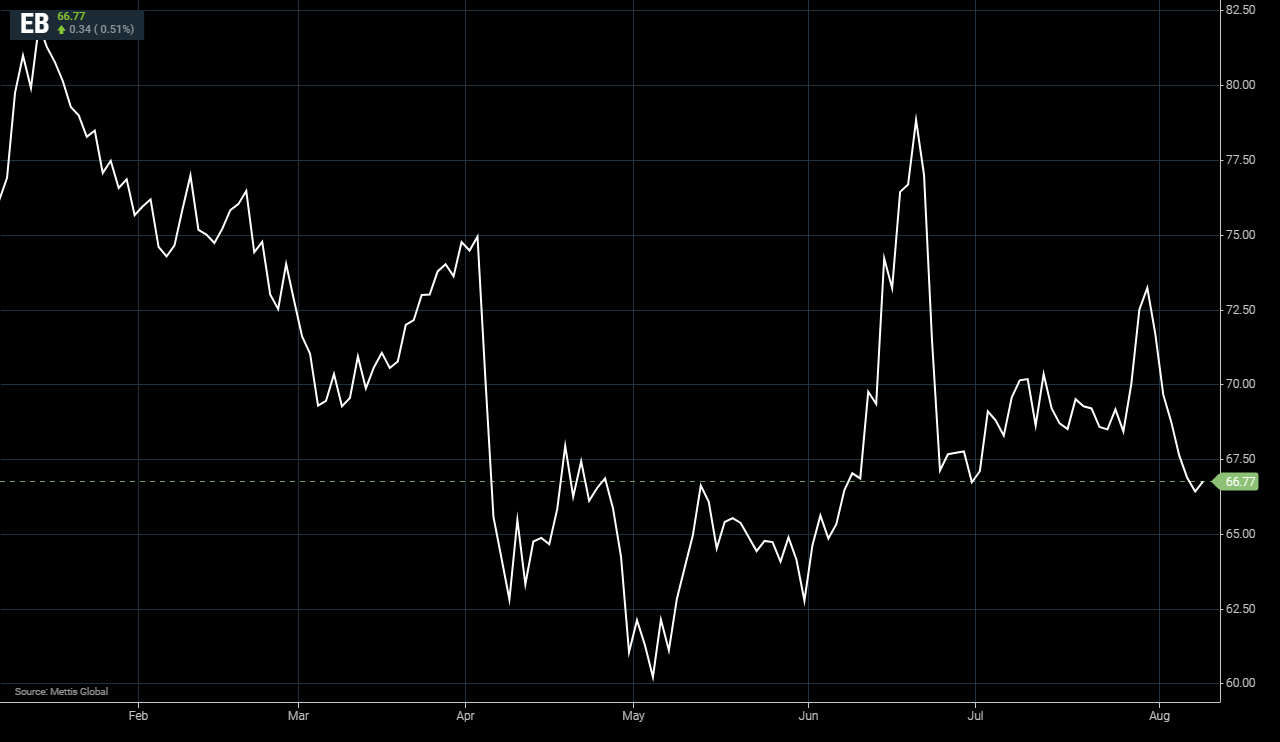

Brent crude futures decreased by $0.34 or 0.51%, to $66.77 per barrel.

West Texas Intermediate (WTI) crude futures fall

by $0.30, or 0.47%, to $64.18 per barrel by [3:05 pm] PST.

U.S. tariffs targeting several trade partners came into force on

Thursday, fueling fears of a slowdown in economic activity and reduced crude

demand according to a note from ANZ Bank analysts.

Oil prices were already under pressure following OPEC+’s decision last

weekend to completely phase out its largest production cuts by September months

earlier than previously planned.

By Thursday’s close WTI futures had declined for six straight sessions

matching the losing streak last seen in December 2023. A further drop on Friday

would mark the longest decline since August 2021.

Further weighing on the oil market, the Kremlin confirmed on Thursday

that Russian President Vladimir Putin would soon meet U.S. President Donald

Trump, raising hopes for a diplomatic resolution to the Ukraine conflict.

Meanwhile, new U.S. tariffs imposed on India over its purchases of

Russian crude helped soften the fall in oil prices. However, analysts at StoneX

noted on Thursday that the move is unlikely to significantly disrupt Russian

oil exports to global markets.

Trump also stated on Wednesday that China Russia’s biggest crude buyer could

face similar tariffs to those applied to Indian imports.

Copyright Mettis Link

News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.51 | 63.96 62.34 | -1.24 -1.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|