Oil slides on weak demand outlook, rising inventories

MG News | October 20, 2025 at 12:29 PM GMT+05:00

October 20, 2025 (MLN): Oil prices extended their decline on Monday as escalating trade tensions between the United States and China, coupled with mounting concerns over a growing supply glut, weighed heavily on global energy markets.

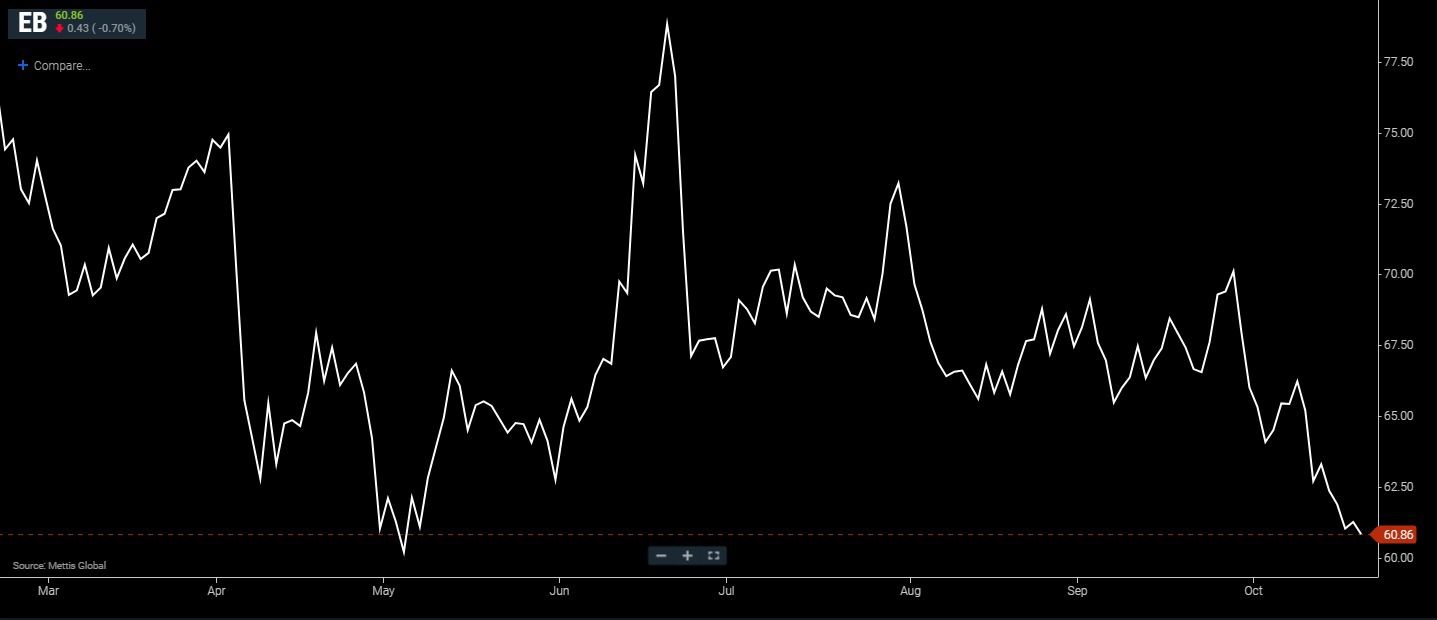

Brent crude futures went up by $0.43, or 0.70%, to $60.86

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.49, or 0.85%, to $57.05 per barrel by [12:20 pm] PST.

The renewed trade dispute between the world’s two largest

economies has clouded the outlook for global energy demand. Washington’s recent

decision to reimpose tariffs on Chinese imports along with sanctions targeting

key commodities, including Chinese cooking oil has sparked fears of a slowdown

in industrial activity.

Analysts warn that the economic strain on both nations

could dampen fuel consumption across manufacturing and transportation sectors,

further depressing global oil demand.

Market strategists say the revived trade hostilities have

injected fresh uncertainty into the global economy, undermining investor

confidence in commodity markets.

The World Trade Organization (WTO) has urged both sides

to de-escalate, warning that a prolonged rift could slash long-term global

economic growth by up to 7%.

Adding to the bearish sentiment are concerns over an

expanding supply surplus. The International Energy Agency (IEA) has projected a

record oil glut of nearly 4 million barrels per day (bpd) by 2026 equivalent to

roughly 4% of global demand.

The surge is being driven by rising production from OPEC+

members and non-OPEC producers, even as demand growth remains sluggish. The

latest IEA outlook suggests that this imbalance will continue to exert downward

pressure on prices.

Data from the U.S. Energy Information Administration

(EIA) revealed that U.S. commercial crude inventories climbed to a five-week

high of 423.8m barrels as of October 10, marking a 0.8% increase year-on-year.

When including barrels held in the Strategic Petroleum

Reserve, total inventories reached a four-month peak, stressing persistent

oversupply concerns. Although gasoline and distillate fuel stocks dipped

slightly, the overall trend remains bearish for crude markets.

Despite some easing in geopolitical tensions following

plans for an upcoming summit between U.S. President Donald Trump and Russian

President Vladimir Putin to discuss the Ukraine conflict, oil prices have yet

to find stable footing.

Analysts note that while reduced geopolitical risk may

lower the traditional price premium, it also introduces new uncertainties about

future global energy supply dynamics.

In a bid to bring more transparency and stability to the

market, OPEC has initiated a review of member nations’ production capacities

using independent consultancy assessments instead of self-reported data.

The move comes ahead of the 2026 quota negotiations and

is part of OPEC’s broader strategy to recalibrate supply amid growing pressure

to maintain price stability.

Bank of America analysts expect oil prices to find a

potential floor near $55 per barrel, noting that some investors may view

current levels as attractive for long term positioning.

However, the bank cautions that prices are likely to

remain below $60 in the near term until there is a meaningful improvement in

supply-demand fundamentals and a reduction in geopolitical uncertainty.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes