Oil slides amid 2026 oversupply concerns

MG News | November 25, 2025 at 01:18 PM GMT+05:00

November 25, 2025 (MLN): Oil prices eased on Tuesday as concerns that supply could exceed demand in 2026 outweighed worries about restricted Russian shipments amid ongoing Ukraine war talks.

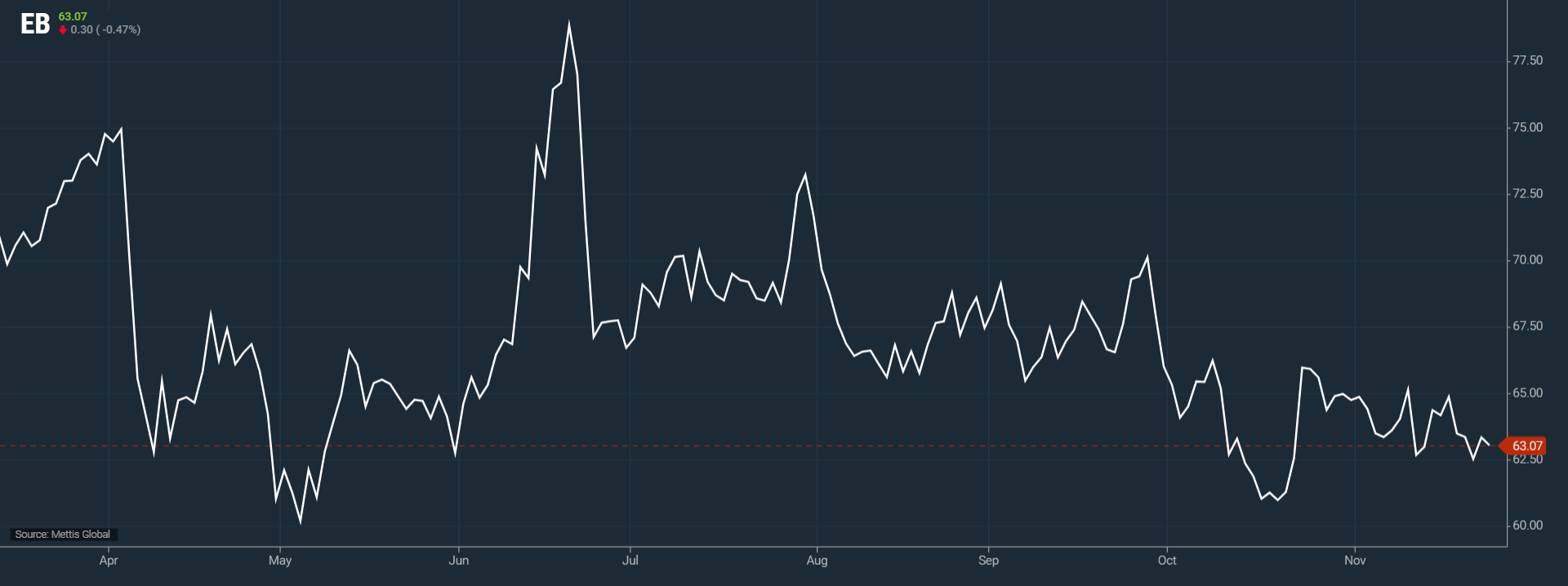

Brent crude futures went down by $0.30, or 0.47%, to $63.07

per barrel.

West Texas Intermediate (WTI) crude futures decreased by $0.48,

or 0.28%, to $58.56 per barrel by [1:10 pm] PST.

Both crude benchmarks had risen 1.3% on Monday as doubts

over a Russia-Ukraine peace deal supported prices, limiting expectations for

unrestricted Russian crude and fuel supplies under Western sanctions.

“Short-term, the key risk is oversupply, and current price

levels appear vulnerable,” said Priyanka Sachdeva, senior market analyst at

Phillip Nova, according to CNBC.

New sanctions on Russian oil majors Rosneft and Lukoil,

along with restrictions on selling refined Russian products to Europe, have led

some Indian refiners, including Reliance, to reduce Russian oil purchases.

With limited options, Russia is seeking to expand exports to

China.

Russian Deputy Prime Minister Alexander Novak noted that

Moscow and Beijing are discussing ways to increase Russian crude shipments to

the Chinese market.

Analysts remain focused on potential supply-demand

imbalances. Deutsche Bank forecasts a 2026 crude oil surplus of at least 2

million barrels per day, with no clear path back to deficits even by 2027.

Oil markets are also finding some support from expectations

that the U.S. may cut interest rates at its December 9-10 policy meeting,

following signals from Federal Reserve members.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 71,620.00 | 72,235.00 67,615.00 | 3155.00 4.61% |

| BRENT CRUDE | 81.12 | 84.48 80.70 | -0.28 -0.34% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 123.00 | 124.00 123.00 | -5.00 -3.91% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 73.96 | 77.23 73.56 | -0.60 -0.80% |

| SUGAR #11 WORLD | 13.81 | 14.07 13.78 | -0.12 -0.86% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction