Oil prices steady as drone srikes on Russian refineries stir market concerns

MG News | September 15, 2025 at 12:57 PM GMT+05:00

September 15, 2025 (MLN): Oil prices held steady on Monday as markets weighed the poten.tial impact of Ukrainian drone strikes on Russian refineries, which may threaten crude and fuel exports, while also monitoring signs of rising U.S. fuel demand.

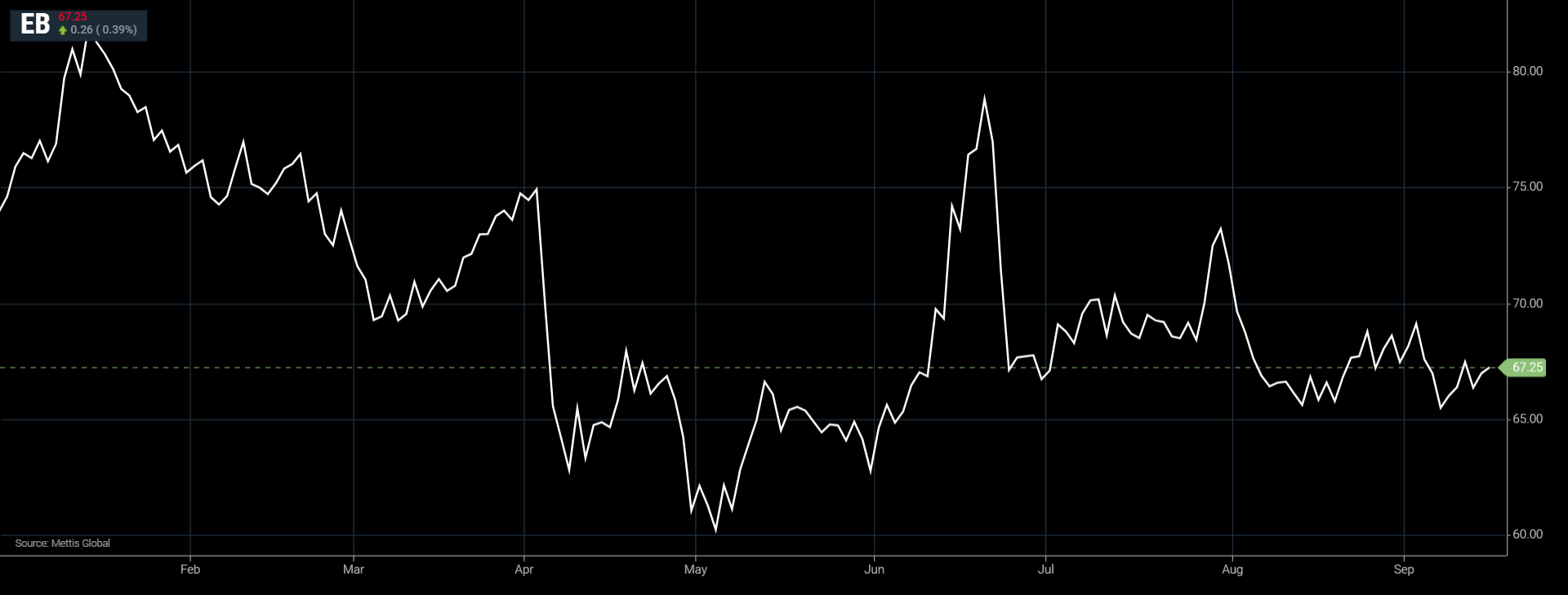

Brent crude futures

went up by $0.26, or 0.39%, to $67.25 per barrel.

West Texas

Intermediate (WTI) crude futures decreased by $0.36, or 0.57%, to $63.05 per

barrel by [12:58 pm] PST.

“The attack signals

a growing intent to disrupt global oil markets, which could put upward pressure

on prices,” JPMorgan analysts led by Natasha Kaneva noted, referring to the

strike on Primorsk.

Primorsk, capable

of loading about 1 million barrels per day (bpd) of crude, serves as a major

export hub and the largest oil port in western Russia.

The Kirishi

refinery, run by Surgutneftegaz, processes around 17.7m metric tons annually

(355,000 bpd) of crude, accounting for 6.4% of Russia’s total refining

capacity.

In Bashkortostan, a

regional oil producer will maintain its output despite a drone strike on

Saturday, regional governor Radiy Khabirov said.

Russia faces

mounting pressure after U.S. President Donald Trump reiterated on Sunday his

readiness to impose sanctions, while stressing that Europe must match U.S.

measures.

“Europe is buying

oil from Russia. I don’t want them to buy oil,” Trump told reporters. “And the

sanctions they’re applying aren’t strong enough. I’m prepared to impose

sanctions, but they need to toughen theirs to be in line with mine.”

Meanwhile,

investors are closely following U.S.-China trade negotiations in Madrid, which

began on Sunday as Washington urged its allies to place tariffs on Chinese

imports in response to Beijing’s purchases of Russian oil.

Last week, weaker

U.S. job growth and higher inflation fueled concerns over economic momentum in

the world’s largest oil consumer, even as the Federal Reserve is expected to

cut interest rates at its September 16–17 meeting.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 154,954.68 152.17M | 0.33% 514.99 |

| ALLSHR | 94,924.96 601.03M | 0.27% 256.80 |

| KSE30 | 47,310.94 76.62M | 0.41% 191.03 |

| KMI30 | 226,188.26 70.89M | 0.03% 62.54 |

| KMIALLSHR | 63,671.84 239.63M | 0.16% 102.79 |

| BKTi | 41,820.43 32.88M | 0.47% 197.60 |

| OGTi | 31,480.61 6.18M | -0.03% -8.18 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 115,145.00 | 117,240.00 114,940.00 | -2120.00 -1.81% |

| BRENT CRUDE | 67.18 | 67.52 66.78 | 0.19 0.28% |

| RICHARDS BAY COAL MONTHLY | 84.00 | 0.00 0.00 | -1.20 -1.41% |

| ROTTERDAM COAL MONTHLY | 93.00 | 0.00 0.00 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.93 | 63.24 62.52 | 0.24 0.38% |

| SUGAR #11 WORLD | 15.89 | 15.98 15.84 | 0.10 0.63% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|