Oil prices slip as U.S. pauses fresh action on Russian exports

MG News | August 18, 2025 at 11:56 AM GMT+05:00

August 18, 2025 (MLN): Oil prices fell on Monday after the United States held off on imposing additional measures against Russian oil exports, following Friday’s meeting between the two presidents that offered no new pressure on Moscow to end the Ukraine war.

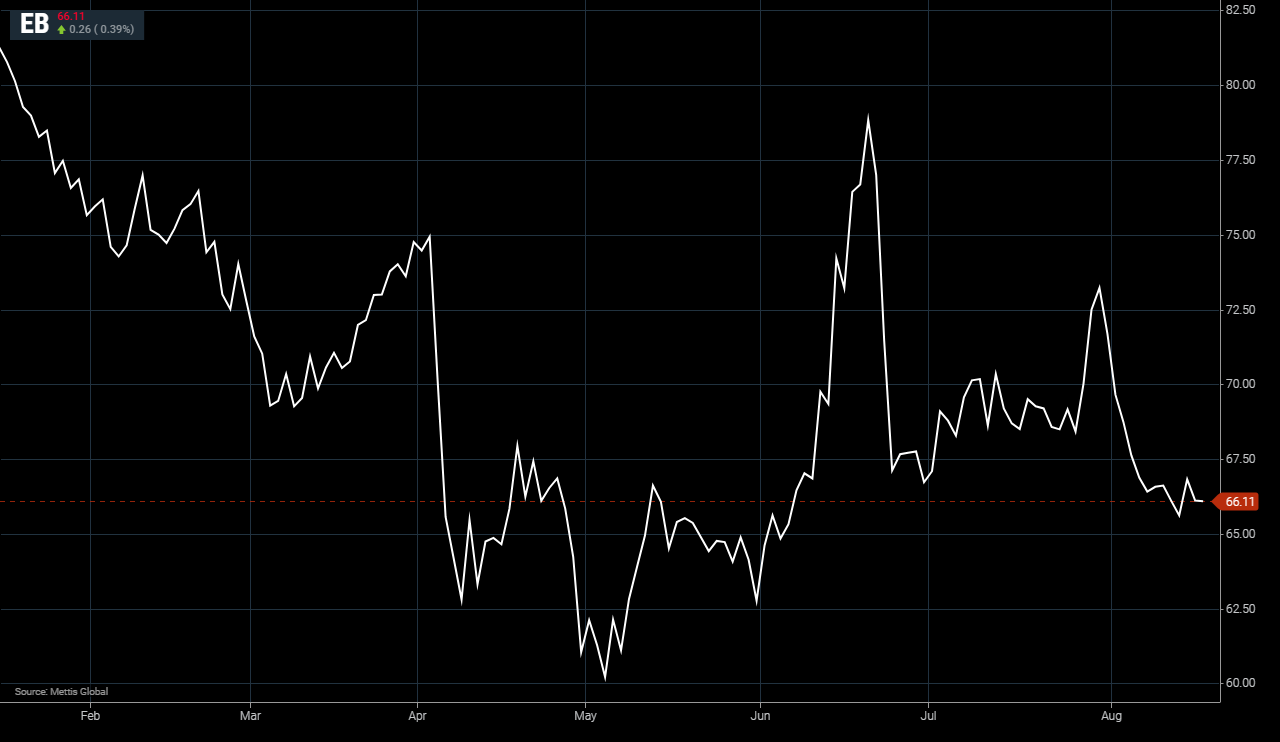

Brent crude futures increased by $0.26, or 0.39%, to

$66.11 per barrel.

West Texas Intermediate (WTI) crude futures rose by $0.36,

or 0.57%, to $63.16 per barrel by [11:52 am] PST.

U.S. President Donald Trump met Russian President Vladimir Putin in Alaska

on Friday, signaling greater alignment with Moscow on pursuing a peace

agreement rather than prioritizing a ceasefire.

Trump is set to meet Ukrainian President

Volodymyr Zelenskiy and European leaders on Monday as part of efforts to push

for a rapid resolution to what has become Europe’s deadliest conflict in eight

decades.

On Friday, Trump said he did not see an

immediate need to impose retaliatory tariffs on countries such as China for

purchasing Russian oil, though he left open the possibility of doing so “in two

or three weeks.” His remarks eased market concerns about disruptions to Russian

crude supply.

China, the world’s top oil importer, remains the

largest buyer of Russian oil, followed by India.

RBC Capital analyst Helima Croft noted that the

key issue under consideration was secondary tariffs targeting major importers

of Russian energy. She said Trump’s decision to pause further action,

particularly toward China, keeps the current situation largely unchanged.

“The status quo remains intact for now,” Croft

added, pointing out that Moscow continues to hold firm on its territorial

demands, while Ukraine and several European leaders resist any land-for-peace

arrangement.

Meanwhile, investors are also closely tracking

Federal Reserve Chairman Jerome Powell’s upcoming remarks at the Jackson Hole

symposium, looking for signals on the outlook for interest rate cuts that could

propel U.S. equities to fresh record highs.

“It’s likely Powell will stay cautious and

emphasize a data-driven approach, especially with one more jobs report and CPI

release due before the September 17 FOMC meeting,” IG market analyst Tony

Sycamore wrote in a note.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,196.42 229.07M | 1.16% 1704.79 |

| ALLSHR | 91,470.88 608.78M | 1.03% 934.55 |

| KSE30 | 45,270.73 123.44M | 0.98% 438.23 |

| KMI30 | 211,324.33 120.31M | 1.44% 3007.84 |

| KMIALLSHR | 61,059.70 318.65M | 1.13% 681.30 |

| BKTi | 41,471.11 46.59M | 1.06% 434.80 |

| OGTi | 30,476.43 17.83M | 0.96% 288.85 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 117,610.00 | 119,810.00 117,175.00 | -805.00 -0.68% |

| BRENT CRUDE | 66.13 | 67.06 65.73 | -0.71 -1.06% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 62.29 | 63.27 61.87 | -0.74 -1.17% |

| SUGAR #11 WORLD | 16.47 | 16.63 16.35 | -0.11 -0.66% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.png)