Oil prices rise, weekly loss still looms

MG News | November 07, 2025 at 10:39 AM GMT+05:00

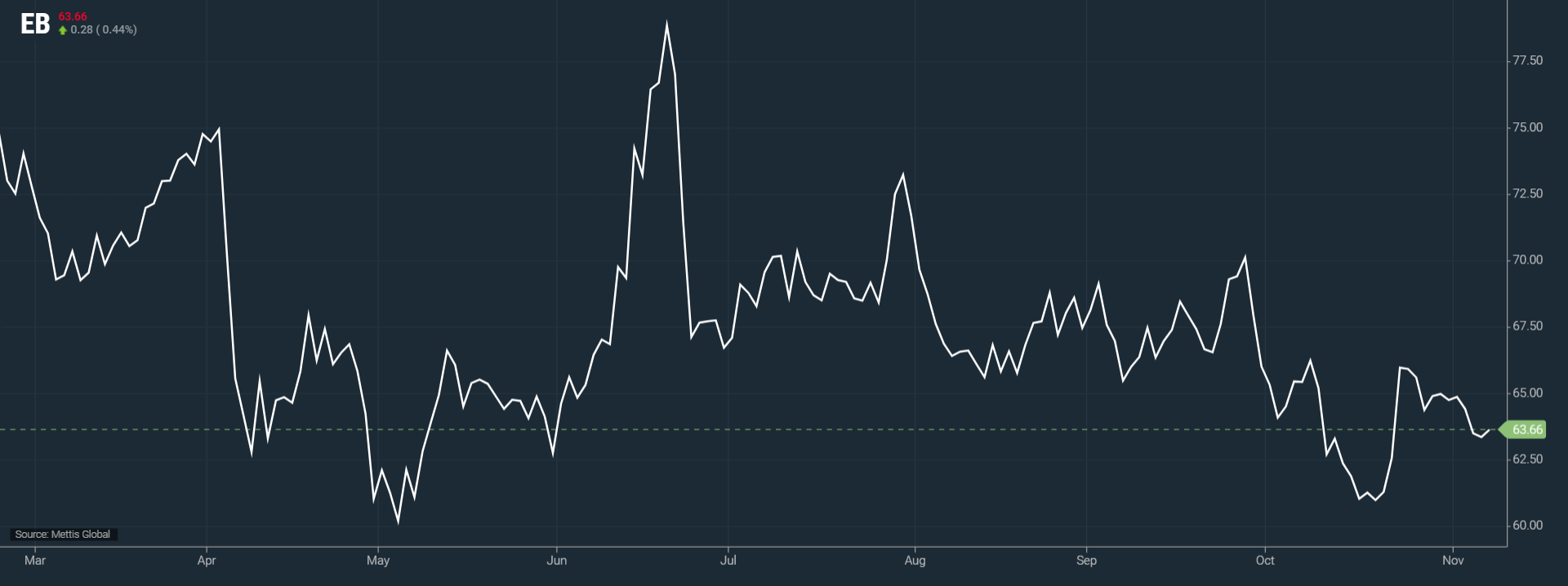

November 07, 2025 (MLN): Oil prices edged higher on Friday after three consecutive days of declines, supported by short-covering and bargain hunting. However, both Brent crude and West Texas Intermediate (WTI) remain on track for a second straight weekly loss of around 2%, pressured by rising global output and weakening U.S. demand signals.

Brent crude futures went up by $0.28, or 0.44%, to $63.66

per barrel.

West Texas Intermediate (WTI) crude futures decreased by

$0.29, or 0.49%, to $59.72 per barrel by [11:00 am] PST.

The latest price drop follows a surprise 5.2

million-barrel build in U.S. crude inventories, which reignited fears of

oversupply. According to the Energy Information Administration (EIA), the

increase was driven by higher imports and reduced refining activity, while

gasoline and distillate stocks fell.

Tony Sycamore, analyst at IG Markets, said the inventory

surge, combined with “risk-aversion flows, a stronger dollar, and the ongoing

U.S. government shutdown,” has weighed heavily on market sentiment. “WTI prices

are likely to remain range-bound between $58 and $62 per barrel in the near

term,” he added, noting that a potential reopening of the U.S. government could

offer short-term upside.

The prolonged U.S. government shutdown the longest in

history has fueled worries over economic growth, with reports of weaker

labor market data and flight reductions at major airports due to staffing

shortages.

Meanwhile, OPEC+’s recent decision to slightly

increase output in December while pausing additional hikes for the first

quarter of next year has added mixed signals to the market. The move reflects

the group’s cautious stance amid fears of a supply glut.

In a further sign of competitive pricing, Saudi Arabia

the world’s top crude exporter sharply reduced its December selling prices for

Asian buyers, signaling confidence in supply availability.

Despite ample inventories, geopolitical factors continue to

lend some support to prices. Western sanctions on Russia and Iran have

disrupted energy flows to major importers such as China and India, tightening

regional supplies.

Adding to market tensions, Swiss commodity trader Gunvor

announced on Thursday that it had withdrawn its proposal to acquire foreign

assets of Russia’s Lukoil after the U.S. Treasury labeled the company a

“puppet” of Moscow and voiced opposition to the deal.

Overall, traders remain cautious as oil markets balance

between rising supply pressures, softer demand outlooks, and geopolitical

uncertainties, keeping price volatility elevated in the weeks ahead.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 74,015.00 | 74,365.00 67,615.00 | 5550.00 8.11% |

| BRENT CRUDE | 81.32 | 84.48 80.30 | -0.08 -0.10% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 74.57 | 77.23 73.28 | 0.01 0.01% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction