Oil prices rise from five-week low on supply fears

MG News | August 06, 2025 at 05:12 PM GMT+05:00

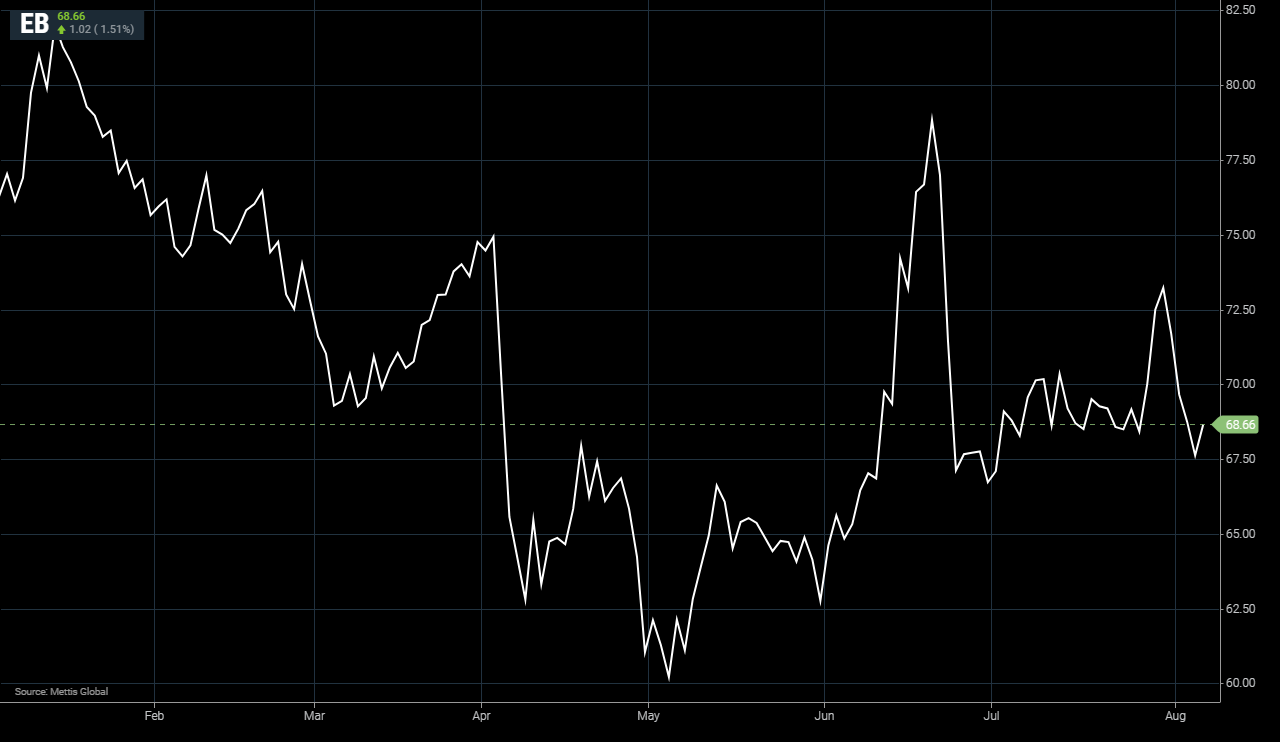

August 6, 2025 (MLN): Oil prices rose on Wednesday, recovering from a five-week low recorded a day earlier, amid fears of potential supply disruptions following U.S. President Donald Trump's threat to impose tariffs on India in response to its continued imports of Russian crude.

Brent crude futures decreased by

$1.02 or 1.51%, to $68.66 per barrel.

West Texas Intermediate (WTI) crude

futures fall by $1.07, or 1.57%, to $66.18 per barrel by [4:55 pm]

PST.

Oil prices dropped

by over $1 on Tuesday, closing at their lowest level in five weeks and marking

a fourth consecutive day of declines.

The slump was driven

by concerns of oversupply following OPEC+’s decision to raise output in

September.

"Investors are

weighing the possibility that India may scale back its Russian crude imports in

response to Trump’s tariff threats, which could tighten global supply. However,

it's still unclear whether India will make such a move," said Yuki

Takashima, an economist at Nomura Securities.

Takashima added that

if India continues its current level of imports, West Texas Intermediate (WTI)

prices are likely to remain within the $60–$70 range through the end of the

month.

OPEC+, which

includes the Organization of the Petroleum Exporting Countries and its allies,

agreed on Sunday to increase production by 547,000 barrels per day in

September.

This move will end

their latest round of output cuts earlier than initially planned.

The alliance, which

produces about half of the world’s oil, has been reducing supply for several

years to stabilize the market.

However, it has

recently adopted more aggressive production hikes in an effort to reclaim lost

market share.

Meanwhile, U.S.

pressure on India to curb Russian oil purchases as Washington seeks to compel

Moscow toward a peace deal in Ukraine may disrupt established supply routes.

Indian refiners

might seek alternative sources, while Russian crude could shift to other

markets.

On Tuesday, Trump

renewed his threat to impose steeper tariffs on Indian imports within 24 hours,

citing New Delhi’s continued buying of Russian oil.

He also suggested

that falling energy prices might force Russian President Vladimir Putin to end

the conflict in Ukraine.

India dismissed

Trump’s warning as “unjustified” and pledged to safeguard its economic

interests, further straining trade relations between the two countries.

Takashima also

highlighted that recent industry data supports the oil market, pointing to a

significant drawdown in U.S. crude inventories.

According to sources

citing American Petroleum Institute data, U.S. crude stocks fell by 4.2 million

barrels last week far exceeding the 600,000-barrel decline expected in a

Reuters poll for the week ending August 1.

The U.S. Energy

Information Administration is scheduled to publish official inventory figures

on Wednesday.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.51 | 63.96 62.34 | -1.24 -1.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|