Oil prices pause decline after hitting one-week lows

MG News | August 05, 2025 at 02:33 PM GMT+05:00

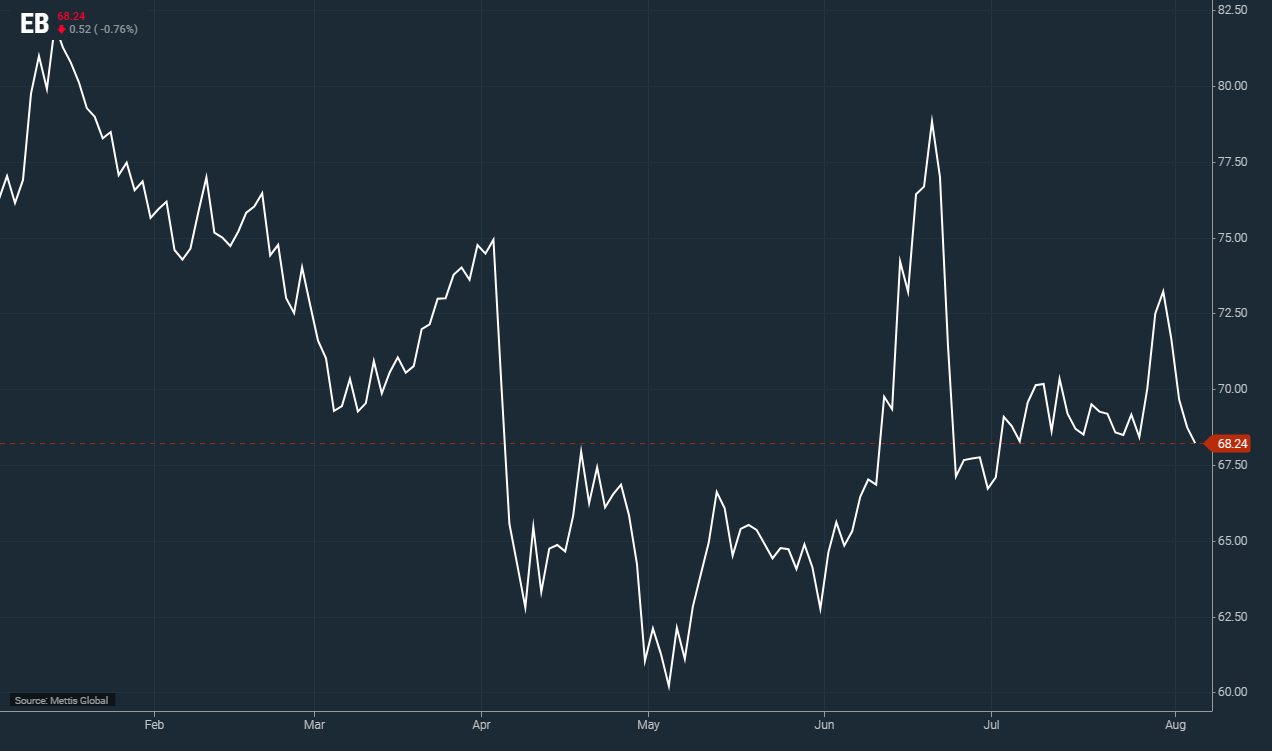

August 5, 2025 (MLN): Oil prices were little changed on Tuesday after three days of declines on mounting oversupply concerns after OPEC+ agreed to another large output increase in September, though the potential for more Russian supply disruptions supported the market.

Brent crude futures decreased by $0.52, or 0.76%,

to $68.24 per barrel.

West

Texas Intermediate (WTI) crude futures fall by $0.58, or 0.87%, to $65.71

per barrel by [2:26 pm] PST.

Both

benchmarks dropped by over 1% in the previous session, closing at their lowest

level in a week.

OPEC+, which includes the Organization of the Petroleum Exporting

Countries and its allies and supplies about half of the world’s oil, had been

limiting output for several years to support prices.

However, the

group shifted strategy this year by introducing a series of accelerated

production increases to reclaim market share.

In its most recent move, OPEC+ announced on Sunday that it would

raise oil production by 547,000 barrels per day for September.

This decision represents a full and early rollback of the group’s

largest production cuts, totaling around 2.5 million barrels per day, or

roughly 2.4% of global demand.

However,

analysts warn that the actual volume returning to the market is expected to be

lower.

Simultaneously, mounting pressure from the United States on India

to halt purchases of Russian oil, as part of Washington’s efforts to urge

Moscow toward a peace agreement in Ukraine, has raised fears of supply

disruptions.

President Donald Trump has threatened to implement 100% secondary

tariffs on countries buying Russian crude. This follows a 25% tariff imposed on

Indian imports in July.

India, the largest importer of Russian seaborne crude, brought in

approximately 1.75 million barrels per day from January to June this year an

increase of 1% compared to the same period last year, according to trade data

shared with Reuters.

“India has emerged as a key purchaser of Russian oil since the

2022 Ukraine invasion. Any disruption to this trade would compel Russia to seek

alternative buyers among a shrinking pool of allies,” noted Daniel Hynes,

senior commodity strategist at ANZ, in a report.

Meanwhile,

traders are closely monitoring potential updates on recent U.S. tariffs

affecting its trade partners, as analysts caution these measures could hinder

global economic growth and reduce the pace of fuel demand expansion.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 0.00 0.00 | 535.00 0.59% |

| BRENT CRUDE | 62.53 | 63.96 62.34 | -1.22 -1.91% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.86 | 58.88 58.85 | -0.02 -0.03% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|