Oil prices fall further ahead of U.S. Russia peace talks

MG News | August 11, 2025 at 01:54 PM GMT+05:00

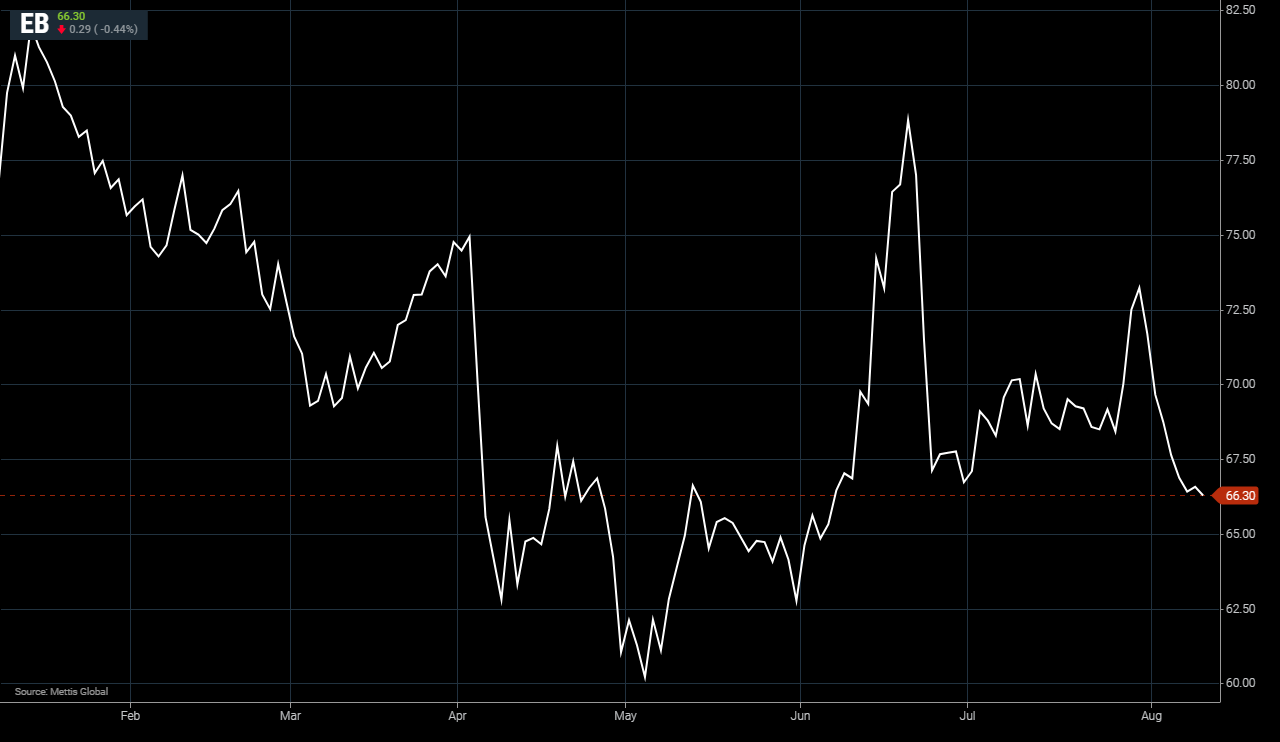

August 11, 2025 (MLN): Oil prices dropped in Asian trading on Monday, building on last week’s slide of over 4%, as markets awaited the results of upcoming U.S.–Russia discussions on the Ukraine conflict.

Brent crude futures decreased by $0.29 or 0.44%, to

$66.30 per barrel.

West Texas Intermediate (WTI) crude futures fall

by $0.36, or 0.56%, to $63.52 per barrel by [1:44 pm] PST

Hopes for a possible lifting of sanctions restricting Russian oil exports

have grown after U.S. President Donald Trump informed on Friday that he will

meet Russian President Vladimir Putin in Alaska on August 15 to negotiate an

end to the war in Ukraine.

The planned talks come amid heightened U.S.

pressure on Moscow with the possibility that sanctions could be tightened if no

peace agreement is reached.

“If negotiations collapse and the conflict continues

market sentiment could quickly turn bullish, potentially sparking a sharp surge

in oil prices,” said Sugandha Sachdeva, founder of New Delhi-based SS

WealthStreet.

Trump had given Russia until last Friday to

agree to peace or risk having its oil buyers face secondary sanctions.

At the same time, Washington is urging India to scale back its purchases of

Russian crude.

According to consultancy Energy Aspects Indian

refiners have already booked 5 million barrels of WTI for August loadings with

another 5m barrels possible depending on tender results, and an additional 5m

barrels for September loadings.

The firm noted that the WTI arbitrage to Asia remains favorable, allowing

India to continue absorbing U.S. crude for the time being.

Meanwhile, Trump’s newly imposed higher

tariffs on imports from dozens of countries, which took effect on Thursday, are

expected to slow economic activity by disrupting supply chains and adding to

inflationary pressures.

Weighed down by these economic concerns, Brent

crude fell 4.4% last week, while WTI dropped 5.1%.

“The short-term market direction will depend

on several key developments, including the August 15 meeting between the U.S.

and Russian leaders, upcoming remarks from Federal Reserve officials, and the

release of U.S. CPI data,” Sachdeva added.

In a

separate development, China’s National Bureau of Statistics reported on

Saturday that producer prices declined more than anticipated in July while

consumer prices were unchanged.

The data stressed how sluggish domestic demand and persistent trade

uncertainty are dampening both consumer and business confidence.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI