Oil falls sharply on Israel-Iran ceasefire news

MG News | June 24, 2025 at 05:49 PM GMT+05:00

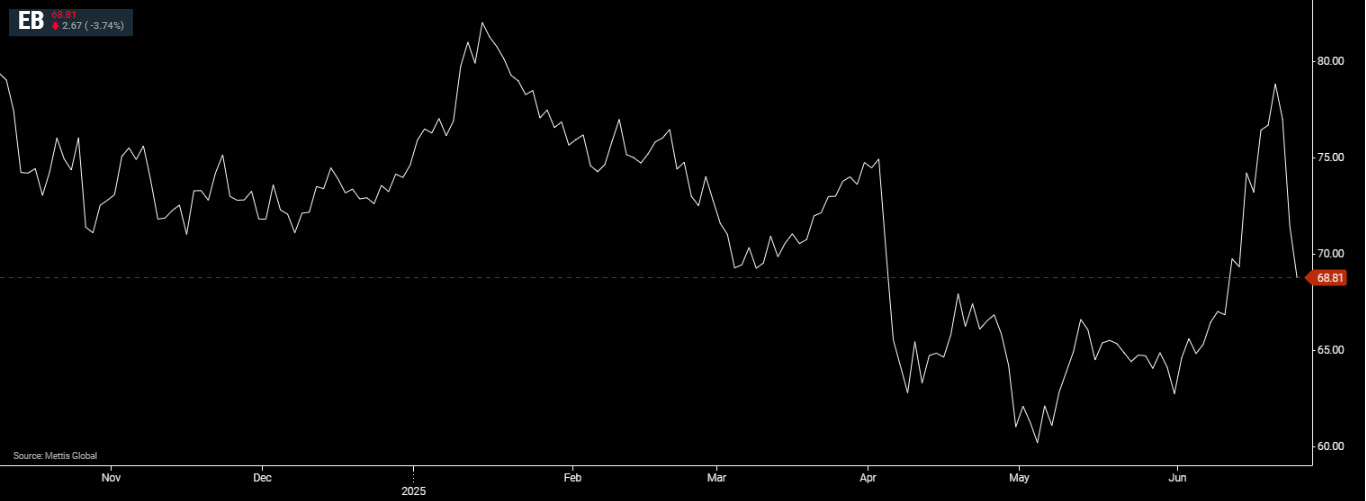

June 24, 2025 (MLN): Oil prices sank more than 3% Tuesday after Israel said it had agreed to US President Donald Trump's proposal for a bilateral ceasefire with Iran.

Brent crude futures decreased by $2.82, or 3.87%, to $68.66 per barrel.

West Texas Intermediate (WTI) crude futures fall by $2.84, or 4.15%, to $65.67 per barrel by [5:50 pm] PST.

Oil prices, which had surged roughly 10% since the onset of Iran-Israel hostilities in mid-June, began to ease following U.S. President Donald Trump’s announcement of a ceasefire between the two nations.

The pullback came despite lingering uncertainty over the ceasefire’s implementation and unresolved tensions surrounding Tehran’s nuclear program a key flashpoint cited by both Israel and the U.S.

The conflict had intensified in recent days with direct U.S. military involvement and Iran’s retaliatory missile strike on an American base in Qatar, as CNBC reported.

These developments heightened fears of supply disruption in Iran, which produced 3.3 million barrels per day in May, according to OPEC’s June report citing independent sources, and across the wider Middle East if the conflict spilled over.

One of the most critical concerns among investors was whether Iran would follow through on threats to close the Strait of Hormuz the strategic waterway linking the Persian Gulf and the Gulf of Oman.

The strait serves as a vital artery for global oil shipments, including from major exporters like Saudi Arabia, the UAE, Iraq, Kuwait, and Bahrain.

Over the weekend, Iran’s parliament reportedly approved the strait’s closure, according to state-run Press TV.

However, final authority rests with the country’s national security council, and the decision had not been confirmed independently by international media.

“The potential closure of the Strait of Hormuz remains a tail risk in our view,” Barclays analysts noted in a report Tuesday.

“However, we maintain that oil prices would race past $100 per barrel in such a scenario, due to limited avenues to bypass the narrow passage and the constraints it would pose to the marketability of spare capacity.”

They also observed that crude prices came under pressure as broader regional escalation failed to materialize despite U.S. strikes on Iranian nuclear sites.

In light of the situation, the International Energy Agency (IEA) reiterated that it holds 1.2 billion barrels in emergency reserves to stabilize markets if needed.

Additionally, some members of the OPEC+ alliance, following a pre-existing strategy, have been gradually increasing production and hold spare capacity that could be deployed to offset potential supply shocks.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 170,901.07 216.72M | 0.61% 1036.54 |

| ALLSHR | 103,341.40 516.08M | 0.60% 616.28 |

| KSE30 | 52,024.02 96.87M | 0.68% 353.60 |

| KMI30 | 245,961.48 78.75M | 0.71% 1730.66 |

| KMIALLSHR | 67,571.14 280.79M | 0.64% 429.31 |

| BKTi | 45,775.57 28.28M | 0.58% 264.32 |

| OGTi | 34,367.54 17.39M | 1.72% 580.49 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,780.00 | 90,250.00 87,745.00 | -660.00 -0.73% |

| BRENT CRUDE | 61.45 | 61.50 61.07 | 0.33 0.54% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 1.00 1.11% |

| ROTTERDAM COAL MONTHLY | 97.30 | 0.00 0.00 | 0.60 0.62% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.75 | 57.80 57.38 | 0.31 0.54% |

| SUGAR #11 WORLD | 15.10 | 15.27 14.83 | 0.25 1.68% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|