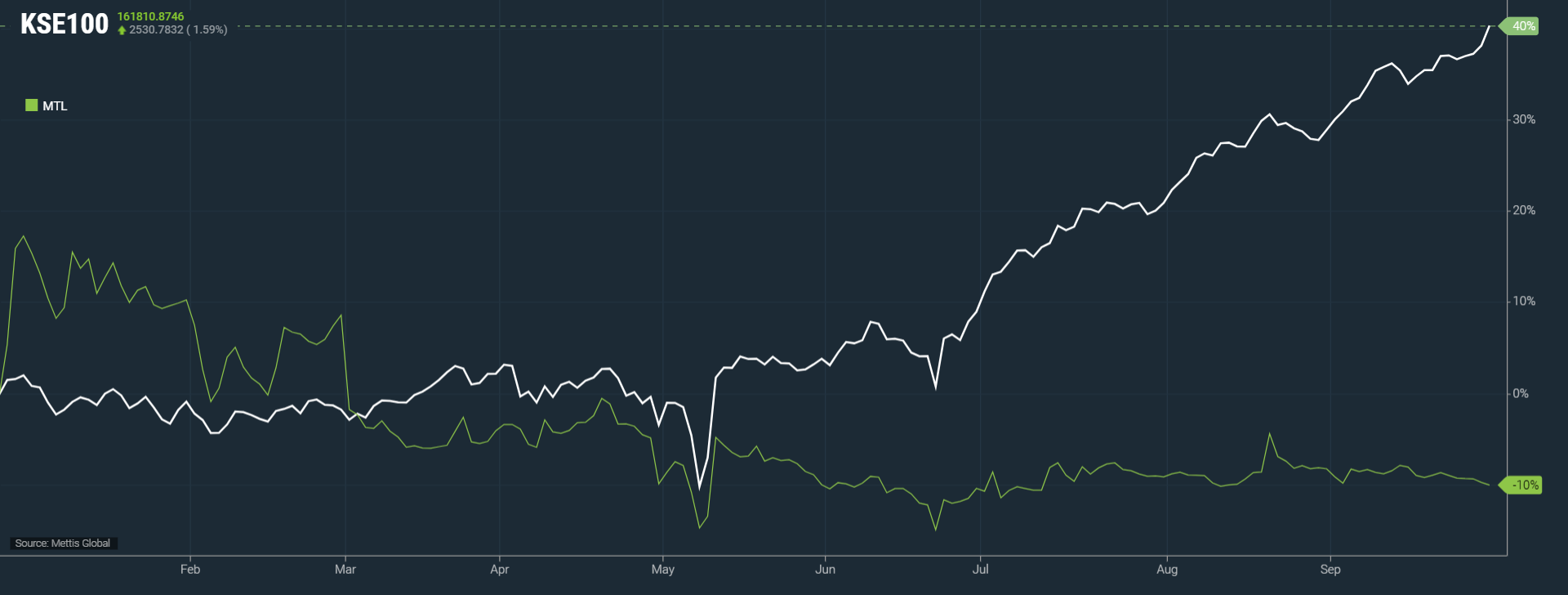

Millat Tractors slated for 18% downside as analyst downgrades to SELL

MG News | September 26, 2025 at 01:03 PM GMT+05:00

September 26, 2025 (MLN): According to Topline Securities, Millat Tractors (MTL) has a December 2026 target price of Rs425 per share, based on a Discounted Cash Flow (DCF) valuation. The current market price of MTL is approximately Rs563.

This target price implies a potential total downside of 18%

when considering the projected 6% dividend yield. The firm has downgraded the

stock to a "SELL" recommendation from a previous "HOLD"

stance.

The bearish outlook

is primarily driven by expectations of subdued tractor sales, despite

government initiatives.

Historical data

indicates that floods significantly weaken farmers’ purchasing power, typically

leading to weak post-flood sales, a trend Topline Securities expects to

continue, keeping tractor demand soft.

A DCF-based

valuation of MTL’s core operations points to Rs379 per share, while other

businesses, valued using a market multiple/Book Value (BV) approach, add

roughly Rs46 per share, bringing the total target to Rs425.

Topline Securities

estimates the company’s earnings per share (EPS) at Rs29 in FY26E and Rs43 in

FY27F. While a 20,000-unit tractor scheme by the Punjab government is expected

to boost industry sales by 16% to around 34,000 units in FY26E, this figure

remains 53% below the FY10 peak.

After adjusting for

the scheme, overall tractor sales are projected to decline by approximately 30%

to roughly 14,000 units in FY26, with MTL retaining a dominant market share of

60–65%.

Key risks that could

offset the "SELL" recommendation include faster-than-expected

implementation or larger-than-anticipated scope of government tractor schemes,

Millat Tractors achieving a higher market share in these schemes, and a

favorable Pakistani Rupee (PKR) exchange rate.

Laterally, a starkly

different outlook has been provided by Taurus Securities Limited, which argues

that MTL is "well-positioned to offer an upside potential of 14%,"

setting a higher target price of Rs650/share by December 2025.

This optimistic view

is driven by the anticipated pickup in demand and earnings, significantly

bolstered by the Punjab Government's recently launched Phase-II of the Green

Tractor Scheme.

The brokerage

highlights that under Phase-II, 20,000 tractors are slated for distribution split

evenly between 50–65HP models with a Rs500,000 subsidy and 75–125HP models with

a Rs1 million subsidy. Given MTL's dominant 64% market share and product line

alignment, the company is expected to capture a significant portion of this

demand.

Taurus Securities

believes Phase-II could add 8,000–10,000 extra units to MTL’s FY26 sales,

potentially contributing Rs14-17/share to earnings.

Deliveries are

expected to commence in 2QFY26, following the August 2025 application opening,

setting the stage for robust growth.

The firm's optimism

is further supported by improving farm economics through broader incentives

like the Kissan Card and the enhanced Rs123bn budget allocation for agriculture

in Punjab for FY26.

It is noted that the

preceding Phase-I scheme had already delivered a significant boost, helping MTL

end FY25 with 18,580 units, well exceeding the earlier estimate of 14,500.

While the company

reported a 43% year-on-year revenue decline to Rs40bn in 9MFY25 due to soft

farm economics and higher finance costs, the Phase-I rollout in Nov–Dec 2024

helped stabilize volumes and provided some relief to profitability during a

challenging year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes