Meezan Bank plans aggressive branch expansion to drive deposit growth

MG News | November 11, 2025 at 10:28 AM GMT+05:00

November 11, 2025 (MLN): Meezan Bank Ltd (PSX:MEBL) plans a major branch

expansion to strengthen its deposit base, with management sharing that the

network will exceed 1,100 branches by the end of 2025, followed by the

addition of 100–150 new outlets in 2026 and further 8–10% growth in

2027.

The expansion aims to support the bank’s target of 20–30%

annual deposit growth, backed by both physical and digital channels, as

highlighted in the company’s corporate briefing session.

Deposits rose 23% year-on-year to Rs 3.18 trillion,

led by a 27% increase in current accounts, which strengthened the CASA ratio

to 94% (49% current and 45% savings).

Management said the bank’s strategy combines branch

network growth with a strong push in digital banking. The continued digital

shift, it added, enhances efficiency and helps offset pressure from the minimum

deposit rate (MDR) on margins.

Meezan’s management also reaffirmed plans to maintain a quarterly

dividend of Rs 7 per share, targeting a 50% payout ratio in line

with its growth strategy and capital position.

The bank’s Capital Adequacy Ratio (CAR) stood at a

healthy 23.3%, comfortably above regulatory requirements, providing room

to fund expansion and maintain its dividend policy. Although Meezan is retiring

its Tier-II capital, it intends to keep a capital buffer in the 15–16% range

preferred by rating agencies.

The bank now targets an ADR of around 45%, depending

on economic growth and corporate lending opportunities.

Meezan also reported growth in its trade and remittance

businesses. The bank maintained a 10% market share in trade finance,

while its share in remittances doubled.

Meezan Bank reported a profit after tax of Rs 22billion

(EPS: Rs 12) for the third quarter of 2025, a 13% decline from the

same period last year. This brought nine-month earnings to Rs70.52 billion,

down 10% year-on-year.

The bank declareda cash dividend of Rs 7 per share,

taking total payouts for the nine months to Rs 21 per share.

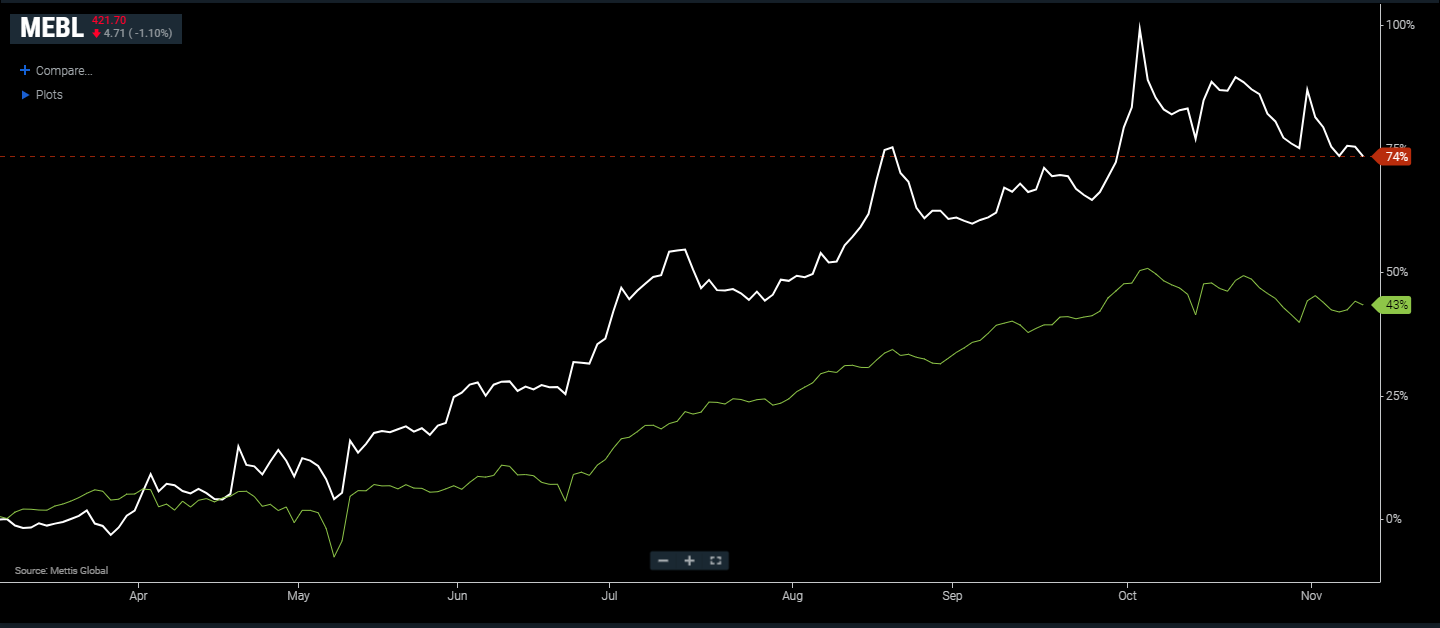

The bank’s current stock are trading at Rs421.7 down 1.1% as of [10:20 am] PST, according to data reported by Mettis Global.

Furthermore, it was mentioned that 20% of home remittances are deposited into Meezan Bank accounts, and a repricing of approximately 20–30 basis points is anticipated in the fourth quarter.

The company also highlighted two big challenges one relating to the growth in economy in order to maintain its financing book and second how fast and far effective the digital channels will be in attracting customers.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile