Measures announced in Mini-Budget to foster exports and help narrow current account deficit: Moody’s

By MG News | January 31, 2019 at 11:40 AM GMT+05:00

January 31, 2019 (MLN): Moody’s Investors Service expects Pakistan’s deficit to widen to 6% of GDP in fiscal 2019 because revenue growth is likely to be below government projections, given slower economic growth and the new revenue based incentives, before gradually narrowing to 5% of GDP by fiscal 2021 as the economy picks up.

While Moody’s believes the government remains committed to fiscal consolidation, a wider for longer deficit could raise questions over the credibility of its fiscal policy.

In a report released on Thursday, Moody’s said that the measures announced in government’s second mini-budget on January 23, 2019 would support manufacturing sector, fostering exports and import substitution and help narrow current account deficit.

The report said these measures will keep Pakistan’s budget deficits wider for longer, potentially eroding the credibility of government efforts to achieve fiscal consolidation as no new spending cuts or revenue-raising measures were announced.

Compared with the government’s first mini-budget in September 2018, which emphasized spending cuts, the second mini-budget aims to improve business conditions, including for manufacturers and exporters, by removing or reducing existing taxes that erode profit margins or disincentivise reinvestment.

“While the mini-budget will support the export sector, there is a greater risk of fiscal slippage and slower fiscal consolidation in the absence of further revenue-raising measures,” says the report.

The government presented limited revenue-raising measures, primarily taxes on large vehicles and high-end mobile phones. As a result, the mini-budget places greater weight on improvements in tax administration and spending restraint for the government to meet its deficit target of 5.1% of GDP.

Moody’s believes that the budget came against a backdrop of low export growth in the first six months of fiscal 2019, despite the Pakistani rupee's 25% decline against the US dollar since December 2017. “The government is seeking to narrow the current-account deficit by reducing some of the tax distortions exporters’ face.”

Weak exports aside, Pakistan's current-account dynamics have been largely positive in recent months. Remittances rose by 10% year on year in US dollar terms in the first half of fiscal 2019, while goods imports slowed sharply to around 3% year on year as non-fuel goods imports contracted.

However, although Moody’s expects the current-account deficit to narrow to 4.7% of GDP in fiscal 2019 and to 4.2% in fiscal 2020 from 6.1% in fiscal 2018, it will remain sizable and wider than in 2013-16, driving Pakistan’s external financing needs.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 131,949.07 198.95M |

0.97% 1262.41 |

| ALLSHR | 82,069.26 730.83M |

0.94% 764.01 |

| KSE30 | 40,387.76 80.88M |

1.11% 442.31 |

| KMI30 | 191,376.82 77.76M |

0.36% 678.77 |

| KMIALLSHR | 55,193.97 350.11M |

0.22% 119.82 |

| BKTi | 35,828.25 28.42M |

3.64% 1259.85 |

| OGTi | 28,446.34 6.84M |

-1.02% -293.01 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,915.00 | 110,525.00 107,865.00 |

-500.00 -0.45% |

| BRENT CRUDE | 67.64 | 67.81 67.22 |

-0.66 -0.97% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

0.75 0.78% |

| ROTTERDAM COAL MONTHLY | 106.00 | 106.00 105.85 |

-2.20 -2.03% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.85 | 67.18 65.40 |

-1.15 -1.72% |

| SUGAR #11 WORLD | 16.37 | 16.40 15.44 |

0.79 5.07% |

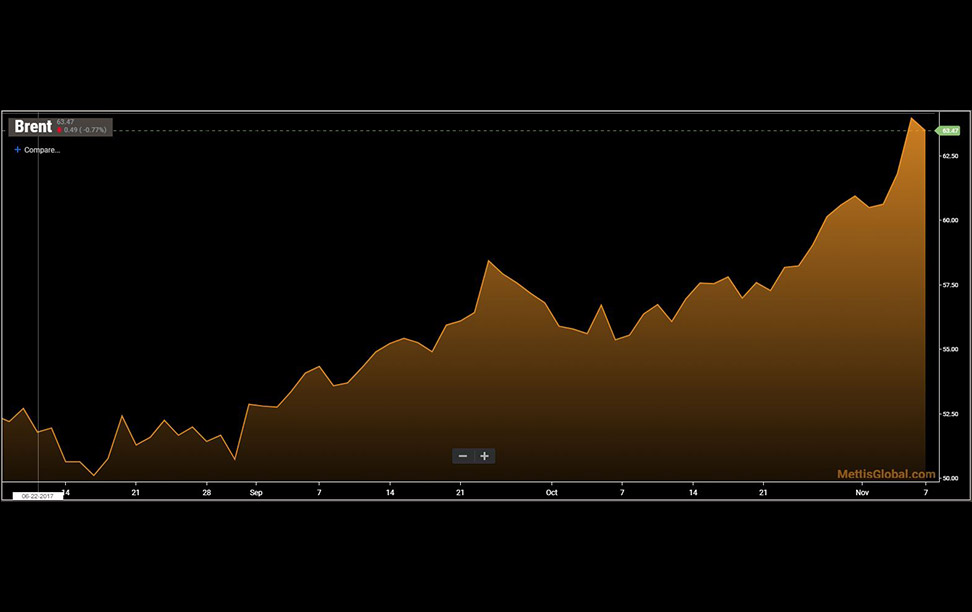

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Central Government Debt

Central Government Debt

CPI

CPI