LOTCHEM: Robust uptick in income continues

MG News | April 22, 2021 at 05:44 PM GMT+05:00

April 22, 2021 (MLN): Lotte Chemical Pakistan Limited (LOTCHEM) has disclosed 1QCY21 results today, wherein the company posted earnings of Rs1.6bn (EPS: Rs1.1/sh), which was 28.2x higher than the profits of Rs57.9mn (EPS Re0.04) in 1QCY20.

The impressive growth in the company’s earnings attributed to a surge in PTA-PX margin and upbeat demand from the downstream PSF segment.

During the quarter, net sales went up by25% YoY to Rs14.7bn largely on the back of higher international PTA prices and production. As a result, the company witnessed gross profit margins of 15.4% compared with loss during 1QCY20. The rise in gross margins is witnessed due to a 44% YoY rise in PTA margins, 1.5% YoY PKR depreciation, GIDC suspension, and inventory gains.

On the expense side, Distribution and Administration cost inclined by 16% and 8.5% respectively. While other expenses surged by a whopping 38.3x YoY.

Among other line items, the Other income has declined by 19% YoY on the back of lower deposit rates.

Moreover, the company booked a finance income of Rs98mn due to exchange gain on the back of PKR appreciation during the quarter under review.

On the tax front, the company incurred an effective tax rate of 29% compared to 31% in 1QCY20.

|

Profit and Loss Account for the quarter ended March 31, 2021 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Mar-21 |

Mar-20 |

% Change |

|

Revenue |

14,671,880 |

11,712,002 |

25.27% |

|

Cost of Sales |

(12,408,169) |

(11,825,089) |

4.93% |

|

Gross Profit |

2,263,711 |

(113,087) |

-2101.74% |

|

Distribution and Selling Expenses |

(28,929) |

(24,861) |

16.36% |

|

Administrative Expenses |

(115,090) |

(106,044) |

8.53% |

|

Other Expenses |

(199,928) |

(5,211) |

3736.65% |

|

Other Income |

277,704 |

343,375 |

-19.13% |

|

Finance Cost/(income) |

98,015 |

(10,585) |

- |

|

Profit/(loss) before Taxation |

2,295,483 |

83,587 |

2646.22% |

|

Taxation |

(656,482) |

(25,593) |

2465.08% |

|

Profit after Taxation |

1,639,001 |

57,994 |

2726.16% |

|

Earnings per share - Basic and Diluted (Rs.) |

1.08 |

0.04 |

2600.00% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

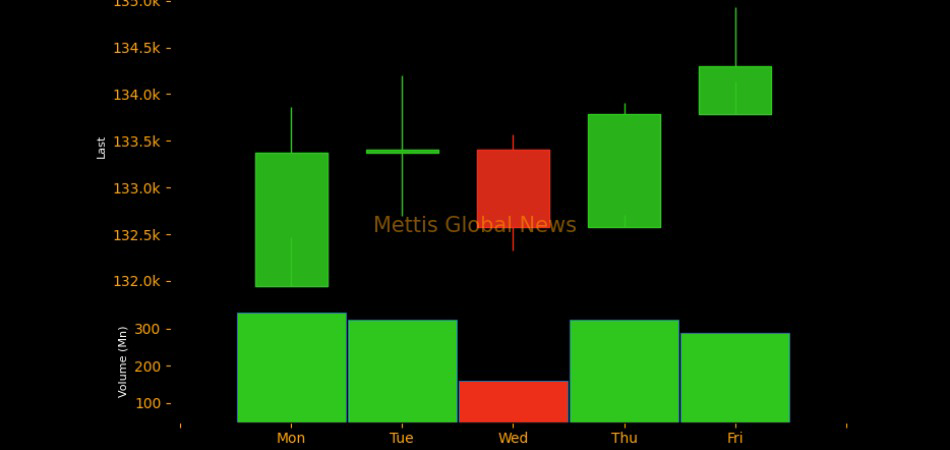

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|