LOADS shifts focus to radiators, streamlines balance sheet

MG News | November 13, 2025 at 10:39 AM GMT+05:00

November 13, 2025 (MLN): Loads Limited (PSX: LOADS) is gearing up for an aggressive expansion in its aftermarket radiator segment, which management identified as a major growth driver for the coming years.

The company plans to focus on copper and brass radiators,

targeting sales of 40,000 units in FY26, with volumes expected to double

in subsequent years.

Radiators are projected to contribute nearly 15% to

revenue in FY26, rising to around 30% in the following years,

marking a meaningful diversification of the company’s product mix.

Meanwhile, LOADS is in discussions to divest its stake in

Hi-Tech Alloy Wheels Limited (HAWL), as Expected Credit Losses (ECLs) have

already been recorded.

The move is aimed at streamlining the balance sheet and

enhancing liquidity, allowing the company to focus on its core

manufacturing and expansion initiatives.

Management also highlighted that discussions with new OEM

partners are underway, aligned with the government’s localization policy

for auto parts, which could help LOADS secure fresh contracts and expand its

market footprint.

Additionally, the company is evaluating aluminum radiator

production to cater to both domestic and export markets, further

broadening its product portfolio.

These developments were shared during LOADS’ FY25

corporate briefing session, where management reaffirmed confidence in the ongoing

recovery of Pakistan’s auto sector, supported by stable exchange rates,

improving economic indicators, and growing consumer demand.

During FY25, the company posted a topline of Rs6.0bn,

up 34% year-on-year from Rs4.5bn in FY24, primarily driven by higher OEM

volumes amid a rebound in the auto industry.

Net earnings stood at Rs495m (EPS: Rs1.97)

compared to Rs827m (EPS: Rs3.29) in FY24, as pricing negotiations with

OEMs affected profit margins.

In terms of the sales mix, mufflers contributed

61%, followed by sheet metal (35%) and radiators (4%). On the

customer front, Pak Suzuki led with 55% of total sales, followed

by Indus Motor Company (Toyota) at 24%, Honda at 14%,

while the aftermarket, Yamaha, and others made up the remaining share.

To support its growth strategy, the company plans to raise

Rs1.5bn through a rights issue of 120m shares at a maximum price

of Rs12.50 per share.

The subscription process is expected to begin in January

2026 and conclude by February 2026. The proceeds will be used to meet working

capital requirements and fuel expansion across both OEM and

aftermarket segments.

Management expects automobile sales to increase by 20–25%

in FY26, supported by economic stability, improved consumer sentiment, and

the continuation of duty concessions under the Automotive Industry

Development and Export Policy (AIDEP), which expires in June 2026.

The expiry of AIDEP is expected to push OEMs toward greater localization,

benefitting parts manufacturers like LOADS.

On the Hi-Tech Alloy Wheels project, management

confirmed that the plant is yet to be commissioned and requires an

additional Rs2–3bn investment for completion. The company is considering

either selling its stake or forming a joint venture (JV) to

advance the project.

Management reaffirmed confidence in the ongoing recovery

of Pakistan’s auto sector, citing stable exchange rates, improving

macroeconomic indicators, and rising consumer demand as key growth

drivers.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 146,140.91 261.56M | -7.21% -11355.19 |

| ALLSHR | 88,278.15 390.33M | -6.31% -5948.86 |

| KSE30 | 44,838.79 100.60M | -7.22% -3491.41 |

| KMI30 | 208,993.43 84.29M | -6.98% -15693.90 |

| KMIALLSHR | 57,165.02 256.17M | -6.04% -3674.07 |

| BKTi | 42,305.91 41.36M | -7.00% -3184.05 |

| OGTi | 30,699.22 12.48M | -4.31% -1384.25 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 67,810.00 | 68,215.00 65,685.00 | -485.00 -0.71% |

| BRENT CRUDE | 107.44 | 119.50 99.00 | 14.75 15.91% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -11.85 -10.65% |

| ROTTERDAM COAL MONTHLY | 127.00 | 0.00 0.00 | 0.05 0.04% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 103.30 | 119.48 98.00 | 12.40 13.64% |

| SUGAR #11 WORLD | 14.09 | 14.17 13.69 | 0.37 2.70% |

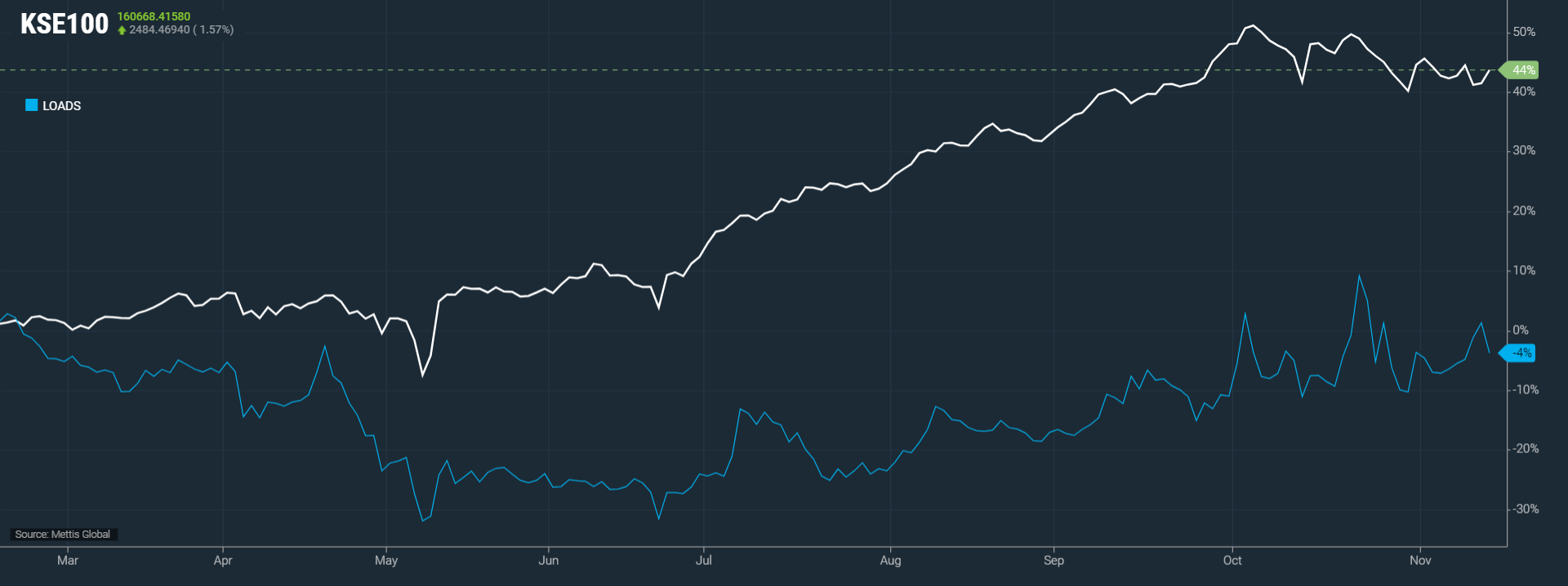

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|