ASL eyes sector revival amid import curtailment, CCP case challenge

MG News | November 13, 2025 at 02:57 PM GMT+05:00

November 13, 2025 (MLN): Aisha Steel Mills Limited (PSX: ASL), one of Pakistan’s leading flat steel producers, expects a robust recovery in demand for flat steel products in FY26.

The management anticipates this growth will be supported by a decline in import market share and stabilization in international Hot Rolled Coil (HRC) prices. ASL also aims to expand its export footprint, targeting markets in the US, Europe, and the Middle East.

The company addressed the recent Competition Commission of

Pakistan (CCP) case involving a Rs648m penalty for alleged cartelization and

price-fixing.

ASL clarified that there was no coordination between flat

steel players and that the CCP’s findings were based on listed prices rather

than actual transaction values.

Management explained that ASL’s sales were made at

market-driven discounts, differing from the prices referenced by the CCP.

However, in response to a query raised by Mettis Global during the session, the

management only provided a partial explanation without a clear answer.

The company has challenged the decision and is awaiting a

response, expressing confidence in a positive outcome.

ASL operates with a nameplate capacity of 700,000 tons per

annum and remains optimistic about the steel sector’s revival, citing improving

market conditions and supportive policy measures.

Global HRC prices fell by 15% year-on-year to $ 450 per ton

in FY25 (from $ 530 per ton in FY24), but have since stabilized amid signs of

recovery in China’s industrial activity. Although US tariff measures initially

disrupted global trade flows, steel markets are gradually recovering as demand

improves across key regions.

Domestically, flat steel consumption surged 84% from 570,000 tons in FY23 to 1.05m tons in FY25, but local producers contributed only 3% of the total due to higher imports. Imports expanded 1.5 times over the period, supported by sales tax exemptions for the FATA/PATA regions.

With the

government now imposing a 10% sales tax on these regions set to rise gradually

to 18% local producers are expected to benefit from stronger demand and better

pricing power.

The withdrawal of import concessions and the extension of

anti-dumping duties on CRC and Galvalume steel have already improved ASL’s

sales performance.

In 1QFY26, total flat steel sales rose 1.1 times

year-on-year to 43,376 tons, while exports doubled to 5,856 tons. Capacity

utilization currently stands at around 25% and is expected to rise to 35% by

year-end.

Imports accounted for 65% of Pakistan’s flat steel supply in

FY25, but this share is projected to decline to 50% in FY26, enhancing the

profitability of local players.

ASL posted a loss per share of Rs1.55 in FY25 (versus Rs0.26

loss in FY24) primarily due to lower volumes and limited gross margin

generation.

However, the company returned to profitability in 1QFY26,

reporting earnings per share of Rs0.07 compared to a loss of Rs0.93 in the same

period last year. The company aims to achieve production of 210,000–245,000

tons in FY26, closely aligned with sales targets. Exports are expected to

exceed 50,000 tons this year, compared to around 25,000 tons in FY25.

Management highlighted ongoing challenges related to

importers obtaining stay orders against National Tariff Commission (NTC)

duties, allowing duty-free clearances during the interim period.

ASL continues to contest this practice and is also opposing

the acceptance of post-dated checks by customs authorities in place of tangible

guarantees. Progress on this case is expected soon.

ASL acknowledged that International Steels Limited (ISL) has

an advantage in the OEM segment due to its in-house service center for

cut-to-size and slitted products. ASL, which currently relies on third-party

service centers, plans to strengthen its position in the OEM market.

Electricity costs represent about 4–5% of ASL’s total

production cost, with consumption averaging 100 units per ton far lower than

that of melters. To further improve efficiency, the company plans to install a

2 MW solar power project this year to offset daytime energy costs.

Management expects improved sales volumes and profitability

as import dependence declines and anti-dumping duties on Galvalume, ZAM and

other coated products remain in effect. CRC demand continues to be driven

largely by the automotive sector, while GI caters to white goods, general

engineering, housing and ducting applications.

ASL remains confident that stable global prices, favorable

government measures, and operational efficiency will drive a sustainable

turnaround in FY26.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,570.00 | 74,365.00 67,615.00 | 5105.00 7.46% |

| BRENT CRUDE | 82.32 | 84.48 80.30 | 0.92 1.13% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 75.85 | 77.23 73.28 | 1.29 1.73% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

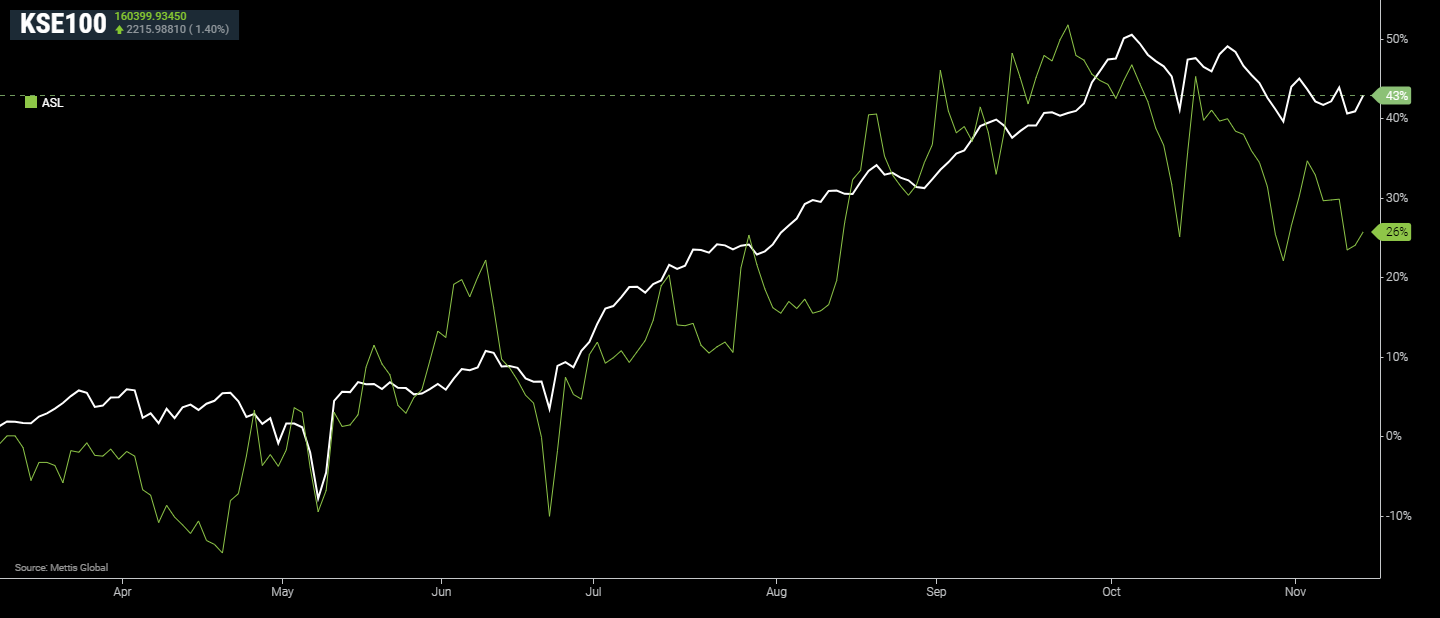

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction