KSE-100 rockets past 170k in early trade

MG News | December 10, 2025 at 10:02 AM GMT+05:00

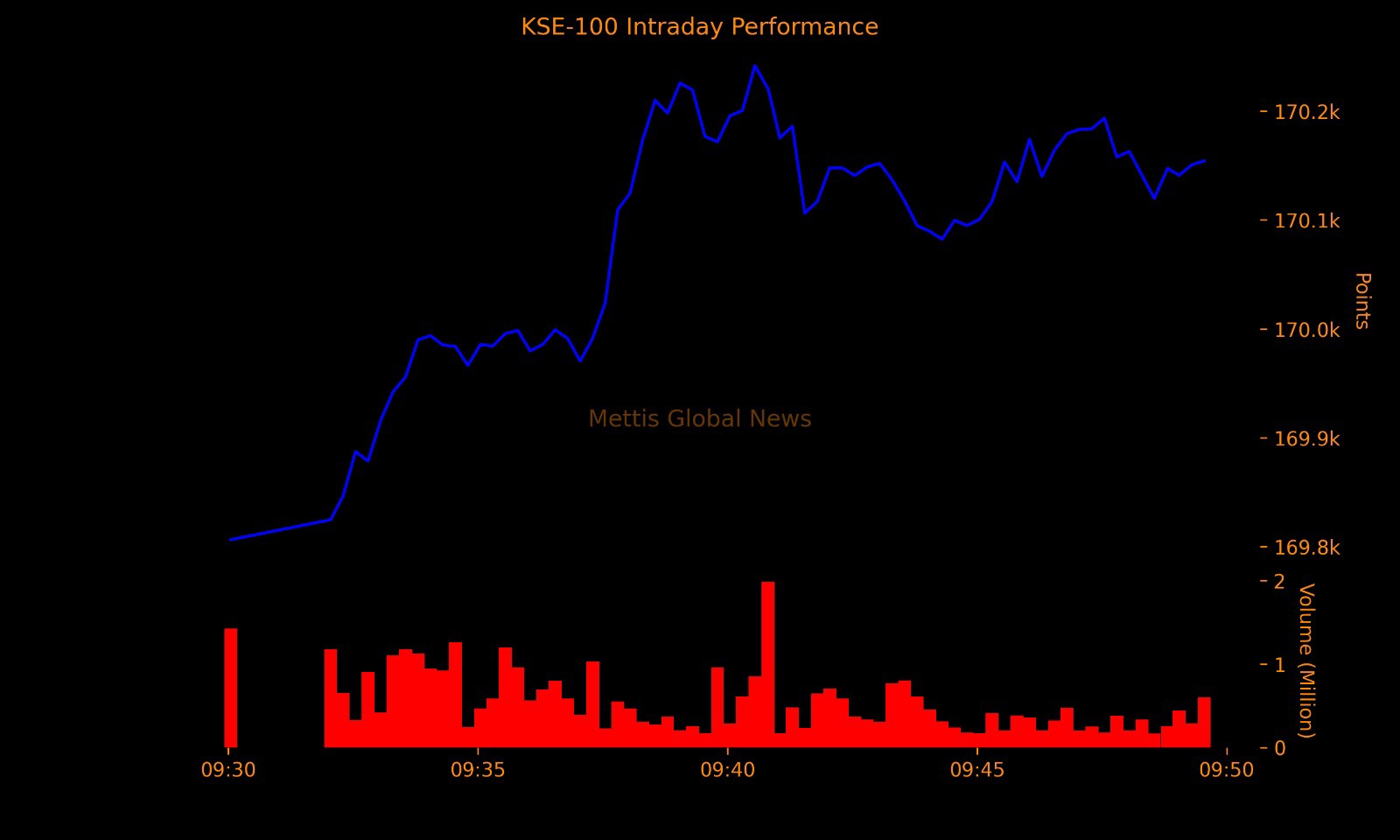

December 10, 2025 (MLN): The benchmark KSE-100 Index surged past the 170,000 mark in early trade

on Wednesday, lifted by improved investor sentiment following the IMF’s fresh

approval for Pakistan’s next loan disbursement.

The clarity on the economic front helped fuel strong buying

interest across key sectors.

By 9:50 AM, the index was hovering around 170,164.63, up 708.25 points or 0.42%.

Throughout the early session, the market stayed firmly in

positive territory, touching an intraday high of 170,241.72, while the lowest

level recorded so far was 169,806.32.

The KSE-100 also witnessed active participation, with total

traded volume reaching 40.44 million shares.

Out of the 100 index constituents, 75 were trading in the green, 15 were down, six remained unchanged, and four had not yet been traded.

_20251210050120331_514c5c.jpeg)

The strongest performers of the morning included ISL, which

hit its upper limit with a 10% gain, followed by INIL rising 5.84%, DHPL up

5.60%, JVDC higher by 3.13%, and PKGP climbing 3.02%.

On the weaker side, PSEL led the declines with a fall of

1.88%, while THALL, SRVI, PAEL, and PAKT also recorded mild losses.

In terms of index contribution, FFC, ISL, HUBC, DHPL and

LUCK provided the most upward support in early trade.

Meanwhile, PSEL, SYS, THALL, DGKC and PAEL collectively

pulled the index lower, though their impact remained limited compared to the

broader upward momentum.

Sector-wise, the market’s strength was driven primarily by

Commercial Banks, Fertilizer, Investment Companies and Securities, Engineering,

and Cement, all of which added meaningful points to the benchmark.

On the flip side, pressure emerged from the Miscellaneous

sector, Automobile Parts & Accessories, Cable & Electrical Goods,

Tobacco, and Sugar & Allied Industries, though their negative contribution

remained marginal.

The broader market also reflected the upbeat tone, with the

All-Share Index standing at 102,892.33, higher by 413.76 points or 0.40%. Total

market volume reached 139.25 million shares in the early session.

The most actively traded stocks so far include BML, KEL,

BOP, TPLP, QUICE, ASL, BNL, HUMNL, TPL, and PIAHCLA, with BML leading the

charts with over 33.7 million shares.

To note, the KSE-100 has already gained 44,537 points or

35.45% during the fiscal year, while its calendar-year rise stands at 55,038

points or 47.81%.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 152,366.67 294.94M | 0.26% 393.67 |

| ALLSHR | 91,153.51 526.33M | -0.03% -25.35 |

| KSE30 | 46,765.54 143.82M | 0.95% 439.07 |

| KMI30 | 213,274.10 142.68M | 0.52% 1103.93 |

| KMIALLSHR | 58,253.66 295.20M | -0.22% -128.72 |

| BKTi | 44,920.39 37.88M | 1.39% 614.36 |

| OGTi | 29,139.11 12.71M | 0.11% 32.31 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Trade Balance

Trade Balance