Is silver the real opportunity while gold holds steady?

_20260107052821953_c5dfdc.jpg?width=950&height=450&format=Webp)

MG News | January 07, 2026 at 10:48 AM GMT+05:00

January 07, 2026 (MLN): Gold and silver are expected to remain at the

center of investor attention in 2026, with both metals poised to benefit from

macroeconomic uncertainty, shifting monetary policy, and rising demand for

portfolio hedges.

While gold is projected to maintain its role as a

stabilizing asset, silver is increasingly being viewed as the higher-octane

opportunity, offering the potential for outsized gains if historical patterns

reassert themselves.

A renewed precious metals cycle emerging, one where gold

typically takes the lead before silver accelerates more aggressively.

This pattern has appeared repeatedly during past bull

markets, driven by silver’s smaller market size, higher volatility, and

sensitivity to both financial flows and industrial demand. As a result, silver

often outperforms gold during the later stages of a metals rally.

These dynamics were highlighted in a recent metals outlook

from Bank of America, where the firm’s Head of Metals Research, Michael

Widmer, emphasized gold’s enduring importance as a portfolio hedge while

pointing to silver as a potential standout performer.

The bank forecasts the average gold price could reach around $4,538 per ounce in 2026, with a possible move toward $5,000, supported by tightening supply, rising mining costs, and strengthening investment demand.

Currently, gold prices were already moving higher in early trading, with spot gold up 2.05% at $4,444.51 an ounce as of [10:48 a.m.] PST, according to Mettis Global.

At the same time, the report argues that silver’s upside

could be substantially larger.

The current gold-to-silver ratio sits near 59:1, well

above long-term historical norms.

In past market extremes, the ratio has compressed to 32:1 in 2011 and even 14:1 in 1980, according to NAI500.

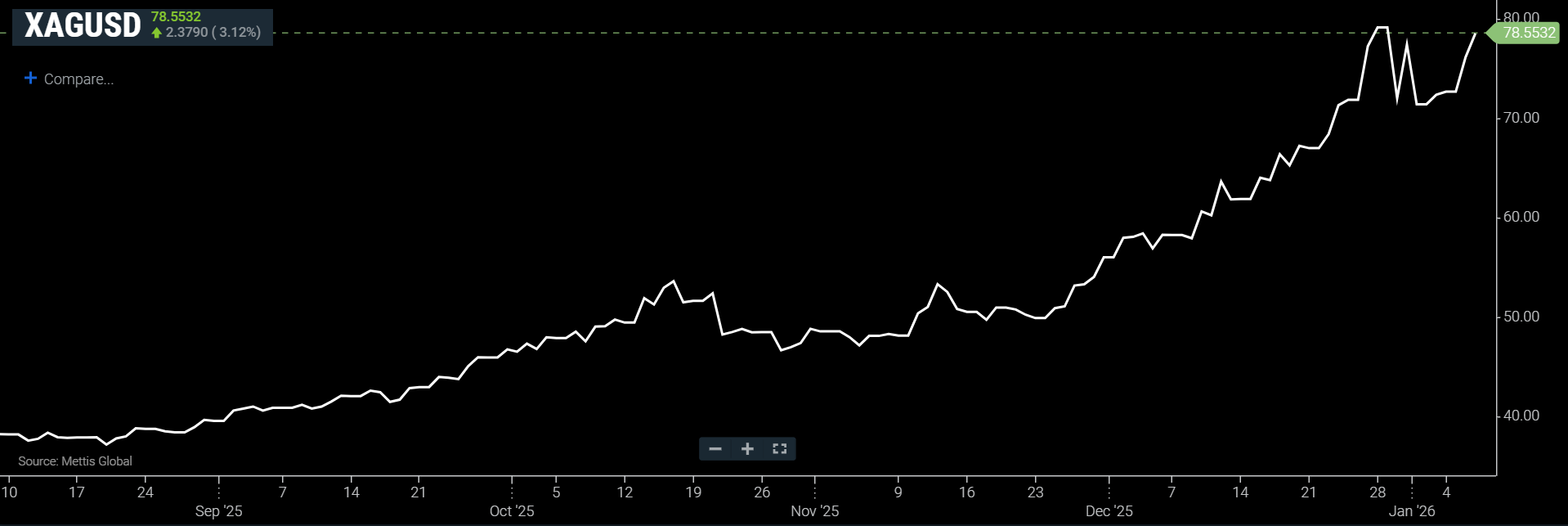

Silver prices also advanced alongside gold, with spot silver up 2.37% at $78.55 an ounce by [10:48 a.m.] PST, Mettis Global data show.

A partial return toward those levels would mathematically

imply silver prices far above current levels, potentially testing ranges that

would represent historic highs.

One of silver’s key advantages lies in its dual identity.

Like gold, it benefits from safe-haven demand during periods of financial

stress, but unlike gold, it also plays a critical role in industrial

applications.

Growing use in solar panels, electronics, and other

technologies tied to the energy transition could provide an additional demand

tailwind if global manufacturing activity strengthens.

Investment positioning also favors silver from a relative

perspective.

While gold has already seen notable inflows particularly

from ETFs and institutional investors silver exposure remains comparatively

modest. Should investor sentiment rotate more aggressively toward precious

metals, capital inflows into silver could have a disproportionate price impact.

Gold, however, continues to rest on a solid fundamental

base. Production among major North American miners is expected to decline

modestly in 2026, while all-in sustaining costs are projected to rise to

roughly $1,600 per ounce, helping to underpin prices.

The report also notes that even a relatively small increase

in investment demand could be enough to propel gold to new record levels.

Central bank behavior remains another critical support

factor. Gold holdings have already overtaken U.S. Treasury allocations in many

reserve portfolios, yet gold still represents a relatively small share of total

reserves on average. Models suggest there is room for further accumulation,

reinforcing expectations of continued official-sector demand.

With traditional equity–bond portfolios facing growing challenges, precious metals are increasingly being viewed as effective diversifiers.

Overall, the outlook suggests a familiar division of roles:

gold acting as the portfolio anchor, and silver as the more volatile but

potentially more rewarding player.

If historical trends, ratio dynamics, and demand drivers

align, silver could emerge as the most eye-catching performer in the next phase

of the precious metals cycle.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,057.83 215.80M | 0.00% 0.00 |

| ALLSHR | 111,198.99 737.64M | 0.00% 0.00 |

| KSE30 | 56,808.99 106.85M | 0.00% 0.00 |

| KMI30 | 262,806.56 83.35M | 0.00% 0.00 |

| KMIALLSHR | 71,591.94 222.57M | 0.00% 0.00 |

| BKTi | 53,634.85 44.18M | 0.00% 0.00 |

| OGTi | 38,885.40 12.11M | 0.00% 0.00 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 79,105.00 | 79,435.00 77,870.00 | 900.00 1.15% |

| BRENT CRUDE | 66.02 | 66.64 65.66 | -0.28 -0.42% |

| RICHARDS BAY COAL MONTHLY | 90.00 | 0.00 0.00 | -4.75 -5.01% |

| ROTTERDAM COAL MONTHLY | 102.50 | 102.50 100.25 | -0.90 -0.87% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 61.93 | 62.46 61.55 | -0.21 -0.34% |

| SUGAR #11 WORLD | 14.26 | 14.35 14.13 | -0.01 -0.07% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

CPI

CPI