Inventory build in U.S. caps oil price moves

MG News | August 13, 2025 at 03:06 PM GMT+05:00

August 13, 2025 (MLN): Oil prices steadied on Wednesday, following a decline in the previous session, after industry data revealed a rise in U.S. crude inventories last week, signaling that the seasonal peak in summer demand is approaching its end.

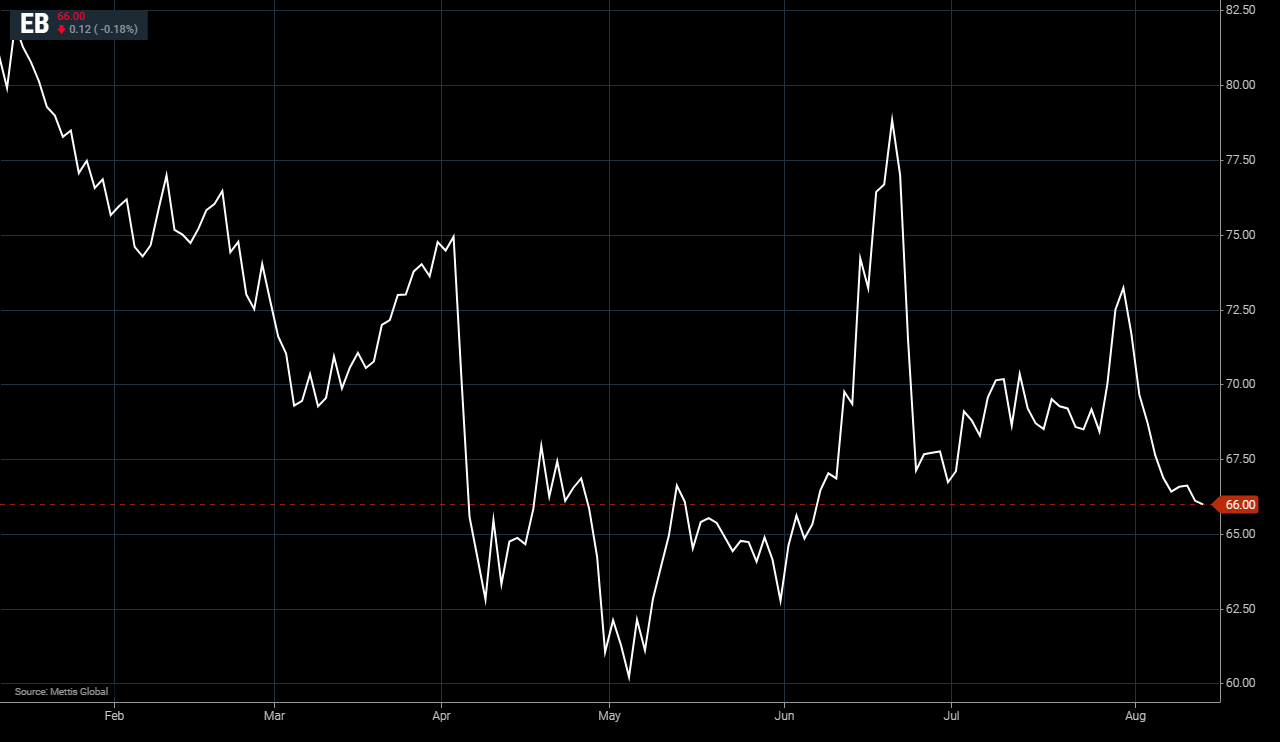

Brent crude futures decreased by $0.12, or 0.18%, to $66.00 per

barrel.

West Texas

Intermediate (WTI) crude futures fall by $0.33, or 0.52%, to $62.84 per

barrel by [3:00 am] PST.

U.S. crude inventories rose by 1.52 million barrels last week according to

market sources citing American Petroleum Institute (API) data released Tuesday.

The figures also showed gasoline stocks declined while distillate

inventories posted a slight increase.

If the U.S. Energy Information Administration’s

(EIA) official data due later on Wednesday confirms a drop in crude

inventories, it could signal that demand during the summer driving season has

peaked and refiners are beginning to scale back output.

The season typically spans from the Memorial Day holiday in late May through

Labor Day in early September.

A Reuters poll of analysts forecasts that the

EIA will report a crude inventory draw of roughly 300,000 barrels for the week.

Price sentiment was further pressured by

production outlooks from both OPEC and the EIA on Tuesday, which projected

higher global supply this year.

Both, however, anticipate that U.S. output the world’s largest will decline

in 2026, while production in other regions continues to grow.

The EIA’s monthly report predicts U.S. crude

production will reach a record 13.41m barrels per day in 2025, driven by

improved well productivity, before easing in 2026 due to lower prices.

OPEC’s latest monthly forecast maintained its 2025 demand growth projection

but lifted its 2026 estimate by 100,000 barrels per day to 1.38 million bpd.

Meanwhile, the White House on Tuesday played

down the likelihood of a rapid peace agreement between Russia and Ukraine, a

move that could prompt markets to reassess expectations for a swift end to the

war and any relaxation of sanctions on Russian oil factors that have been

supporting prices.

U.S. President Donald Trump and Russian

President Vladimir Putin are set to meet in Alaska on Friday for talks aimed at

ending the conflict.

“Trump

downplayed expectations for his meeting with President Putin... However, the

market is seeing a continued decline in expectations for additional sanctions

on Russian crude,” ANZ senior commodity strategist Daniel Hynes noted.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 168,303.25 328.07M | 0.73% 1217.67 |

| ALLSHR | 101,798.94 781.32M | 0.57% 578.22 |

| KSE30 | 51,168.55 142.41M | 0.78% 396.53 |

| KMI30 | 242,124.59 148.48M | 0.92% 2201.24 |

| KMIALLSHR | 66,390.97 419.71M | 0.53% 348.17 |

| BKTi | 45,186.23 25.50M | 0.18% 79.85 |

| OGTi | 33,669.86 17.96M | 0.26% 86.81 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 91,525.00 | 92,620.00 89,800.00 | 1925.00 2.15% |

| BRENT CRUDE | 62.52 | 63.96 62.34 | -1.23 -1.93% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.20 0.22% |

| ROTTERDAM COAL MONTHLY | 97.00 | 97.70 97.00 | -0.25 -0.26% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 58.85 | 60.30 58.68 | -1.23 -2.05% |

| SUGAR #11 WORLD | 14.83 | 14.93 14.72 | 0.03 0.20% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|