Higher margins elevate PRL’s profits by 13x YoY in FY22

MG News | August 22, 2022 at 11:28 AM GMT+05:00

August 22, 2022 (MLN): Pakistan Refinery Limited (PRL) has witnessed a robust growth of 13x YoY in its net profit to clock in at Rs12.57 billion (EPS: Rs19.96) for the FY22 ended on June 30, 2022, compared to Rs937 million (EPS: Rs1.52) in FY21, mainly on the back of higher gross margins.

According to the financial statement sent to PSX, the topline of the company surged to Rs191bn in FY22, showing a two-fold increase compared to Rs92bn in FY21. As a result, the gross margins expanded to 11% from 4% in FY21 as improvement in economic activities around the world amid easing of coronavirus-related restrictions and slower than expected increase in OPEC+ output increased the oil demand.

Also, international oil prices showed a steady upward trend owing to the ongoing war between Russia and Ukraine, fueling fear of disruption to energy supplies. These higher prices amid supply constraints resulted in better product margins.

With regards to major expense heads, the company encountered a 7.6x YoY higher operating expenses which stood at Rs2.43bn while the company witnessed a 15% YoY and 20.6% YoY rise in its administrative and distribution expenses, respectively.

Similarly, the finance cost of the company also went up by 20% YoY to clock in at Rs1.11bn in FY22 on an account of an increase in the policy rate.

On the taxation front, the company paid Rs3.34bn, up by 4.7 times YoY during the review period, compared to Rs701mn in SPLY.

|

Profit and Loss Account for the year ended June 30th, 2022 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Jun-22 |

Jun-21 |

% Change |

|

Revenue from contracts with customers |

191,316,055 |

92,084,090 |

107.76% |

|

Cost of sales |

(171,043,647) |

(88,843,085) |

92.52% |

|

Gross Profit |

20,272,408 |

3,241,005 |

525.50% |

|

Distribution costs |

(321,270) |

(266,280) |

20.65% |

|

Administrative expenses |

(552,145) |

(478,810) |

15.32% |

|

Other operating expenses |

(2,432,894) |

(176,074) |

1281.75% |

|

Other income |

534,828 |

636,931 |

-16.03% |

|

Operating profit |

17,500,927 |

2,956,772 |

491.89% |

|

Finance cost |

(1,579,332) |

(1,311,384) |

20.43% |

|

Share of loss of associated accounted for using the equity method |

(3,416) |

(6,364) |

-46.32% |

|

Profit before taxation |

15,918,179 |

1,639,024 |

871.20% |

|

Taxation |

(3,344,729) |

(701,868) |

376.55% |

|

Profit after taxation |

12,573,450 |

937,156 |

1241.66% |

|

Earnings per share - basic and diluted (rupees) |

19.96 |

1.52 |

1213.16% |

Copyright Mettis Link News

Related News

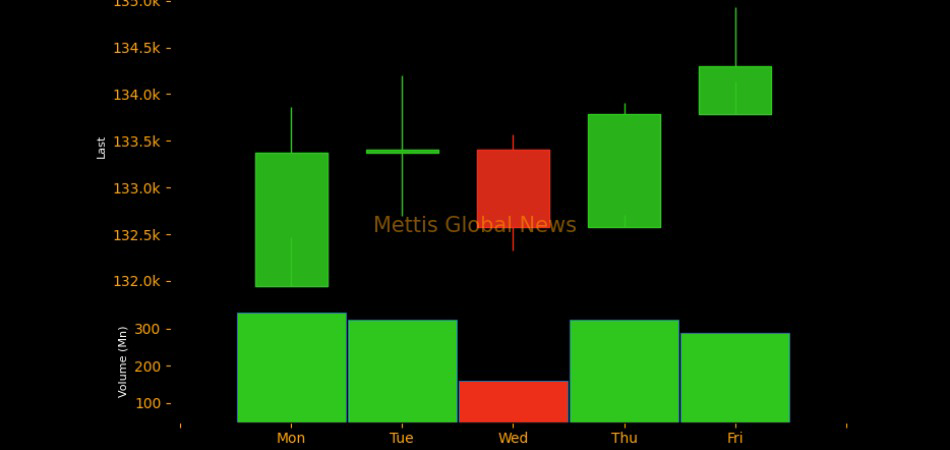

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 0.00 0.00 |

-390.00 -0.33% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 0.00 0.00 |

0.30 0.44% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|