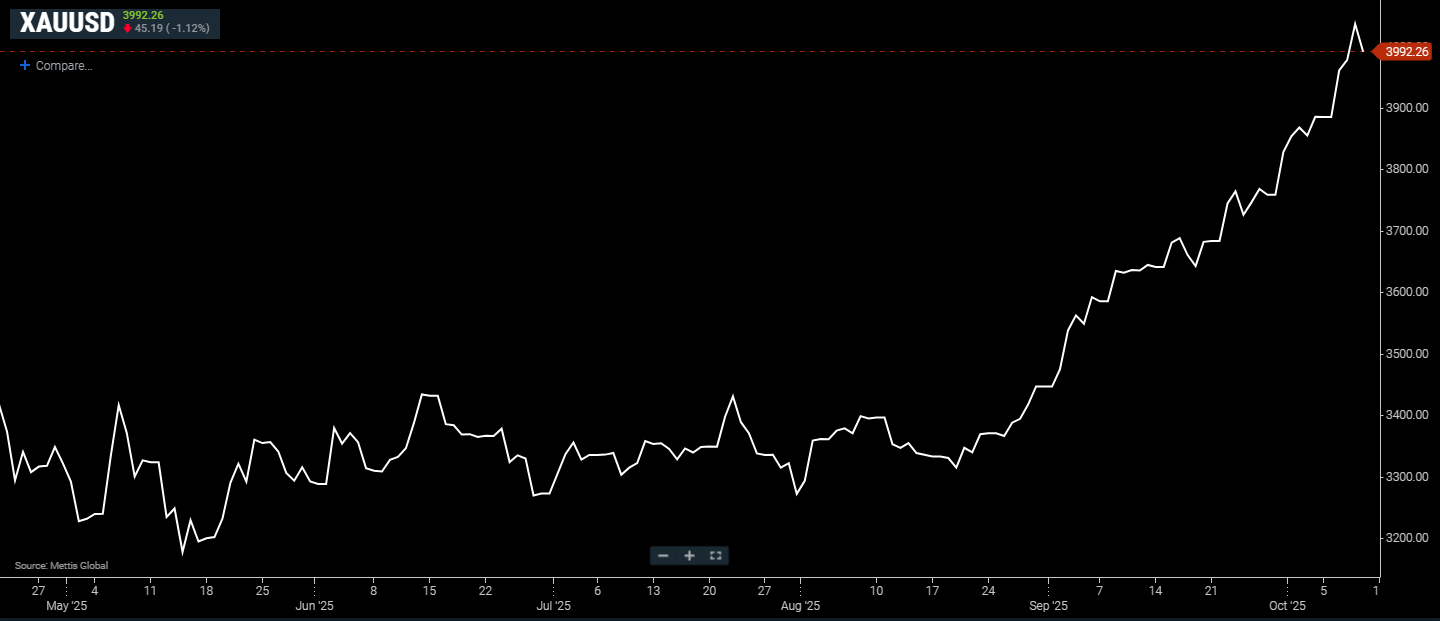

Gold’s bull run continues, eyes eighth straight weekly gain

MG News | October 10, 2025 at 04:38 PM GMT+05:00

October 10, 2025 (MLN): Gold rebounded from early losses on Friday and was poised to notch its eighth consecutive weekly gain, supported by persistent political and economic uncertainty and growing expectations of further U.S. interest rate cuts.

Silver, meanwhile, hovered just below a record high.

Spot gold was down 1.12% at $3,992.26 an ounce as of [4:35 pm] PST, according to data reported by Mettis Global.

U.S. gold futures for December delivery rose 0.8% to $4,005.30 per ounce.

The non-yielding

metal, traditionally viewed as a safe haven during periods of instability, has

drawn strong demand amid global market turbulence.

“Gold is no longer

just a defensive asset it’s becoming an offensive one,” said Alex Ebkarian,

COO at Allegiance Gold to CNBC.

“In this environment, it stands as the

strongest alternative to the dollar and a true measure of trust in the global

financial system.” Ebkarian added that gold is in a “secular bull market”

likely to last the next five years.

The rally has been fueled by a combination of geopolitical risks, robust central bank purchases, inflows into gold-backed exchange-traded funds, and expectations of U.S. rate cuts.

On the other hand, Silver climbed 3.7% to $50.95 per ounce, following a record high of $51.22 reached on Thursday.

The metal has surged

76% so far this year, supported by tight supply conditions and

speculative momentum.

“Given the rise in

lease rates, a steep backwardation curve, and limited liquidity in the London

over-the-counter market, greater volatility in silver should be expected,” said

Hugo Pascal, a precious metals trader at InProved.

Backwardation occurs

when a commodity’s spot price exceeds its future price. Ebkarian noted that if contango

the opposite of backwardation returns and market stress eases, a short-term

pullback in silver could emerge, potentially offering “the next great buying

opportunity.”

The U.S. dollar

index slipped 0.3%, making dollar-denominated bullion more

affordable for foreign investors.

Minutes from the Federal

Reserve’s September meeting indicated policymakers were open to cutting

rates to cushion the labor market, though inflation concerns lingered, CNBC

reported.

Markets are

currently pricing in two rate cuts of 25 basis points each in October

and December.

In geopolitical developments, Israel’s government ratified a ceasefire with Hamas on Friday, marking a potential step toward easing tensions in the region.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes