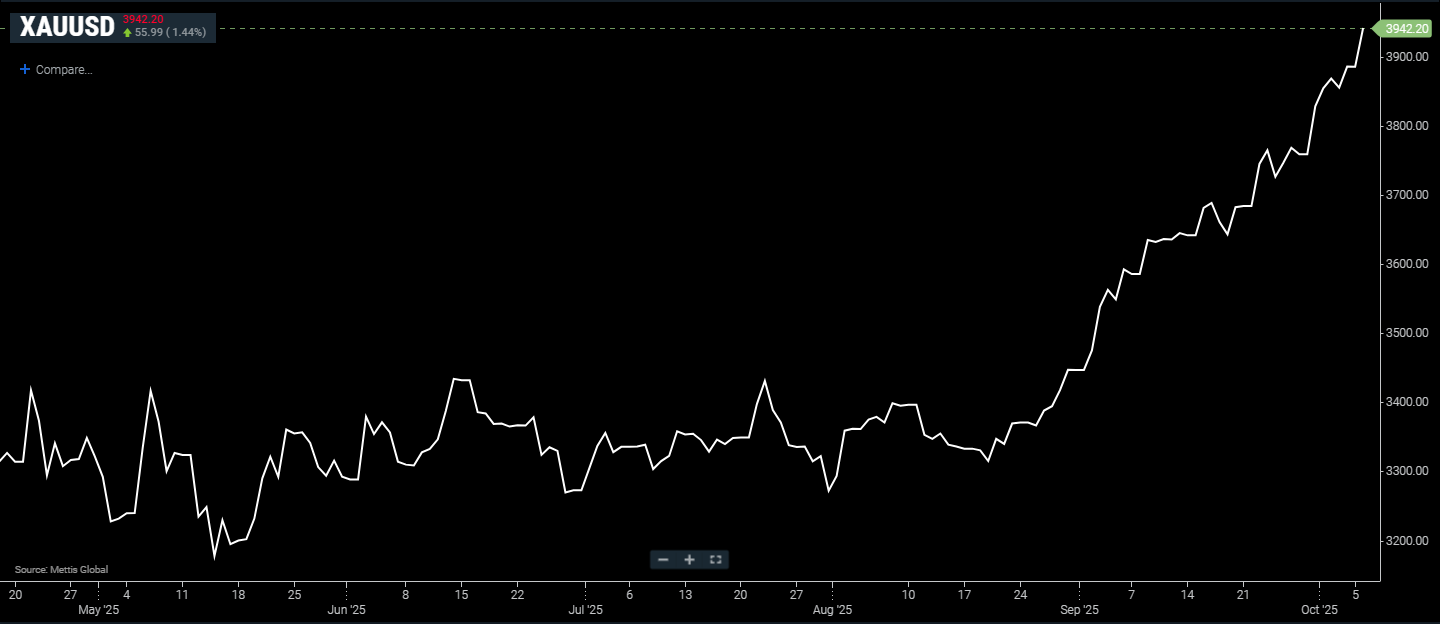

Gold soars to record high above $3,900

MG News | October 06, 2025 at 02:20 PM GMT+05:00

October 06, 2025 (MLN): Gold prices surged

past the $3,900 mark for the first time on Monday, driven by strong safe-haven

demand as the yen weakened sharply and the ongoing U.S. government shutdown

fueled economic uncertainty.

Expectations of further Federal Reserve rate cuts added to the bullish momentum.

Spot gold was up 1.44% at $3,942.20 an ounce as of [2:19 pm] PST, according to data reported by Mettis Global.

U.S. gold futures for December

delivery rose 1% to $3,947.30.

“Yen weakness on the back of the

Japanese LDP elections has left investors with one less safe-haven asset to

turn to, and gold has taken full advantage,” said Tim Waterer, Chief

Market Analyst at KCM Trade to CNBC.

He added that the “enduring U.S.

government shutdown continues to cast a shadow over the economy,” heightening

concerns about potential GDP losses and driving investors toward gold.

The yen plunged to its weakest level

against the U.S. dollar in five months after fiscal dove Sanae Takaichi

was elected leader of Japan’s ruling party, paving the way for her to become

the next prime minister.

In Washington, a senior White House

official warned that mass layoffs of federal workers could begin if President Donald

Trump deems negotiations with congressional Democrats to reopen the

government as “going nowhere.”

Meanwhile, Federal Reserve Governor

Stephen Miran reiterated calls for an aggressive rate-cut path on Friday,

citing the drag from Trump administration economic policies.

Gold has soared 49% so far in 2025,

building on a 27% gain in 2024, as strong central bank buying, robust

ETF inflows, a weaker dollar, and persistent geopolitical tensions underpin

demand.

The rally gained further traction last

month after the Fed cut rates by 25 basis points and signaled more easing to

come.

According to the CME FedWatch Tool,

investors are pricing in additional quarter-point rate cuts in October

and December, with probabilities of 95% and 83%,

respectively.

As a non-yielding asset, gold

typically benefits from lower interest rates and times of economic uncertainty.

The metal first broke above $3,000 in March and surpassed $3,700

in mid-September, prompting many brokerages to adopt a bullish stance on its

outlook.

Elsewhere in precious metals, spot

silver rose 0.8% to $48.33 per ounce, platinum gained 1.1% to

$1,621.90, and palladium advanced 0.8% to $1,270.25.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes