PSX Closing Bell: Manic Monday

MG News | October 06, 2025 at 04:00 PM GMT+05:00

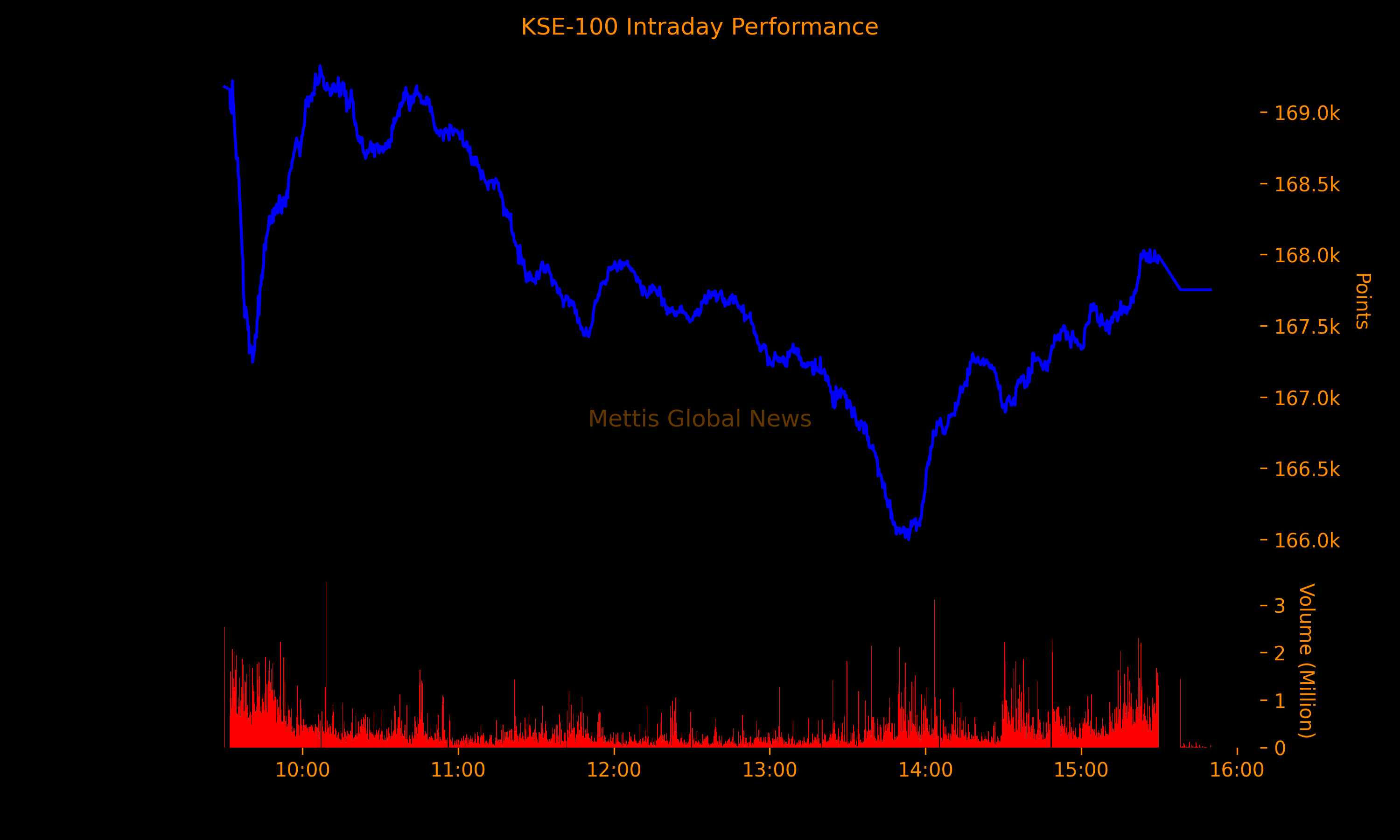

October 06, 2025 (MLN): The benchmark KSE-100 Index remained under pressure throughout Monday’s session, closing at 167,752.40, down 1,237.67 points or 0.73%, as investors engaged in profit-taking after weeks of strong gains.

The index traded in a range of 3,328.99 points showing an intraday high of 169,326.35 (+336.28) and a low of 165,997.36 (-2,992.71) points.

The total volume of the KSE-100 Index was 623.77 million shares.

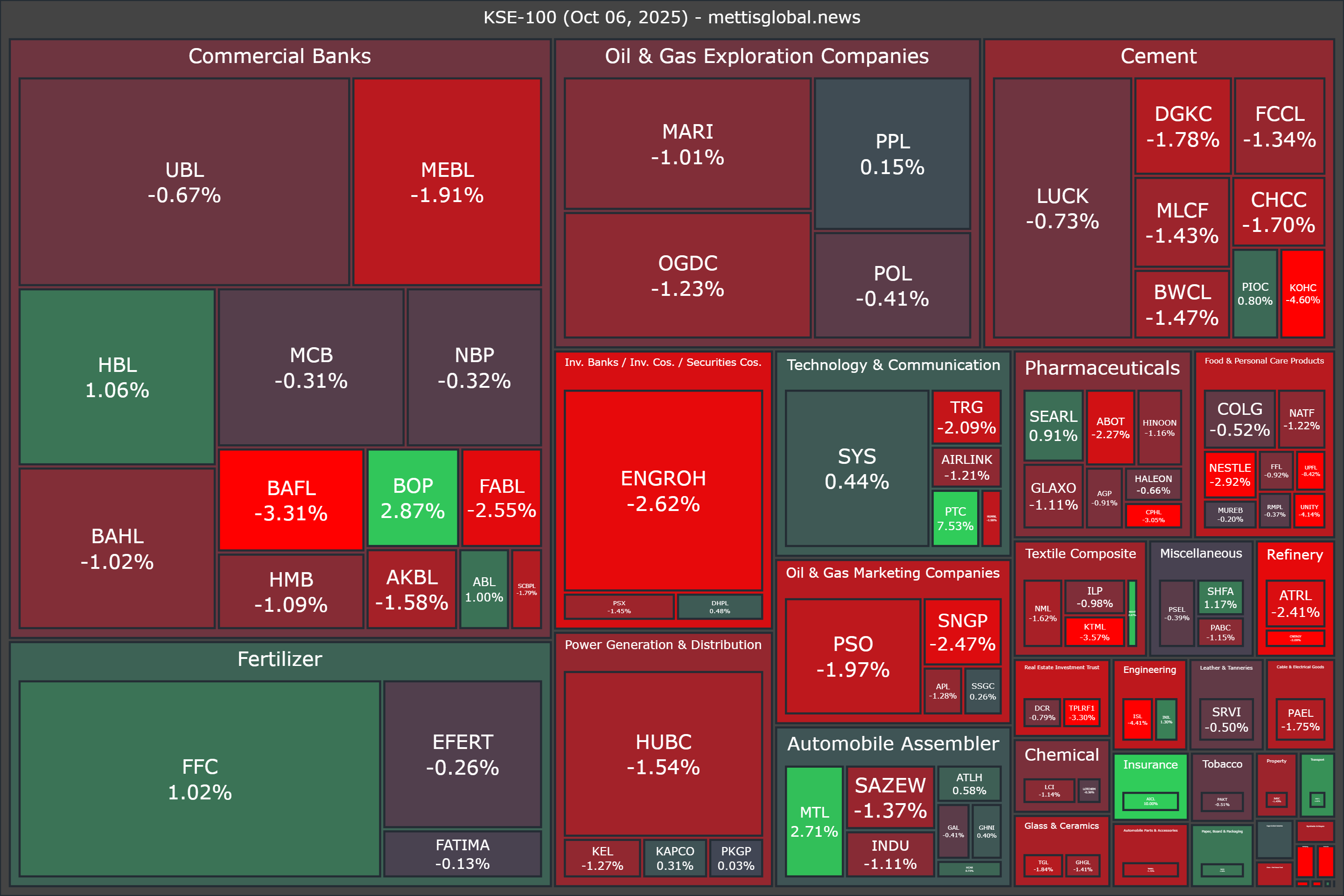

Of the 100 index companies 26 closed up, 74 closed down.

Top losers during the day were SSOM (-9.04%), UPFL (-8.42%), YOUW (-6.33%), KOHC (-4.60%), and ISL (-4.41%).

On the other hand, top gainers were AICL (+10.00%), PTC (+7.53%), BOP (+2.87%), MTL (+2.71%), and MEHT (+2.67%).

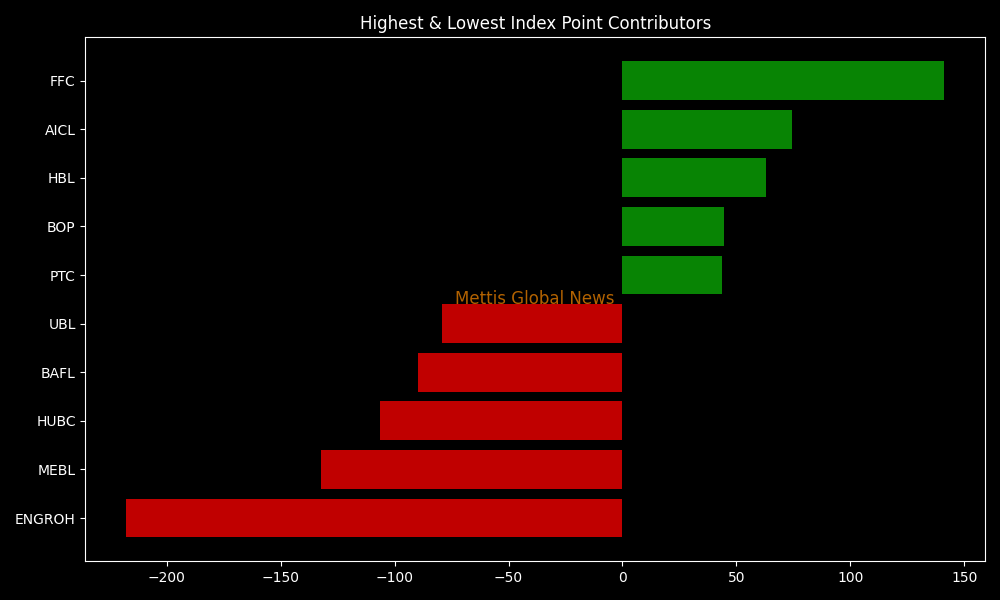

In terms of index-point contributions, companies that dragged the index lower were ENGROH (-217.69pts), MEBL (-132.07pts), HUBC (-106.54pts), BAFL (-89.70pts), and UBL (-79.04pts).

Meanwhile, companies that added points to the index were FFC (+141.13pts), AICL (+74.44pts), HBL (+62.95pts), BOP (+44.47pts), and PTC (+43.75pts).

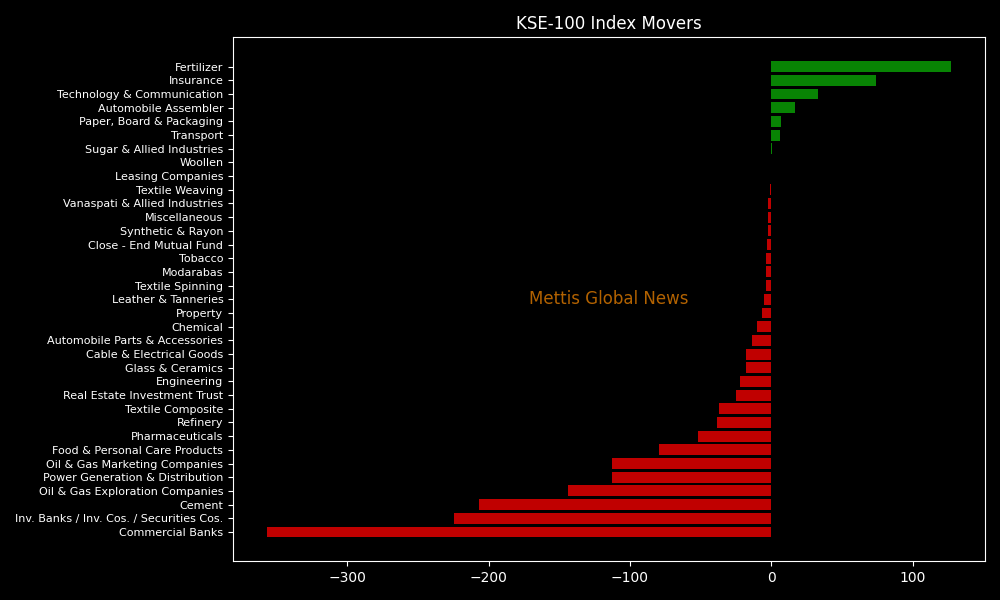

Sector-wise, KSE-100 Index was let down by Commercial Banks (-356.71pts), Inv. Banks / Inv. Cos. / Securities Cos. (-224.67pts), Cement (-206.69pts), Oil & Gas Exploration Companies (-143.58pts), and Power Generation & Distribution (-113.04pts).

While the index was supported by Fertilizer (+127.03pts), Insurance (+74.44pts), Technology & Communication (+32.90pts), Automobile Assembler (+17.01pts),

In the broader market, the All-Share Index closed at 53,488.77 with a net loss of 491.70 points or 0.91%.

Despite Monday’s pullback, analysts noted that investor sentiment remains broadly supported by improving macroeconomic indicators. In a key development, Pakistan recorded one of the fastest declines in sovereign default risk, according to Bloomberg, ranking second globally behind Türkiye.

Total market volume was 1,274.36 million shares compared to 1,573.35m from the previous session while traded value was recorded at Rs60.54 billion showing a decrease of Rs18.13bn.

There were 553,332 trades reported in 487 companies with 108 closing up, 348 closing down, and 31 remaining unchanged.

| Symbol | Price | Change % | Volume |

|---|---|---|---|

| BOP | 34.46 | 2.87% | 131,310,593 |

| KEL | 7.02 | -1.27% | 110,020,680 |

| BML | 8.29 | 6.15% | 78,284,377 |

| WTL | 1.7 | -3.41% | 75,174,726 |

| CNERGY | 8.79 | -3.09% | 64,429,981 |

| PIBTL | 15.69 | 1.69% | 51,222,290 |

| GGL | 28.93 | 0.84% | 45,311,076 |

| PTC | 31.41 | 7.53% | 43,540,218 |

| HASCOLNC | 15.9 | -2.81% | 39,763,617 |

| PACE | 14.13 | -0.56% | 28,038,550 |

To note, the KSE-100 has gained 42,125 points or 33.53% during the fiscal year, whereas it has increased 52,626 points or 45.71% so far this calendar year.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes