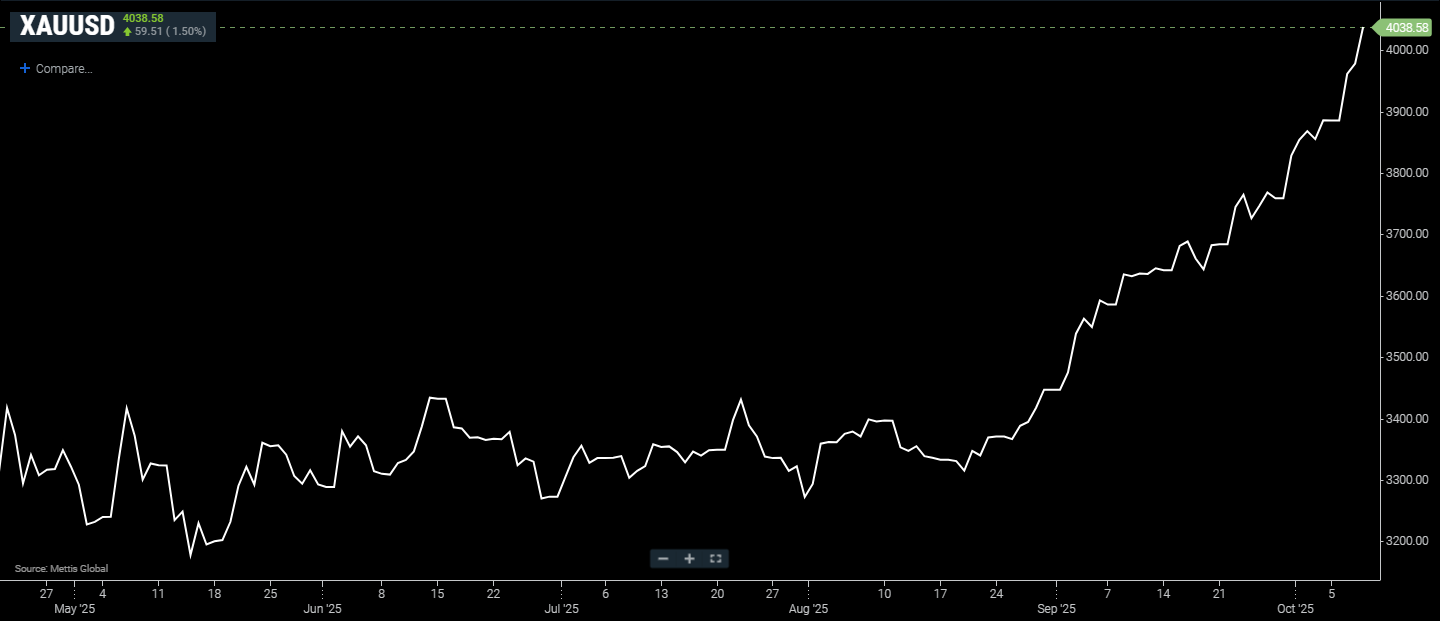

Gold retreats after record high as investors take profits

MG News | October 09, 2025 at 10:16 AM GMT+05:00

October 9, 2025 (MLN): Gold prices eased

on Thursday as investors booked profits following a record-breaking rally that

pushed bullion above the key $4,000 per ounce level for the first time,

driven by mounting economic and geopolitical uncertainties and growing

expectations of further U.S. interest rate cuts.

Spot gold was up 1.55% at $4,038.58 an

ounce as of [10:13 am] PST, according to data reported by Mettis Global.

U.S. gold futures for December delivery slipped 0.7% to $4,042.60.

According to minutes from the Federal

Reserve’s September 16–17 meeting, officials agreed that risks to the U.S.

labor market had increased enough to justify a rate cut.

However, policymakers remained cautious due to

lingering inflation pressures and uncertainty over how much higher borrowing

costs are affecting economic activity, CNBC reported.

Markets are currently pricing in two

more 25 basis point rate cuts one in October with a 95%

probability and another in December with an 83% chance,

according to the CME FedWatch tool.

Gold, a non-yielding asset,

tends to benefit from a low-interest-rate environment and periods of

heightened uncertainty.

Investors have been navigating a

volatile week marked by political turmoil in Japan and France and an

ongoing U.S. government shutdown, prompting renewed safe-haven demand

for bullion.

The yellow metal has surged 54%

year to date, buoyed by strong central bank purchases, robust

inflows into gold-backed Exchange-Traded Funds (ETFs), a weaker U.S.

dollar, and rising retail investor interest amid escalating trade and

geopolitical tensions.

Holdings of the SPDR Gold Trust,

the world’s largest gold-backed ETF, edged up 0.14% to 1,014.58 tons on

Wednesday, from 1,013.15 tons the previous day.

Among other precious metals, spot

silver inched up 0.1% to $48.91 per ounce after touching a record $49.57

on Wednesday. Platinum fell 0.7% to $1,650.60, while palladium

dropped 1% to $1,435.25.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes