Gold poised for $5,400, new buyers to reshape the market

MG News | January 26, 2026 at 10:22 AM GMT+05:00

January 26, 2026 (MLN): Gold’s rally is entering a

new phase, and the forces behind it are no longer confined to central banks

alone.

What began as a defensive move by official institutions has

evolved into a broader diversification trend that now includes private

investors, high-net-worth families, and financial market participants seeking

long-term protection against global policy risks.

This shift is reshaping gold’s price dynamics and pushing

expectations for where the metal could trade by the end of the decade.

In the past two years, central bank buying laid the

foundation for higher gold prices as emerging-market economies accelerated the

diversification of their reserve assets.

That steady accumulation helped lift prices through 2023 and

2024. Since 2025, however, gold’s ascent has accelerated beyond what

traditional models based on interest rates and historical flows would imply.

The difference this time has been the growing presence of

private-sector investors who are using gold as a hedge against fiscal

sustainability concerns, monetary credibility, and broader macroeconomic

uncertainty.

A new research report from Goldman Sachs highlights how

meaningful this transition has become. The bank has raised its December 2026

gold price forecast to $5,400 per ounce from a previous estimate of $4,900,

arguing that private-sector diversification into gold is no longer a

theoretical upside risk but a reality already influencing prices.

Crucially, the forecast assumes these investors do not

unwind their positions in 2026, effectively anchoring gold at a higher starting

level than previously expected.

Western gold exchange-traded fund holdings have risen

sharply since early 2025, increasing by around 500 tonnes and surpassing levels

implied by simple models tied to U.S. interest rate movements.

At the same time, physical gold purchases by wealthy

investors and increased activity in options markets have intensified

competition for limited bullion supply, reinforcing upward price momentum.

Goldman’s revised forecast implies a roughly 17% increase

from early-2026 price levels by the end of that year.

The bulk of this upside is expected to come from continued

central bank demand, particularly from emerging markets that are still in the

process of structurally diversifying their reserves.

Additional support is expected from renewed ETF inflows as

the Federal Reserve is projected to cut interest rates in 2026, lowering the

opportunity cost of holding gold.

The bank also assumes that hedges linked to global macro

policy risks remain in place, reflecting the view that concerns around

long-term fiscal and monetary stability are unlikely to be fully resolved

within the forecast horizon.

Unlike many other commodities, gold does not respond to

higher prices with a surge in supply.

New mine production adds only a small fraction to the

existing global stock each year, making gold supply largely price inelastic. As

a result, rallies in gold tend to reverse only when demand weakens.

According to the analysis, a sustained decline in central

bank purchases, a clear easing of macro policy risks, or a shift by the Federal

Reserve from cutting rates to raising them would be the key signals that the

current bullish phase is nearing an end.

Until such changes materialize, the risks to gold prices

appear skewed to the upside.

If private investors continue to diversify into gold amid

lingering global uncertainty, prices could exceed even the upgraded forecast.

For now, gold’s role as a long-term hedge rather than a short-term trade is gaining traction, suggesting that the metal’s latest rally may prove more durable than previous cycles.

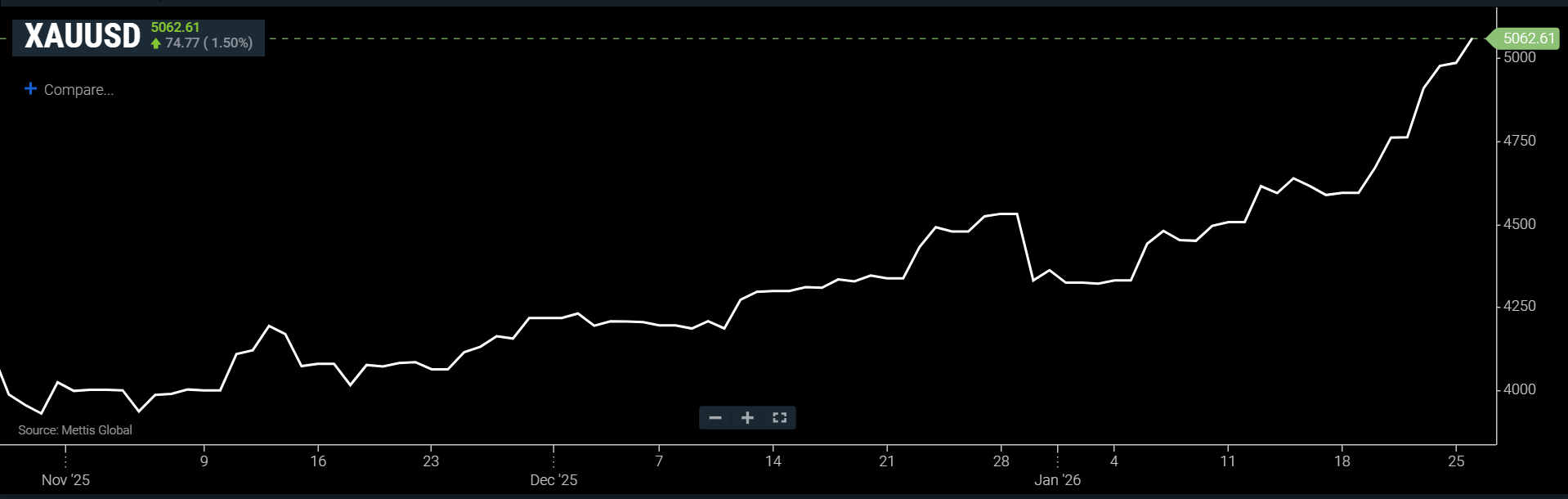

Currently, spot gold up 1.5% at $5,062.61 an ounce as of [10:28 am] PST, according to data reported by Mettis Global.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

_20260101112329999_0153db_20260209062258909_9180ec.webp?width=280&height=140&format=Webp)

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile