Gold holds steady as markets await key U.S. inflation data

MG News | September 25, 2025 at 01:04 PM GMT+05:00

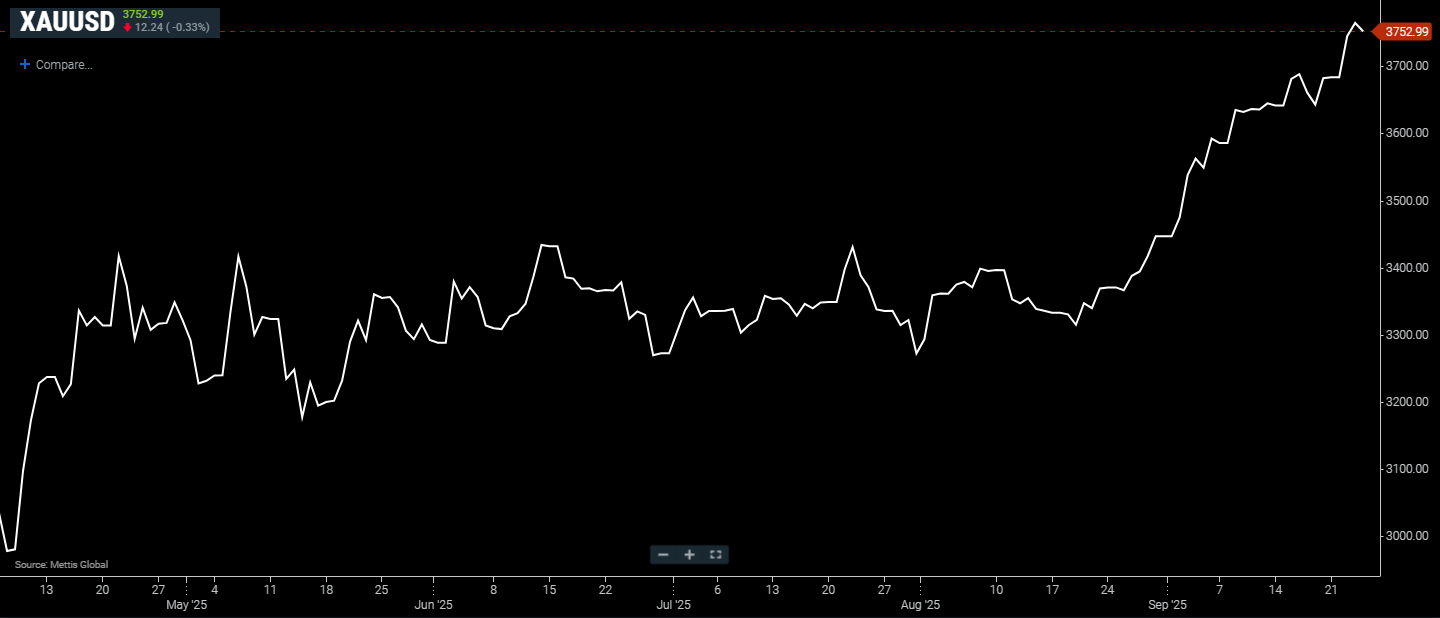

September 25, 2025 (MLN): Gold prices were mostly steady on Thursday as investors looked ahead to U.S. economic data that could provide fresh signals on the Federal Reserve’s policy path, while a softer dollar lent modest support to the metal.

Spot gold was down 0.33% at $3,752.99 an ounce as of [1:02 pm] PST, according to data reported by Mettis Global.

December U.S. gold futures held at $3,765.20 per ounce.

The U.S. dollar index slipped 0.1%,

making bullion slightly more affordable for holders of other currencies.

Federal Reserve

officials continued to shape expectations for monetary policy. San Francisco

Fed President Mary Daly on Wednesday voiced full support for last week’s

interest rate cut, noting she anticipates more reductions ahead, according to

CNBC.

Her comments

reinforced views that the central bank may prioritize employment while

tolerating stronger growth.

“The move may

reflect expectations that the Fed intends to run the U.S. economy hot as it

rebalances its focus to the labour market,” said Ilya Spivak, head of global

macro at Tastylive to CNBC.

He pointed to

technical levels, citing initial support near $3,700–$3,600 and

resistance around the record high of $3,790, with the potential to reach

$3,870–$4,000 if momentum continues.

Fed Chair Jerome

Powell earlier this week stressed the need to balance inflation risks against

signs of a weakening job market.

Attention now turns

to Friday’s release of the personal consumption expenditures (PCE) price

index, the Fed’s preferred inflation gauge.

Weekly jobless

claims figures, due later Thursday, will also be watched for signals on labor

market conditions.

Markets are pricing

in two more 25-basis-point Fed rate cuts this year, likely in October and

December.

Gold, which

typically benefits from lower interest rates, touched a fresh record of $3,790.82

on Tuesday.

Elsewhere in

precious metals, spot silver dipped 0.2% to $43.83 per ounce, platinum

eased 0.1% to $1,470.66, while palladium edged up 0.1% to $1,210.96.

Copyright Mettis

Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes