Gold hits record high amid U.S. shutdown fears and weak labor data

MG News | October 01, 2025 at 10:27 AM GMT+05:00

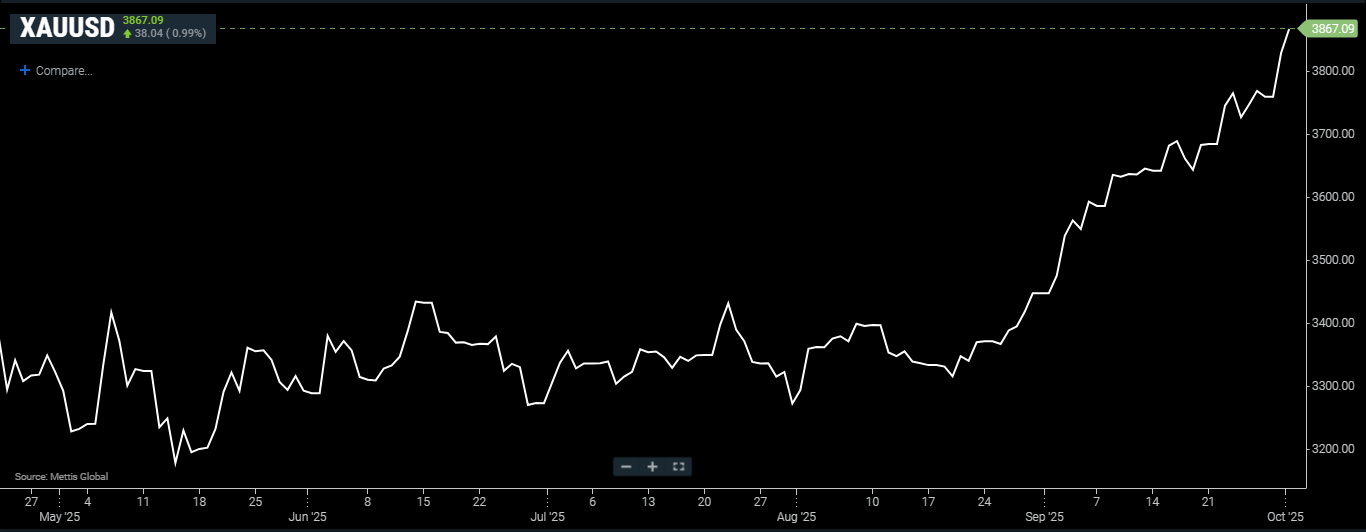

October 01, 2025 (MLN): Gold prices soared to a record high on Wednesday as investors flocked to safe-haven assets amid rising concerns over a potential U.S. government shutdown and signs of a weakening labor market, which reinforced expectations of imminent interest rate cuts by the Federal Reserve.

Spot gold was up 0.99% at $3,867.09 an ounce as of [10:26 am] PST, according to data reported by Mettis Global.

U.S. gold futures for

December delivery climbed 0.7% to settle at $3,901.40.

The U.S. dollar index

hovered near a one-week low, making dollar-denominated gold more appealing to

international buyers.

“Gold is being

supported by a softer dollar, escalating political tensions surrounding the

potential U.S. government shutdown, and broader geopolitical uncertainty,” said

Nicholas Frappell, global head of institutional markets at ABC Refinery to

CNBC.

The U.S. Senate on

Tuesday failed to pass a funding extension bill, moving the country closer to a

shutdown. Former President Donald Trump also weighed in, threatening further

cuts to the federal workforce.

A shutdown could delay

the release of critical economic data, including Friday’s closely watched

non-farm payrolls report, according to CNBC.

Meanwhile, Labor

market data released on Tuesday showed only marginal growth in U.S. job

openings for August, with hiring rates declining indicating a cooling

employment landscape.

The soft Labor data

has heightened expectations for monetary easing. Traders are now pricing in a

97% probability of a 25-basis-point rate cut at the Fed’s upcoming meeting,

with a 76% chance of another cut in December, according to CME Group’s FedWatch

tool.

Investors are also

awaiting the ADP National Employment Report, due later today, for further clues

on the labor market's health.

“It’s hard to see an

immediate end to gold’s rally. We expect further gains in the near term,” said

Michael Hsueh, precious metals analyst at Deutsche Bank, as noted by CNBC.

Gold, which does not

yield interest, typically performs well during periods of economic and

political uncertainty and in low-interest rate environments. It has surged more

than 47% so far this year.

Other precious metals also rallied. Spot silver rose 1.5% to $47.39 per ounce, reaching its highest level in over 14 years. Platinum climbed 1.4% to $1,595.85, while palladium advanced 0.9% to $1,267.75.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 0.00 0.00 | -175.00 -0.20% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 0.00 0.00 | 0.06 0.10% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes