Gold eases as stronger dollar weighs ahead of Fed minutes

MG News | November 19, 2025 at 10:23 AM GMT+05:00

November 19, 2025 (MLN): Gold prices inched lower on Wednesday as a

firmer U.S. dollar weighed on the metal, while investors looked ahead to the

release of Federal Reserve meeting minutes and key U.S. employment data that

could offer further clues about the future path of interest rates.

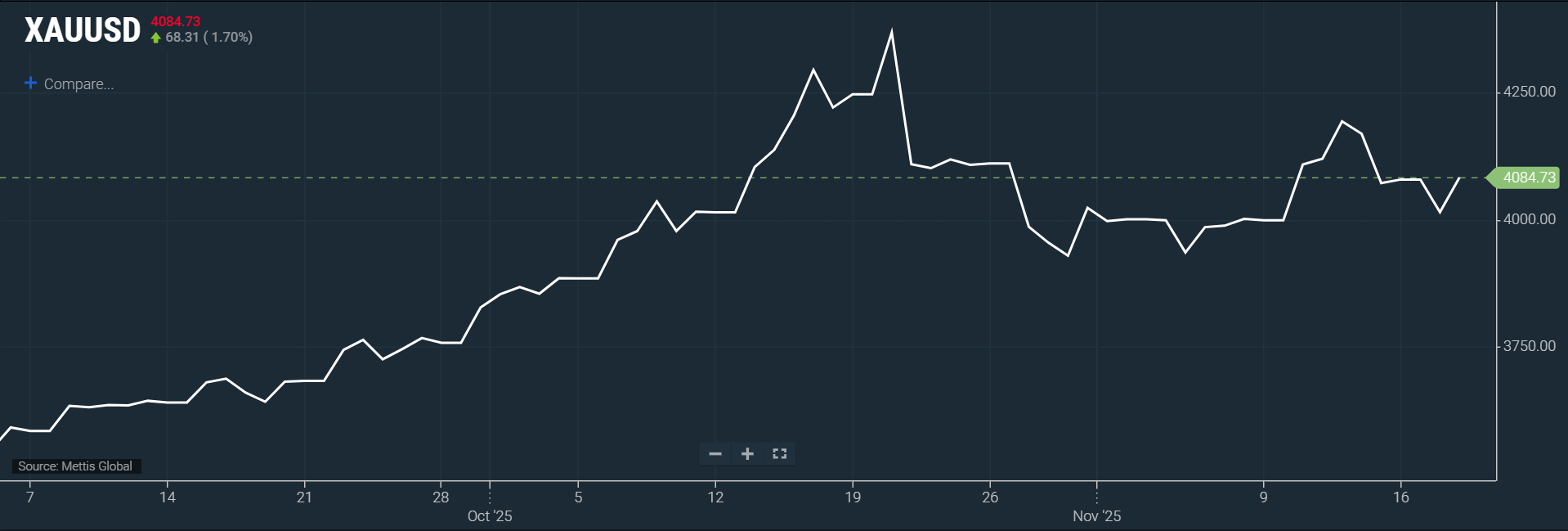

Spot gold was up 1.7% at $4,084.73 an ounce as of [10:18 am] PST, according to data reported by Mettis Global.

December gold futures eased 0.1% to $4,061.60.

“Gold’s recent rally has been tempered by the stronger U.S. dollar and uncertainty over when the Fed might deliver its next rate cut,” said Tim Waterer, Chief Market Analyst at KCM Trade, CNBC reported.

“Still, rising risk

aversion has kept gold attractive as a safe-haven asset, limiting the

downside.”

The dollar edged 0.1% higher against major peers, making

bullion more expensive for buyers using other currencies.

Global equities have come under pressure this week, with the

S&P 500 extending its decline to a fourth straight session amid renewed

worries over the lofty valuations of AI-related stocks.

Market participants are now focused on the Fed’s meeting

minutes due later on Wednesday, as well as the September non-farm payrolls

report delayed due to the recent U.S. government shutdown and now scheduled for

release on Thursday.

The Fed trimmed interest rates by 25 basis points last

month, though Chair Jerome Powell cautioned that further easing this year would

depend heavily on incoming economic data.

According to CME Group’s FedWatch tool, traders are pricing

in nearly a 49% chance of a rate cut at the central bank’s December 9–10

meeting.

Lower rates typically support non-yielding gold, which also

tends to benefit during periods of economic uncertainty.

In other precious metals, spot silver was steady at $50.70 per ounce. Platinum dropped 0.5% to $1,527.63, while palladium fell 0.3% to $1,396.68.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 72,870.00 | 73,135.00 72,390.00 | -575.00 -0.78% |

| BRENT CRUDE | 82.58 | 84.48 80.30 | 1.18 1.45% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 76.03 | 76.19 75.71 | 1.37 1.84% |

| SUGAR #11 WORLD | 13.71 | 14.07 13.70 | -0.22 -1.58% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction