Gold, Silver plunge on Warsh fed pick, dollar surges

MG News | January 31, 2026 at 01:02 PM GMT+05:00

January 31, 2026 (MLN): Gold and silver prices collapsed logging one of their steepest single-day declines in decades.

The sell-off followed U.S. President Donald Trump’s nomination of Kevin Warsh as the next chair of the Federal Reserve, a move that eased concerns over central bank independence and sparked a sharp rally in the U.S. dollar.

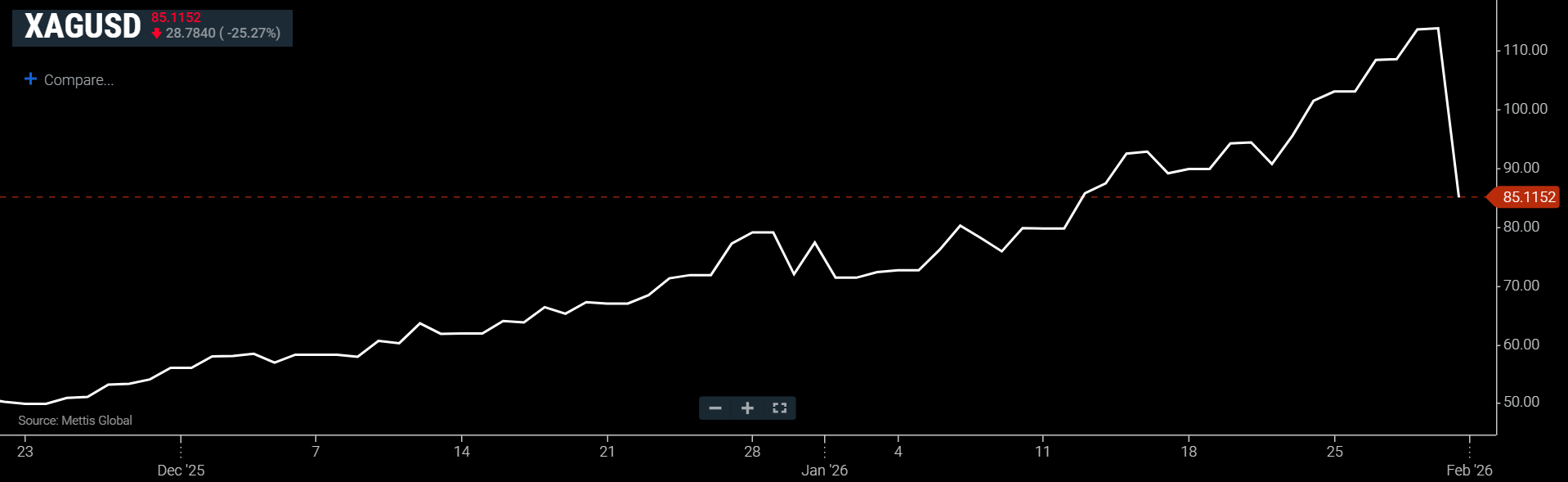

Silver recorded some of the steepest losses, as Spot Silver fell 25.27% to $85.11 an ounce as of [1:09 PM] PST, according to data reported by Mettis Global.

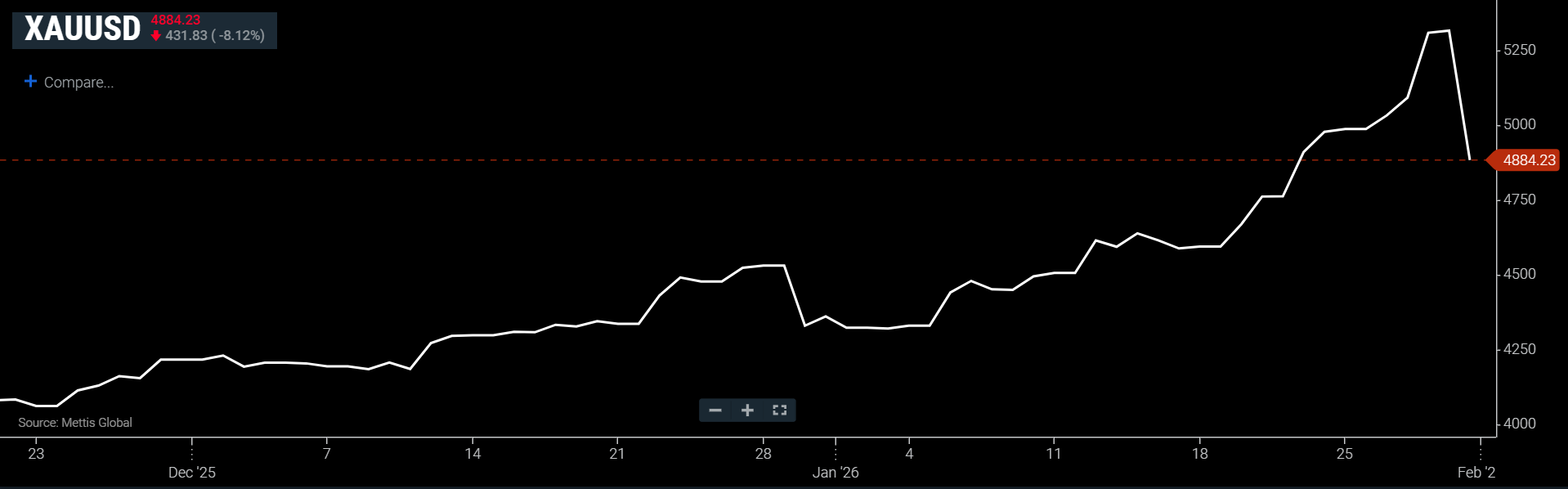

Gold was also not spared from the rout, as Spot gold fell 8.12% to $4,884.23 an ounce as of [1:09 PM] PST, according to data reported by Mettis Global.

The market reaction began soon after headlines pointed to

Warsh emerging as the preferred candidate for the Fed’s top job, but selling

intensified later in the U.S. session.

Traders who had heavily bet on the metals during their

historic rally moved quickly to lock in gains, accelerating the downward

momentum.

A rapidly strengthening dollar added to the pressure.

Because bullion is priced in the U.S. currency, a stronger

greenback raises costs for international buyers and often dampens demand.

The move also challenged the growing narrative that gold and

silver could increasingly serve as alternatives to the dollar in the global

financial system.

Until recently, National Economic Council Director Kevin Hassett had been widely viewed as the leading contender to replace Jerome Powell, as reported by CNBC.

However, shifts in prediction markets suggested confidence

was building around Warsh, with interpretation on the possible appointment as

signaling a firmer stance on inflation.

Uncertainty surrounding the future leadership of the Federal

Reserve has been a quiet but influential driver in commodities trading.

Both metals surged to extraordinary heights in 2025, with gold advancing roughly 66% and silver soaring about 135% amid geopolitical strains, financial market swings, and persistent concerns over central bank policy.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 166,258.55 345.39M | -0.85% -1432.54 |

| ALLSHR | 99,756.66 682.04M | -0.84% -849.13 |

| KSE30 | 50,917.87 169.66M | -0.80% -409.75 |

| KMI30 | 232,771.76 122.66M | -0.63% -1483.82 |

| KMIALLSHR | 63,780.68 324.88M | -0.84% -537.69 |

| BKTi | 49,031.15 76.99M | -1.23% -610.02 |

| OGTi | 32,693.73 16.75M | -1.13% -372.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 66,185.00 | 67,760.00 64,325.00 | -1640.00 -2.42% |

| BRENT CRUDE | 71.88 | 71.96 70.69 | 0.12 0.17% |

| RICHARDS BAY COAL MONTHLY | 96.00 | 0.00 0.00 | -3.50 -3.52% |

| ROTTERDAM COAL MONTHLY | 107.95 | 107.95 107.95 | 0.30 0.28% |

| USD RBD PALM OLEIN | 1,071.50 | 1,071.50 1,071.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 66.60 | 66.67 65.38 | 0.12 0.18% |

| SUGAR #11 WORLD | 14.05 | 14.10 13.78 | 0.18 1.30% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Monetary Aggregates (M3) - Monthly Profile

Monetary Aggregates (M3) - Monthly Profile