Global Sukuk market soars 21% YoY: Fitch

MG News | October 30, 2025 at 01:19 PM GMT+05:00

October 30, 2025 (MLN): The global sukuk market continued its upward momentum in the third quarter of 2025, with Fitch-rated sukuk volumes climbing 21% year-on-year to surpass $231 billion, marking the most active third quarter ever recorded.

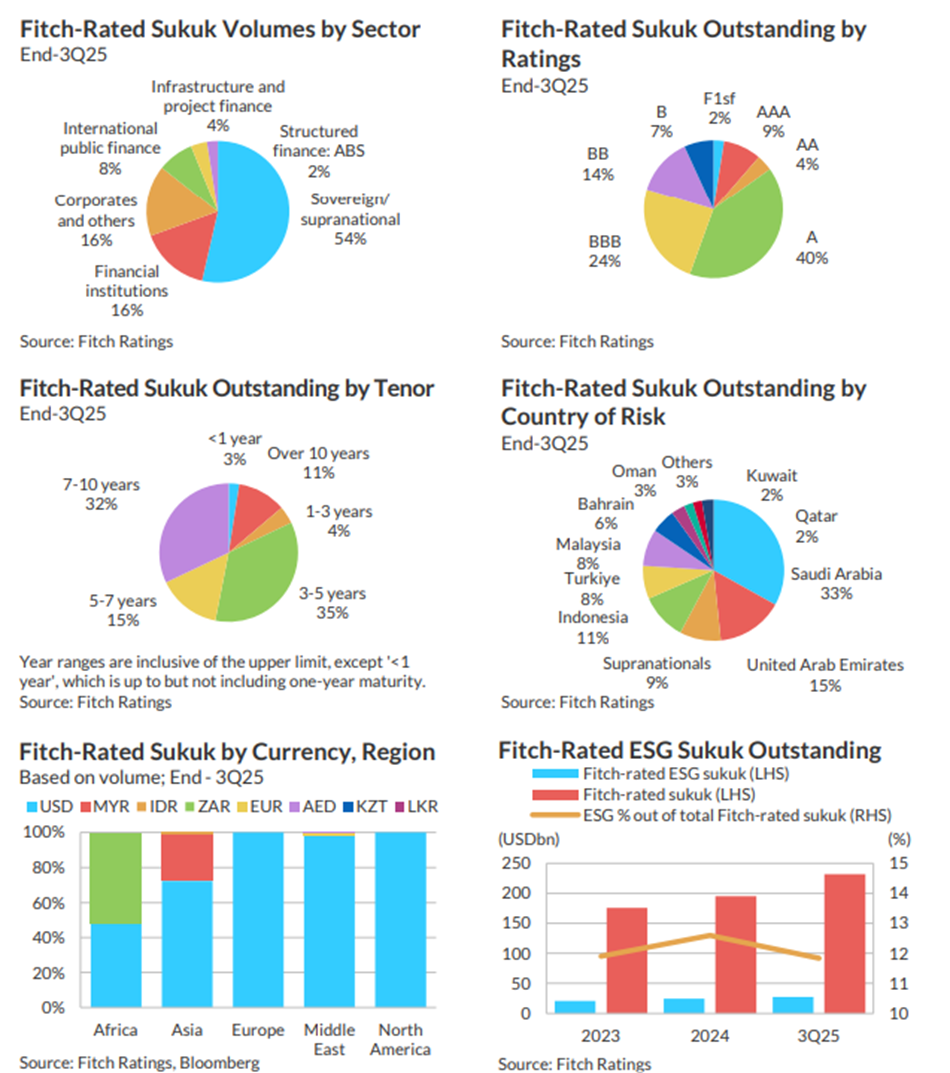

According to Fitch Ratings’ Global Sukuk Monitor (3Q25), the strong performance reflects robust investor demand, steady sovereign and corporate issuance, and the dominance of investment-grade sukuk, which account for around 80% of total rated issues.

Credit Quality Remains Strong

Fitch highlighted that about 88% of rated sukuk issuers hold Stable Outlooks, while 6% are Negative, 3% Positive, and 3% unrated.

The majority of outstanding sukuk fall within the ‘A’ rating category (40%), followed by ‘BBB’ (24%), and ‘BB’ (14%). There have been no defaults, rising stars, or fallen angels so far in 2025.

Nearly 97% of sukuk are senior unsecured, with a small but growing share of subordinated sukuk, particularly among banks seeking regulatory capital and funding diversification.

Issuance and Maturity Profile

Fitch reported 275 sukuk outstanding and 98 sukuk programmes at the end of September 2025.

Most issuances remain medium-term (3–10 years), comprising 82% of total sukuk, followed by long-term instruments (above 10 years) at 11%.

Sukuk with less than three-year maturities make up only 7%.

About one-third of rated sukuk are due to mature by 2027, while the remainder, approximately 73%, will mature in 2028 or later.

Currency and Structure Trends

The US dollar continues to dominate the sukuk landscape, representing 92.7% of outstanding volumes.

The Malaysian ringgit (MYR) ranks second at 5.4%, with other currencies such as the euro, dirham, and rupiah making up the balance.

In terms of structure, nearly all Fitch-rated sukuk (98%) carry fixed rates and follow a bullet repayment structure, where principal is paid at maturity, indicating a clear preference among global investors for predictability and standardization.

Regional and Sectoral Distribution

The Middle East leads the global sukuk market with a 70.6% share, followed by Asia (20.4%), Europe (7.8%), Africa (0.9%), and North America (0.3%).

By issuer type, sovereigns and supranationals dominate with 54% of total volumes.

Financial institutions and corporates each contribute 16%, while international public finance and infrastructure account for 8% and 4%, respectively.

Saudi Arabia remains the largest single market, representing 33% of global Fitch-rated sukuk, followed by the UAE (15%), Indonesia (11%), Malaysia (8%), and Türkiye (8%).

ESG Sukuk on the Rise

Fitch also observed a growing appetite for ESG-compliant sukuk, which now represent 12% of outstanding rated volumes, roughly $27 billion.

The agency expects ESG issuance to remain a growth driver for the Islamic finance industry, supported by strong demand from sovereigns and quasi-sovereign entities in the GCC and Southeast Asia.

Outlook

Fitch anticipates that full-year 2025 sukuk issuance will exceed 2024 levels, and that momentum will carry into 2026, driven by favorable pricing, investor diversification, and regulatory support for Islamic finance instruments.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes