Euro zone bond yields edge up, Germany sells new Bund

By MG News | June 17, 2020 at 06:04 PM GMT+05:00

June 17, 2020: Government bond yields in the euro area edged up on Wednesday as Germany sold a new 10-year bond and hopes for a rapid economic recovery from the coronavirus shock held sway for now.

Bond markets have been pulled between competing forces in recent sessions. Brighter economic data, such as Tuesday's U.S. retail sales, has pushed yields up. But concern about a second-wave of the coronavirus and further signs of central bank support appears to be limiting any selling.

"The tension between better economic data and rising COVID-19 cases continues to drive market volatility," said Antoine Bouvet, senior rates strategist at ING in London.

A full U.S. economic recovery will not occur until Americans are sure that the coronavirus has been brought under control, Federal Reserve Chair Jerome Powell said on Tuesday in the first of two days of hearings before U.S. lawmakers.

"Markets see the glass half full, thanks to central bank support," Bouvet added.

Germany's benchmark 10-year Bund yield edged up to -0.41% , holding above three-week lows hit on Monday at -0.47%. Italy's 10-year bond yield rose 2.5 bps to 1.39% .

Most 10-year euro zone yields were 1 to 2 basis points higher on the day, as markets also digested new supply from Germany. The euro zone's benchmark bond issuer sold 4.14 billion euros of a new 10-year government bond.

Peter McCallum, a rates strategist at Mizuho, said the bond auction was "relatively well received."

Focus in European bond markets was also turning to Thursday's latest European Central Bank funding round of cheap long-term loans to banks -- a three-year TLTRO at minus 1%.

"We think the amount of liquidity coming into the system can benefit most fixed income products, and the TLTRO III numbers will indeed give a more explicit indication of how attractive banks think the current rates are," McCallum said.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 120,023.24 136.80M |

0.02% 20.65 |

| ALLSHR | 74,956.95 415.25M |

0.09% 64.82 |

| KSE30 | 36,533.23 44.37M |

0.25% 91.50 |

| KMI30 | 177,648.07 53.46M |

0.48% 854.02 |

| KMIALLSHR | 51,412.96 224.87M |

0.22% 113.15 |

| BKTi | 30,161.85 6.28M |

0.10% 29.54 |

| OGTi | 27,008.50 5.66M |

0.59% 157.59 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 101,395.00 | 101,705.00 99,090.00 |

-2025.00 -1.96% |

| BRENT CRUDE | 78.18 | 81.40 78.11 |

1.17 1.52% |

| RICHARDS BAY COAL MONTHLY | 88.00 | 0.00 0.00 |

-3.70 -4.03% |

| ROTTERDAM COAL MONTHLY | 103.85 | 0.00 0.00 |

0.10 0.10% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 75.00 | 78.40 74.91 |

1.16 1.57% |

| SUGAR #11 WORLD | 16.53 | 16.73 16.44 |

0.22 1.35% |

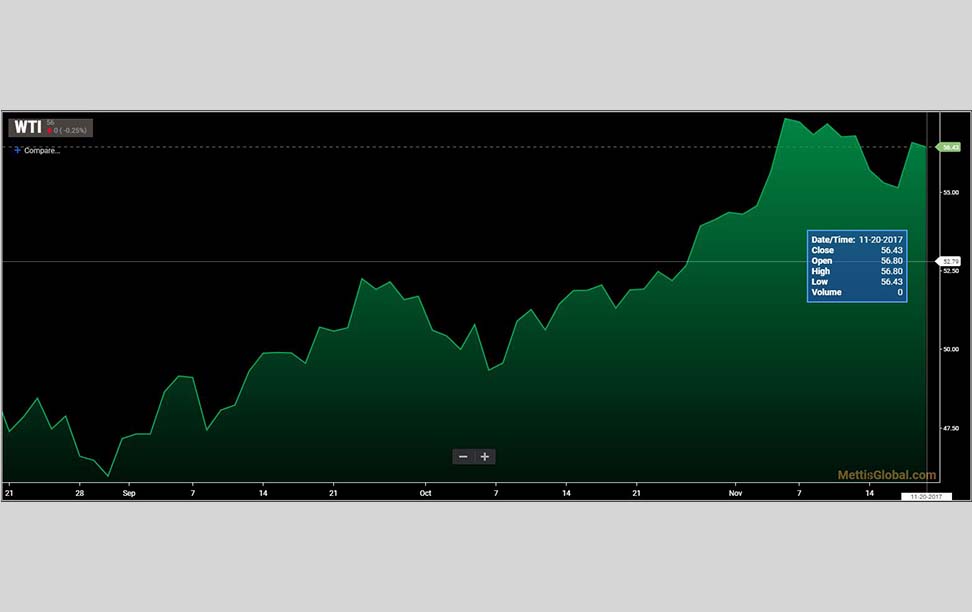

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|