Euro zone bond yields dip, Italy turns focus to supply

MG News | February 11, 2021 at 04:27 PM GMT+05:00

February 11, 2021: Euro zone core bond yields inched lower in early Thursday trade as global markets focused on a dovish Federal Reserve outlook after a soft reading on U.S. inflation.

Italian bond yields remained around recent lows before a bond auction as Mario Draghi was expected to present his new government coalition in the next few days.

Italy's 5-Star Movement, the party with the largest number of lawmakers, will hold an online vote on Thursday on whether to support a government led by Draghi, a former European Central Bank chief. It urged its members to vote yes.

Italy's 10-year BTP, or government bond, yield was one basis point down at 0.490%, not far from its lowest since early January.

The Italian/German 10-year yield spread was trading at 94 basis points, close to its lowest level in more than 5 years .

"We are unlikely to witness a further fall of the Italian bond yields over the next few weeks. But if Draghi gets the EU leaders' support for his coalition government and its projects, we could see a further fall," said MFS fixed-income research analyst Annalisa Piazza.

Italy's Treasury was scheduled to auction up to 9 billion euros in three bonds due 2024, 2028 and 2041 one Thursday.

Late on Wednesday, Federal Reserve Chairman Jerome Powell called for a broad national effort to get Americans back to work after the pandemic.

"A tame U.S. CPI print in January means markets don't have to worry about a hawkish Fed for now. A look at a broader set of indicators than just interest rates shows the reflation trade is alive and kicking. Risk appetite should continue to improve, pushed by ever lower real rates," ING wrote in a note to clients.

Benchmark 10-year U.S. Treasury yield fell to 1.135%, well off Monday's 1.2% peak.

With markets in China, Japan, South Korea and Taiwan on holiday, Germany's 10-year government bond yield was down two basis points at 0.462%.

Germany will extend restrictions to curb the spread of the coronavirus until March 7, though schools and hair salons may open sooner, Chancellor Angela Merkel and leaders of the 16 federal states agreed on Wednesday.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 113,390.00 108,020.00 | -4475.00 -3.97% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 64.55 63.88 | -0.59 -0.91% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

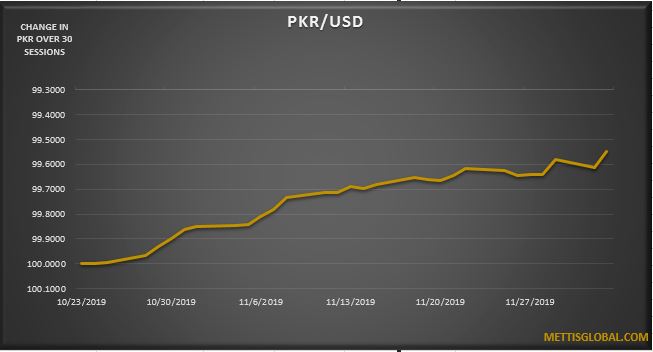

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI