Euro zone bond yields broadly flat; issuance continues

MG News | June 10, 2020 at 01:11 PM GMT+05:00

June 10, 2020: Demand for Euro zone government debt was little changed on Wednesday, after several governments launched syndicated bond sales on Tuesday and were met with strong demand.

More supply was expected on Wednesday, with Germany re-opening a 30-year Bund and Finland launching a new 20-year benchmark bond.

Portugal was expected to sell up to 1.5 billion euros of six and 10-year bonds.

Bond yields usually rise during a sale as investors make room for the new supply.

"Yesterday's widening leg, led by Spain, rather reflects the duration-intensive syndication supply, which continues to push ahead at record pace," wrote Commerzbank rates strategists in a note to clients.

"ECB support remains another crucial factor and pledges to do more if needed continue to resonate," they added.

The benchmark 10-year German Bund yield held near yesterday's close, at -0.315%, with French and Dutch yields down less than 1 basis point (bps) .

Demand for riskier Italian debt fell slightly, with Italy's 10-year government bond yield up around 1 basis point at 1.473% .

The debt has been boosted by prospects of a European Union 750 billion euro recovery fund, which could provide 500 billion euros in grants to help the worst-hit countries recover from the coronavirus pandemic.

The spread between Germany and Italy's 10-year government bond yields widened, at 178.8 bps.

The European Central Bank (ECB) exceeded expectations and increased its emergency bond purchases by 600 billion euros last week, boosting southern European debt.

Asset purchases have been crucial to holding down the borrowing costs of highly indebted member states.

ECB board member Isabel Schnabel said on Tuesday that interest rate cuts remained an option for the European Central Bank, but asset purchases were now a more appropriate tool to stimulate the euro zone economy.

The ECB's vice president, Luis de Guindos, will speak at 1330 GMT.

EU finance ministers reviewed the bloc's plan for post-pandemic recovery on Tuesday, ahead of what will be fractious negotiations over who should get the cash and even the legality of borrowing to offer grants.

Investors will also be focusing on the Federal Reserve's meeting. Analysts say the Fed is likely to be asked about negative rates and yield curve control - measures that Chair Jerome Powell is unlikely to rule out completely.

No new action is expected, but any hint of lessening stimulus could hammer risk sentiment.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 134,299.77 290.06M |

0.39% 517.42 |

| ALLSHR | 84,018.16 764.12M |

0.48% 402.35 |

| KSE30 | 40,814.29 132.59M |

0.33% 132.52 |

| KMI30 | 192,589.16 116.24M |

0.49% 948.28 |

| KMIALLSHR | 56,072.25 387.69M |

0.32% 180.74 |

| BKTi | 36,971.75 19.46M |

-0.05% -16.94 |

| OGTi | 28,240.28 6.19M |

0.21% 58.78 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,140.00 | 119,450.00 115,635.00 |

4270.00 3.75% |

| BRENT CRUDE | 70.63 | 70.71 68.55 |

1.99 2.90% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

1.10 1.14% |

| ROTTERDAM COAL MONTHLY | 108.75 | 108.75 108.75 |

0.40 0.37% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.75 | 68.77 66.50 |

2.18 3.27% |

| SUGAR #11 WORLD | 16.56 | 16.60 16.20 |

0.30 1.85% |

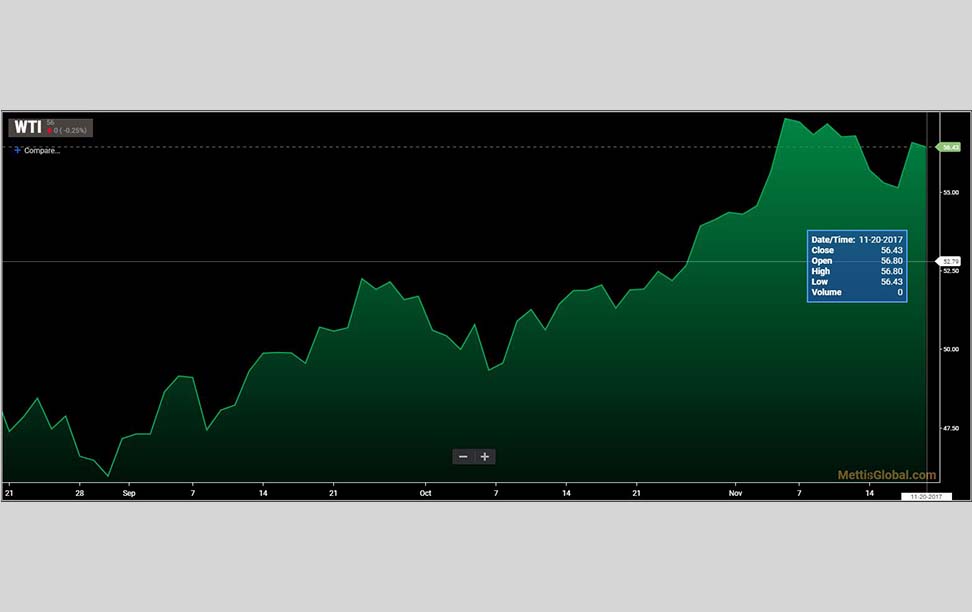

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction