Euro, Italian bonds cheer EU recovery fund plan

MG News | May 19, 2020 at 04:10 PM GMT+05:00

May 19, 2020: The euro and Italian government bonds continued on Tuesday to cheer German- and French-led plans for a 500 billion euro EU coronavirus recovery fund, though stock markets were suffering from fatigue after their best day in months.

There was still a sense of optimism after Monday's news that early-stage tests on a possible COVID-19 vaccine had also proved encouraging but the momentum was shifting.

Europe's STOXX 600 index gave up an early rise to slip 0.4% after surging 4% in the previous session, oil began to tread water and safe-haven U.S. government bonds were making ground in debt markets.

"The Franco-German proposals are ambitious, targeted and, of course, welcome," European Central Bank President Christine Lagarde said of Monday's plan, which would move the EU in the direction of a so-called 'transfer union'.

The euro was buying $1.0932, having gained about 1% against the dollar since the plan was announced. It was also up near a two-month high against the Swiss franc, while the cost of betting against the euro was falling.

After a sizeable fall in Italian borrowing costs, Spanish and Portuguese yields led the moves lower on Tuesday. Morgan Stanley's economists called the Franco-German proposal a "powerful common response, helping to mitigate the risk of a southern slump."

The Spanish 10-year yield fell 9 basis points to 0.715%, the lowest since early April, while Portuguese bond yields hit their lowest since March 31, down 12 bps on the day at 0.78%.

Italian yields were between 2 and 8 bps lower on the day. The 10-year government bond yield fell nearly 10 basis points to 1.602%, its lowest since April 9 at one point.

"It was a meaningful breakthrough but it is not going to be plain sailing from here," said Vasileios Gkionakis, Global Head of FX Strategy at Lombard Odier, citing resistance already voiced by a sizeable number of northern EU countries.

In the equity markets, Wall Street's S&P 500 futures were down 0.4% after Monday's strong rally.

Asia had followed. MSCI's broadest index of Asia-Pacific shares outside Japan jumped 1.8% to two-week highs and Japan's Nikkei had added nearly 2%.

In the commodity markets, profit-taking pruned Brent's early gains, though the rally looked broadly intact amid signs that producers are cutting output just as demand picks up.

Brent last stood 0.5% higher at $35 a barrel, after touching its highest since April 9. U.S. WTI was at $32.50. Gold was little changed at $1,731 an ounce.

Reuters

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

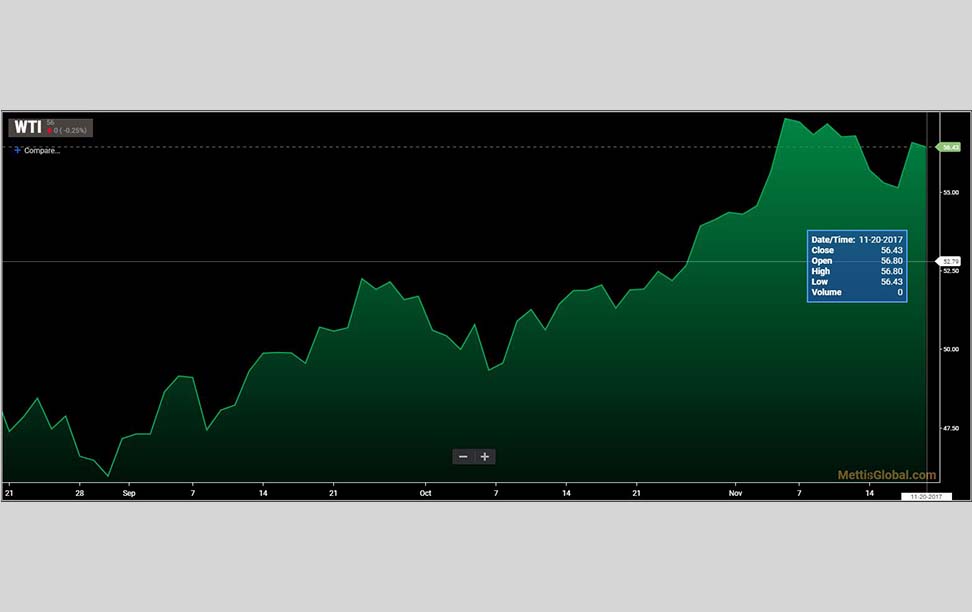

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI