EPCL posts a 55% increase in annual profits

MG News | February 11, 2021 at 12:39 PM GMT+05:00

February 11, 2021 (MLN): Engro Polymer and Chemicals Limited (EPCL) has unveiled its financial results for the year ended December 31, 2020. As per results, the company has posted net profits of Rs 5.73 billion, depicting a significant increase of 55% YoY when compared to net profits of Rs 3.70 billion in the same period last year.

The basic earnings per share of the company for the year ended December 31, 2020, have been reported Rs 6.30 in comparison to Rs 4.07 during the same period last year.

Alongside financial results, the Board of Directors of the company announced a Final Cash Dividend for ordinary shareholders for the year ended December 31, 2020 Rs.1,133,562,268 which is approximately Rs.1.247 per share i.e.12.47% while Cash Dividend for preference shareholders for the period from December 18, 2020, to December 31, 2020 Rs.12,484,932 which is approximately Rs. 0.042 per share i.e. 0.42%.

The massive increase in earnings seen in the financial results below is a result of higher other income and lower cost of sales. The gross profits of the company surged by 35.1% YoY, expanding the gross margins from 21% to 31%.

As per the financial statement issued by the company, some of the positive highlights include a decrease in distribution and marketing expenses and operating expenses by 25.7% YoY and 31% YoY respectively while other income of the company surged by 27% YoY to Rs 1.18 billion.

The other major highlight is the colossal finance cost which increased by around 22% YoY from Rs 1.79 billion to Rs 2.19 billion when compared to the prior year.

|

Consolidated Profit and Loss Account for the year ended December 31, 2020 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Dec-20 |

Dec-19 |

% Change |

|

Net revenue |

35,331,398 |

37,836,632 |

-6.62% |

|

Cost of sales |

(24,382,129) |

(29,730,593) |

-17.99% |

|

Gross profit |

10,949,269 |

8,106,039 |

35.08% |

|

Distribution and marketing expenses |

(294,393) |

(396,145) |

-25.69% |

|

Administrative expenses |

(550,307) |

(565,866) |

-2.75% |

|

Other operating expenses |

(859,300) |

(1,241,226) |

-30.77% |

|

Other income |

1,179,635 |

930,269 |

26.81% |

|

Operating profit |

10,424,904 |

6,833,071 |

52.57% |

|

Finance cost |

(2,191,135) |

(1,793,776) |

22.15% |

|

Profit before taxation |

8,233,769 |

5,039,295 |

63.39% |

|

Taxation |

(2,503,533) |

(1,343,258) |

86.38% |

|

Profit for the year after taxation |

5,730,236 |

3,696,037 |

55.04% |

|

Earnings per share - basic |

6.30 |

4.07 |

54.79% |

|

Earnings per share - diluted |

6.23 |

4.07 |

53.07% |

Copyright Mettis Link News

Related News

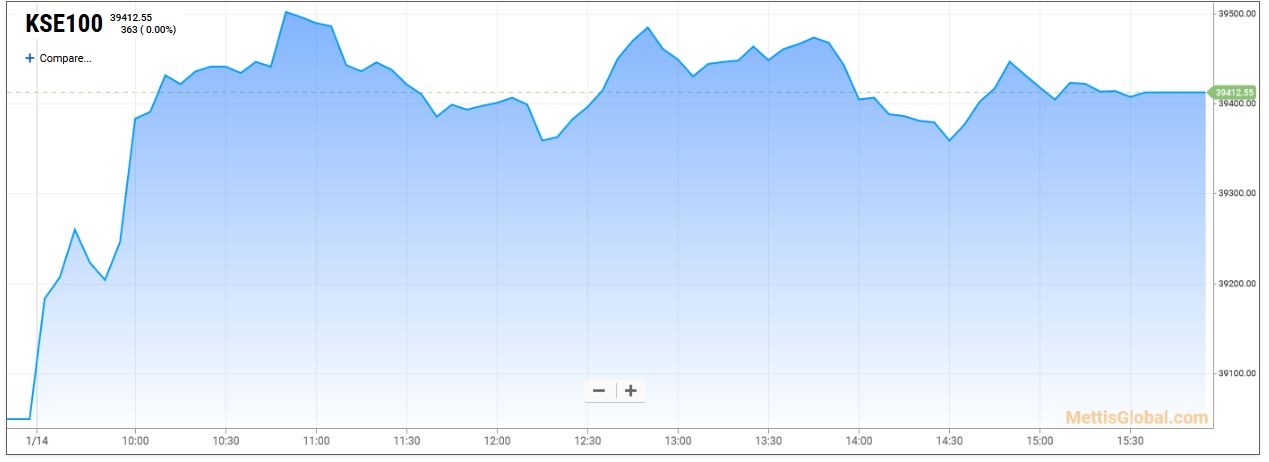

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 138,466.80 209.89M |

1.53% 2086.84 |

| ALLSHR | 85,669.80 500.86M |

1.21% 1021.44 |

| KSE30 | 42,242.95 69.15M |

1.68% 696.72 |

| KMI30 | 194,811.49 71.86M |

1.61% 3091.73 |

| KMIALLSHR | 56,440.86 299.90M |

1.10% 613.13 |

| BKTi | 38,359.81 10.75M |

1.41% 532.21 |

| OGTi | 27,864.32 10.08M |

0.70% 193.65 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 118,535.00 | 119,915.00 118,035.00 |

-1095.00 -0.92% |

| BRENT CRUDE | 68.53 | 69.01 68.34 |

0.01 0.01% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 |

0.95 0.99% |

| ROTTERDAM COAL MONTHLY | 104.50 | 0.00 0.00 |

-0.65 -0.62% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 66.50 | 66.99 66.31 |

0.12 0.18% |

| SUGAR #11 WORLD | 16.74 | 16.82 16.54 |

0.18 1.09% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

PIB Auction

PIB Auction