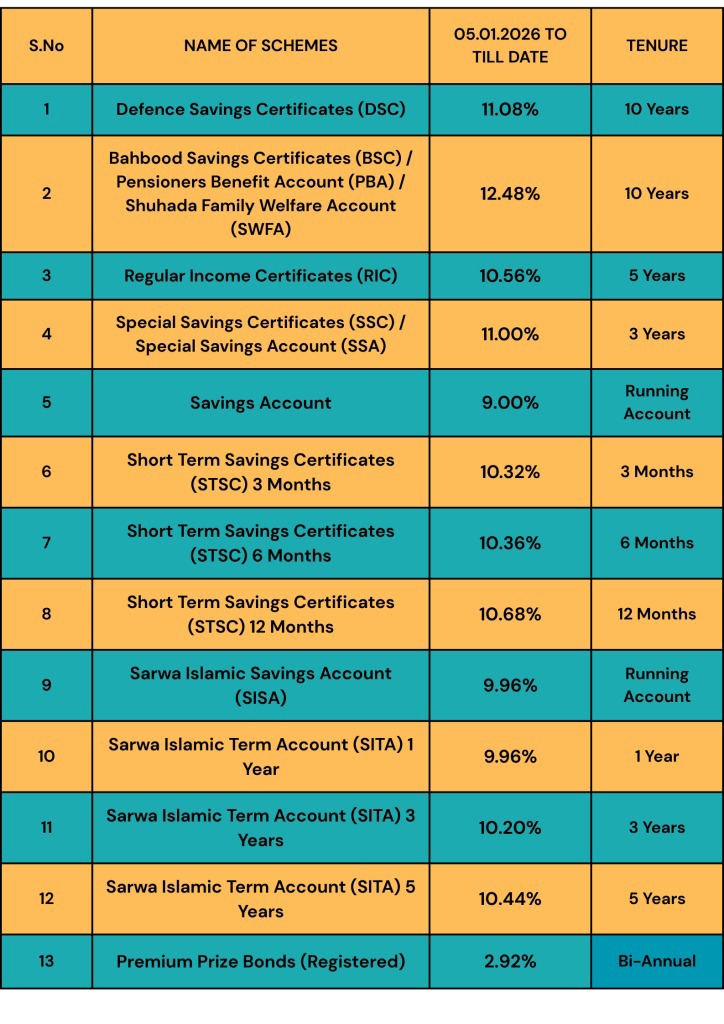

CDNS revises profit rates on National Savings Schemes

MG News | January 07, 2026 at 02:14 PM GMT+05:00

January 07, 2026 (MLN): The Central Directorate of National Savings

(CDNS) has revised profit rates on various savings schemes, effective January

5, 2026, adjusting returns across both conventional and Islamic instruments in

line with the prevailing market and monetary conditions.

As per the latest update, the profit rate on Defence Savings

Certificates (DSC) has been reduced by 23 basis points to 11.08% per annum for

a 10-year tenure.

Similarly, returns on Behbood Savings Certificates (BSC),

Pensioners Benefit Accounts (PBA), and Shuhada Family Welfare Accounts (SFWA)

have been lowered by 24 basis points to 12.48% per annum, applicable for a

10-year tenure.

Meanwhile, the profit on Regular Income Certificates (RIC)

has been reduced by 36 basis points to 10.56% per annum for a 5-year tenure.

The rates for Special Savings Certificates (SSC) and Special

Savings Accounts (SSA) have been raised by 40 basis points, now offering 11.00%

per annum for a 3-year tenure.

For shorter durations, Short Term Savings Certificates

(STSC) will yield 10.32% per annum for three months, 10.36% per annum for six

months, and 10.68% per annum for twelve months.

The Savings Account has been reduced by 50 basis points, now

offering 9.00% per annum on a running account basis.

In the Islamic segment, the Sarwa Islamic Savings Account

(SISA) provides a return of 9.96% per annum on a running basis, up 4 basis

points from the previous rate.

The Sarwa Islamic Term Account (SITA) offers 9.96% per annum

for one year (up 4 basis points from the previous rate), 10.20% per annum for

three years (down 10 basis points), and 10.44% per annum for five years (down

12 basis points).

Additionally, the Premium Prize Bonds (Registered) carry a

return of 2.92% per annum with bi-annual profit distribution, unchanged from

the previous rate.

The revision reflects CDNS's regular review of profit rates to align returns on national savings schemes with market dynamics, policy rates, and overall economic trends.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 185,543.01 576.35M | -0.52% -975.70 |

| ALLSHR | 110,883.95 1,421.07M | -0.21% -234.71 |

| KSE30 | 56,998.00 313.06M | -0.83% -479.10 |

| KMI30 | 261,472.18 320.16M | -0.88% -2323.37 |

| KMIALLSHR | 71,138.29 707.65M | -0.30% -213.12 |

| BKTi | 54,074.14 81.81M | -1.08% -590.97 |

| OGTi | 36,259.39 25.98M | -0.18% -64.48 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 90,080.00 | 91,840.00 89,760.00 | -1155.00 -1.27% |

| BRENT CRUDE | 60.78 | 60.87 59.96 | 0.82 1.37% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | 0.05 0.06% |

| ROTTERDAM COAL MONTHLY | 98.15 | 98.15 97.75 | -0.55 -0.56% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 56.81 | 56.92 55.97 | 0.82 1.46% |

| SUGAR #11 WORLD | 15.00 | 15.04 14.90 | 0.02 0.13% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction