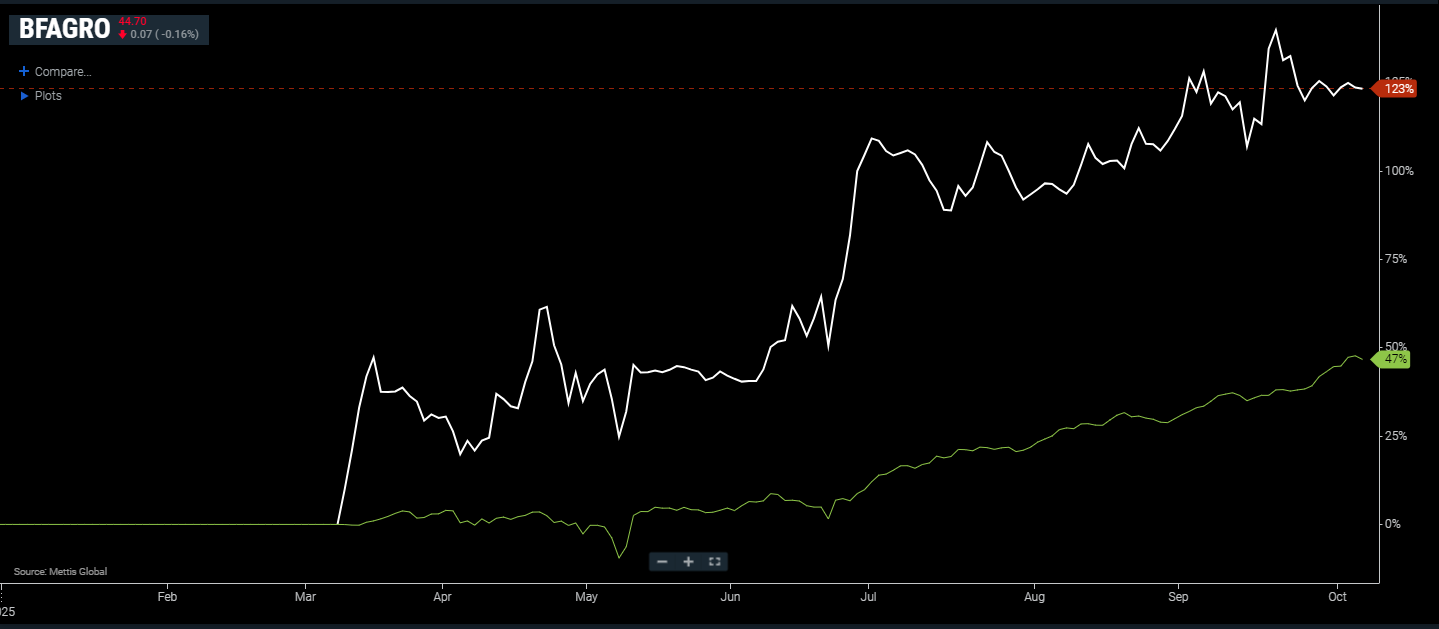

BFAGRO set to rise 34% to Rs60/Share

MG News | October 06, 2025 at 12:01 PM GMT+05:00

October 06, 2025 (MLN): Barkat Frisian Agro Limited (PSX:

BFAGRO), Pakistan’s pioneering producer of pasteurized egg products, is to reach

Rs60 per share implying a 34% upside from its current market price of Rs44.77. The

stock trades at an attractive valuation of 11x FY26E and 7x FY27E P/E, with

P/BV of 1.0x (FY26E) and 0.75x (FY27E).

The brokerage, AL Habib Capital Markets has initiated coverage with a BUY rating, highlighting the company’s strategic capacity expansion, backward integration, and accelerating export momentum as key growth catalysts.

BFAGRO stands at a

turning point as it undertakes a 71% capacity increase through its Faisalabad

expansion project, boosting total processing capacity to 29,000 tons, according

to the brokerage report.

The newly approved Rs690

million backward integration into poultry farming is also set to transform the

company’s operational model by reducing supply chain risks and supporting

long-term margin enhancement.

BFAGRO is

strategically positioned to capitalize on Pakistan’s underpenetrated processed

egg market, currently estimated at 50,000 tons annually in the organized

segment, compared to a much larger unorganized market of roughly 150,000 tons.

The company

currently serves about 38% of the organized sector, leaving significant room

for expansion by converting traditional shell-egg users in the bakery and

confectionery industries through customer education and product demonstration

initiatives.

The company

maintains a strong export footprint across the Middle East, including the UAE,

Saudi Arabia, Qatar, Kuwait, Bahrain, Egypt, Oman, and Sri Lanka.

The establishment of

its UAE subsidiary provides a dedicated platform for regional growth,

leveraging rising demand for safe, certified food products across Gulf markets.

BFAGRO’s

dual-pronged strategy capacity expansion and backward integration positions it

for resilient, sustainable growth. The Faisalabad facility directly addresses a

major logistical inefficiency, as around 70% of the company’s raw materials

originate from Punjab while its current processing plant is in Karachi.

The new location

will cut logistics costs by an estimated 60–70% and improve delivery timelines

to northern clients, boosting operational efficiency.

The backward

integration project, comprising two poultry farms with a capacity of 225,000

birds, will initially secure 20% of daily egg requirements, with potential

scalability to cover 50% in the long term.

This initiative

mitigates raw material volatility, strengthens supply chain reliability, and

offers meaningful cost savings, with commercial production expected within 15

months.

AL Habib Capital

Markets notes that BFAGRO also benefits from significant tax incentives through

its Special Economic Zone (SEZ) status, granting a 10-year income tax exemption

from the start of operations.

The Karachi facility

enjoys tax exemption until FY29, while the new Faisalabad plant will remain

exempt until FY36 factors that meaningfully enhance cash flows and overall

return on capital.

The brokerage

expects sustained margin expansion, driven by logistics optimization, economies

of scale, and cost efficiencies from backward integration. As value-added

products gain share in the revenue mix, profitability is expected to strengthen

further.

However, AL Habib

Capital Markets cautions that concentration risk remains high, as a large

portion of revenue is derived from a few key clients, exposing the company to

potential pricing and volume pressures.

Additionally, the

approximately 60-day cash conversion cycle continues to strain liquidity due to

upfront cash payments to farmers and credit-based sales to corporate clients.

The backward integration initiative, while strategically important, also introduces operational risks related to poultry health and disease management that could impact production and costs.

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 167,085.58 225.68M | 0.48% 802.03 |

| ALLSHR | 101,220.72 685.91M | 0.47% 477.65 |

| KSE30 | 50,772.02 134.57M | 0.57% 290.16 |

| KMI30 | 239,923.35 145.03M | 0.77% 1831.31 |

| KMIALLSHR | 66,042.80 345.76M | 0.65% 425.34 |

| BKTi | 45,106.39 29.18M | 0.06% 24.91 |

| OGTi | 33,583.05 26.44M | 1.52% 502.39 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 89,425.00 | 92,995.00 88,405.00 | -3415.00 -3.68% |

| BRENT CRUDE | 63.86 | 64.09 63.06 | 0.60 0.95% |

| RICHARDS BAY COAL MONTHLY | 91.00 | 0.00 0.00 | 0.10 0.11% |

| ROTTERDAM COAL MONTHLY | 97.25 | 97.25 97.25 | 0.05 0.05% |

| USD RBD PALM OLEIN | 1,016.00 | 1,016.00 1,016.00 | 0.00 0.00% |

| CRUDE OIL - WTI | 60.14 | 60.50 59.42 | 0.47 0.79% |

| SUGAR #11 WORLD | 14.82 | 15.02 14.73 | -0.06 -0.40% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Savings Mobilized by National Savings Schemes

Savings Mobilized by National Savings Schemes