APL: Massive inventory gains expand bottomline

MG News | August 16, 2022 at 02:51 PM GMT+05:00

August 16, 2022 (MLN): Attock Petroleum Limited (APL) has shown significant progress during FY22 as it posted a profit after tax (PAT) of Rs18.54 billion (EPS: Rs186.23), showing around a four-fold jump when compared to the net profit of Rs4.92bn (EPS: Rs49.43) in FY21, backed by huge inventory gains.

In conjunction with financial results, the Board of Directors has recommended a final cash dividend of Rs30 per share i.e., 300% for the year ended June 30, 2022. In addition, the board also recommended to issue bonus shares in the proportion of 1 share for every 4 shares held i.e., 25%.

Going by the financial statement, the company’s top line registered a robust growth of around 96% to Rs370bn when compared to the last fiscal year given a jump in volumes by 22% YoY (sales of MS, HSD and FO ascended by 19%, 36% and 15% YoY, respectively) and a massive surge in prices of petroleum products, a research note by Arif Habib Limited (AHL) said.

Accordingly, the gross margins surged to 11% from 5% in FY21, on account of higher inventory gains realized during the period under review.

On the costs front, APL’s operating expenses swelled by 2.4 times YoY to Rs32.76bn in FY22.

Meanwhile, the company recorded a net finance income of Rs20.7mn against a net income cost of Rs85mn. Notably, the share of profit from associated companies soared by 2x YoY during the said period.

On the tax front, the effective tax rate stood at 39% in FY22 as opposed to 29% in SPLY.

|

Profit and Loss Account for the Year ended June 30, 2022 ('000 Rupees) |

|||

|---|---|---|---|

|

|

Jun-22 |

Jun-21 |

% Change |

|

Sales |

398,383,517 |

221,333,864 |

79.99% |

|

Sales tax and other govt levies |

(28,308,588) |

(32,688,489) |

-13.40% |

|

Net sales |

370,074,929 |

188,645,375 |

96.17% |

|

Cost of products sold |

(329,071,837) |

(178,663,434) |

84.19% |

|

Gross profit |

41,003,092 |

9,981,941 |

310.77% |

|

Other income |

1,622,715 |

1,260,580 |

28.73% |

|

Net impairment reversal on financial assets |

348,787 |

408,961 |

-14.71% |

|

Operating expenses |

(10,214,671) |

(4,151,753) |

146.03% |

|

Operating Profit |

32,759,923 |

7,499,729 |

336.81% |

|

Finance income |

1,607,795 |

1,333,519 |

20.57% |

|

Finance costs |

(1,587,052) |

(1,418,918) |

11.85% |

|

Net finance income/(cost) |

20,743 |

(85,399) |

- |

|

Share of profit of associated companies |

78,756 |

33,553 |

134.72% |

|

Other charges |

(2,249,653) |

(508,825) |

342.13% |

|

Profit before taxation |

30,609,769 |

6,939,058 |

341.12% |

|

Provision for income tax |

(12,073,426) |

(2,019,426) |

497.86% |

|

Profit for the period |

18,536,343 |

4,919,632 |

276.78% |

|

Earnings per share - basic and diluted (Rupees) |

186.23 |

49.43 |

276.76% |

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

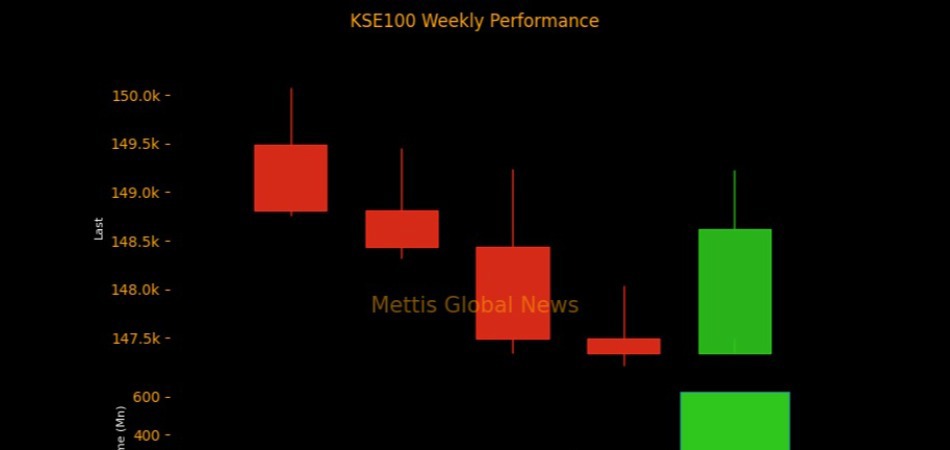

| KSE100 | 148,617.78 624.60M | 0.86% 1274.27 |

| ALLSHR | 91,685.08 1,340.28M | 0.74% 669.39 |

| KSE30 | 45,247.79 197.43M | 0.83% 370.74 |

| KMI30 | 212,370.79 224.51M | 1.05% 2209.48 |

| KMIALLSHR | 61,227.89 711.87M | 1.18% 715.56 |

| BKTi | 41,264.02 160.39M | 0.54% 221.73 |

| OGTi | 30,019.10 23.63M | 0.64% 190.41 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,265.00 | 0.00 0.00 | -510.00 -0.47% |

| BRENT CRUDE | 67.46 | 67.94 67.29 | -0.52 -0.76% |

| RICHARDS BAY COAL MONTHLY | 88.70 | 88.70 88.70 | -0.75 -0.84% |

| ROTTERDAM COAL MONTHLY | 96.15 | 96.75 96.00 | -0.40 -0.41% |

| USD RBD PALM OLEIN | 1,106.50 | 1,106.50 1,106.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 64.01 | 0.00 0.00 | 0.00 0.00% |

| SUGAR #11 WORLD | 16.34 | 16.52 16.33 | -0.14 -0.85% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

SPI

SPI