A World awash in oil yet on edge

MG News | January 21, 2026 at 05:00 PM GMT+05:00

January 21, 2026 (MLN): Global oil markets are stepping into 2026 under mounting pressure from a looming supply glut, even as geopolitical flashpoints continue to inject volatility and prevent prices from fully reflecting weaker fundamentals.

With surplus barrels yet to visibly flood onshore

inventories, crude prices remain vulnerable to sharp but often short-lived moves

on political headlines, particularly in the Middle East and Eastern Europe.

According to a latest report by HSBC Global Investment

Research, the oil market is expected to face an average supply-demand

surplus of 2.8 million barrels per day (mbd) in 2026, marking the largest

imbalance since the 2020 COVID-19 shock.

The bank attributes the oversupply to robust non-OPEC

production growth, the return of OPEC+ barrels, and sluggish global demand

expansion, with the surplus projected to peak above 3mbd in the first half

of the year.

Despite months of warnings about oversupply, the imbalance

has yet to fully materialise in onshore inventories. While global stockpiles

are rising, much of the excess crude remains “on water,” with floating storage

at multi-year highs. OECD inventories, could soon exceed their long-term

historical averages.

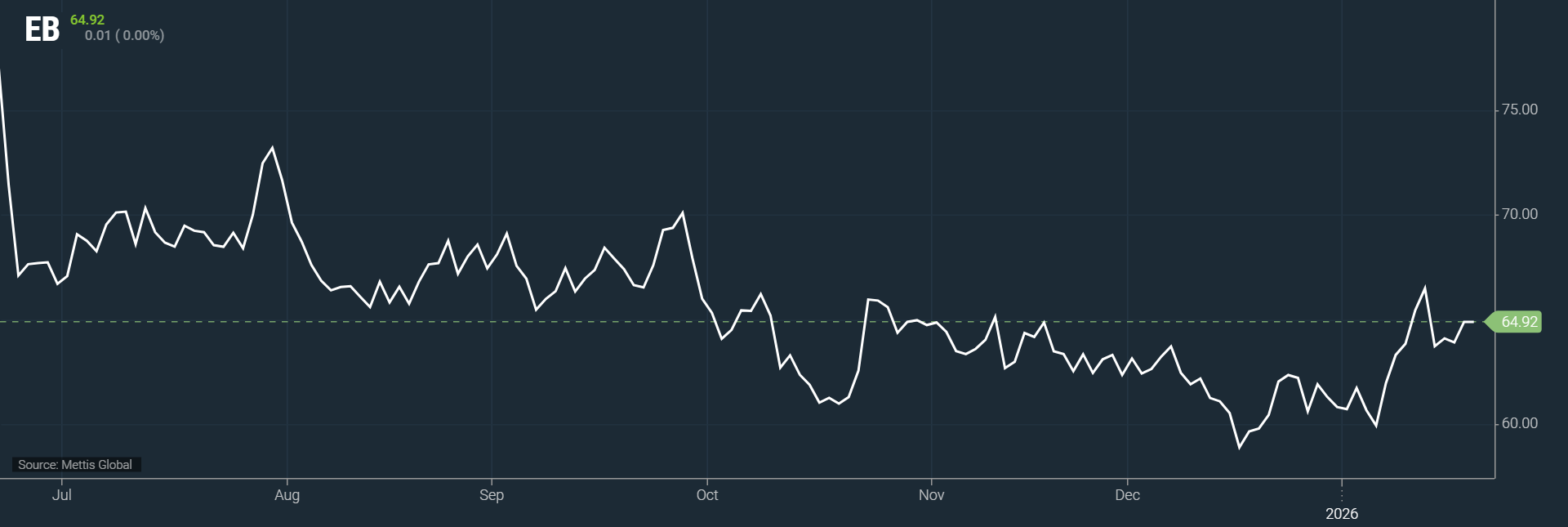

Currently, Brent crude is trading at $64.92 per barrel, according

to Mettis Global data.

In the absence of visible inventory pressure, oil prices

remain highly sensitive to geopolitical headlines.

Iran, Russia/Ukraine, and Venezuela as the key “known

unknowns” shaping price direction in 2026.

Rising tensions between the US and Iran have already pushed

oil prices up by around 10% since early January, driven by fears of

regional supply disruptions.

However, HSBC expects this rally to reverse if Iranian oil

flows remain unaffected. The more severe risk, the report cautions, would be a

destabilisation of Iran’s regime that leads to disorder and falling production.

Russian risks, meanwhile, run both ways. Intensified

Ukrainian attacks on Russian energy infrastructure and tighter enforcement of

Western sanctions have made Russian supply increasingly vulnerable.

At the same time,

warns that any Russia-Ukraine peace agreement could have a bearish

impact on prices, as markets would quickly price in the possibility of

sanctions relief.

Venezuela, once seen as a major upside risk, now appears

less threatening in the near term.

The US administration seems focused on keeping Venezuelan

oil flowing following the fall of President Nicolás Maduro.

While this reduces the risk of immediate supply disruptions,

meaningful long-term production growth remains uncertain due to unclear

investment conditions.

OPEC+ is increasingly predictable, the group’s

influence on prices has diminished compared to recent years. After pausing

production changes in the first quarter, OPEC+ is expected to continue

unwinding its cuts in the second and third quarters, adding barrels to an

already oversupplied market.

The report suggests the group may once again underestimate

the scale of oversupply, limiting its ability to support prices sustainably.

Despite heightened geopolitical tensions, price volatility

has remained relatively subdued. Attributes this to growing “headline fatigue,”

with traders becoming more adept at distinguishing between political rhetoric

and genuine supply risks.

While geopolitical events still trigger price spikes, these

rallies are increasingly short-lived when supply remains intact.

A changing dynamic in US foreign policy. With oil prices

subdued, concerns about high energy costs appear less constraining for

Washington, allowed for more assertive geopolitical actions. Ironically, such

moves can themselves push oil prices higher.

Beyond the main geopolitical flashpoints, flags several

potential wildcards for 2026, including tensions between Saudi Arabia and the

UAE, instability in Nigeria and Libya, and broader Middle East security risks.

Balancing oversupply against persistent geopolitical risk,

HSBC maintains its Brent crude forecast at $65 per barrel for 2026 and

beyond, expecting prices to trade mostly in the $60s unless a major supply

disruption occurs, particularly involving Iran.

While prices could briefly test or even fall below $60/b,

the bank expects geopolitical risks and strategic stockpiling especially by

China to provide periodic support.

HSBC also widened its Brent-WTI spread forecast to $4/b,

showing Brent’s greater sensitivity to global geopolitical risks.

“Despite a sizeable surplus, we caution against excessive bearishness,” HSBC said, noting that geopolitics will likely continue to lift prices even as fundamentals gradually reassert themselves.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 155,777.21 362.16M | -0.86% -1354.88 |

| ALLSHR | 92,994.52 618.17M | -0.61% -572.34 |

| KSE30 | 47,890.76 137.48M | -0.85% -412.22 |

| KMI30 | 220,015.06 115.60M | -0.35% -783.45 |

| KMIALLSHR | 59,910.72 260.41M | -0.13% -77.81 |

| BKTi | 45,388.60 42.55M | -1.74% -804.48 |

| OGTi | 30,631.34 29.10M | 1.45% 438.24 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 73,455.00 | 74,120.00 67,615.00 | 4990.00 7.29% |

| BRENT CRUDE | 81.54 | 84.48 80.30 | 0.14 0.17% |

| RICHARDS BAY COAL MONTHLY | 99.40 | 0.00 0.00 | -17.10 -14.68% |

| ROTTERDAM COAL MONTHLY | 121.50 | 124.00 121.25 | -6.50 -5.08% |

| USD RBD PALM OLEIN | 1,083.50 | 1,083.50 1,083.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 74.94 | 77.23 73.28 | 0.38 0.51% |

| SUGAR #11 WORLD | 13.76 | 14.07 13.71 | -0.17 -1.22% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

MTB Auction

MTB Auction