Weekly Market Roundup

By Nilam Bano | March 09, 2025 at 05:58 AM GMT+05:00

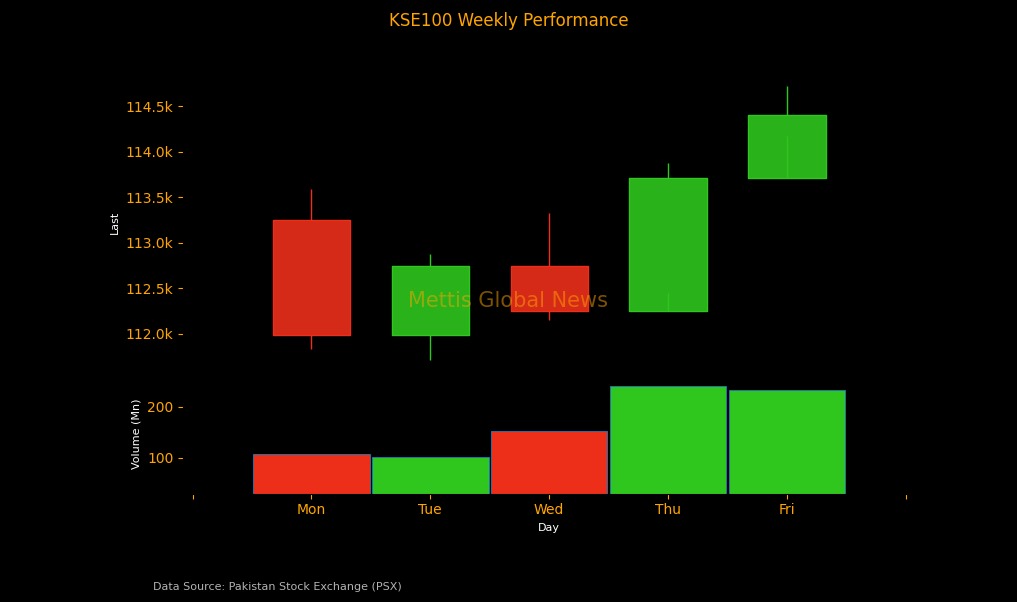

March 09, 2025 (MLN): The capital market witnessed selling pressure on the first day of the week as investors opted for profit booking. However, buyers enthusiastically returned to the bourse during the later sessions, driven by positive developments on the IMF front.

As a result, the benchmark KSE-100 index gained 1,147.03 points, up by 1.01% to close at 114,398.69 compared to the previous week’s close of 113,251.66.

Intraday swings were significant, with the index reaching a high of 114,721.58 (+322.89 points) and a low of 111,717.17 (-2,681.52 points).

Market cap

The KSE-100 market capitalization stood at Rs3.5 trillion, up 0.73% from the previous week’s Rs3.48tr. In USD terms, the market cap was recorded at $12.53 billion, compared to $12.45bn in the prior week, reflecting a surge of $77 million or 0.62%.

This week, the index return in USD terms remained positive 0.9%, compared to last week’s return of 0.36%.

On the economic front, Pakistan's inflation slowed to 1.5% in February 2025, compared to 2.4% in the previous month and 23.1% in February 2024.

Trade deficit in February 2025 increased by 33.43% YoY, standing at $2.3bn compared to $1.72bn in February 2024.

Cotton arrivals in Pakistan fell 34% to 5.5m bales as of February 28, 2025, compared to 8.4m bales in the same period last year.

The State Bank of Pakistan (SBP) conducted an auction on Wednesday in which it sold Market Treasury Bills (MTBs) worth Rs568.72bn.

Furthermore, the Central Bank sold Pakistan Investment Bonds worth Rs629.26bn for 2, 5 and 10 years semiannual bonds against a target of Rs325bn.

The SBP accepted Rs117.1bn through its buyback auction today, for 2-year, 3-year, and 5-year Floating Rate Pakistan Investment Bonds (PFL).

The foreign exchange reserves held by the SBP increased by $27.1m or 0.24% WoW to $11.25bn during the week ended on February 28, 2025.

The positive economic cues helped stabilize investor sentiment, pushing the KSE-100 index’s fiscal year-to-date returns to 45.83%. However, on CYTD return stood at -0.63%.

Top Index Movers

During the week, Oil & Gas Exploration Companies, Cement, and Oil & Gas Marketing Companies contributed 655.63, 450.82, and 345.68 points to the index.

On the flip side, Inv. Banks, Technology & Communication, and Textile Composite dented the index by -447.59, -121.74, and -98.16 points, respectively.

Among individual stocks, PPL added 290.36 points to the index while PSO, OGDC, and HUBC contributed to the index by 246.55, 236.36, and 184.78, respectively.

Conversely, ENGROH, SYS, and MTL eroded -459.33, -84.16, and -76.65 points, respectively.

FIPI/LIPI

This week, Foreign Investors remained net sellers, offloading the equities worth $5.32m.

Among them, Foreign Corporates led the selling activity worth $4.17m while Overseas Pakistanis sold securities worth $1.09m.

On the other hand, this week, local Investors were net buyers, purchasing equities worth $5.32m.

Banks/DFI bought securities worth $43.41m whereas Mutual Funds sold securities worth $37.09m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 132,760.67 103.47M |

-0.48% -642.52 |

| ALLSHR | 83,072.89 580.24M |

-0.14% -115.17 |

| KSE30 | 40,397.90 36.27M |

-0.62% -253.56 |

| KMI30 | 191,086.91 41.15M |

-0.52% -997.00 |

| KMIALLSHR | 55,761.55 296.60M |

-0.15% -86.14 |

| BKTi | 36,215.95 6.40M |

-0.57% -206.93 |

| OGTi | 28,285.50 7.36M |

-0.53% -152.11 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 109,165.00 | 109,545.00 108,625.00 |

-50.00 -0.05% |

| BRENT CRUDE | 70.18 | 70.21 69.85 |

0.03 0.04% |

| RICHARDS BAY COAL MONTHLY | 97.50 | 0.00 0.00 |

2.05 2.15% |

| ROTTERDAM COAL MONTHLY | 106.65 | 106.65 106.25 |

0.50 0.47% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 68.34 | 68.37 67.78 |

0.01 0.01% |

| SUGAR #11 WORLD | 16.15 | 16.37 16.10 |

-0.13 -0.80% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.png)