Weekly Market Roundup

By Abdur Rahman | November 16, 2024 at 06:15 AM GMT+05:00

November 16, 2024 (MLN): Pakistan stocks extended their record-breaking run driven by improving economic conditions.

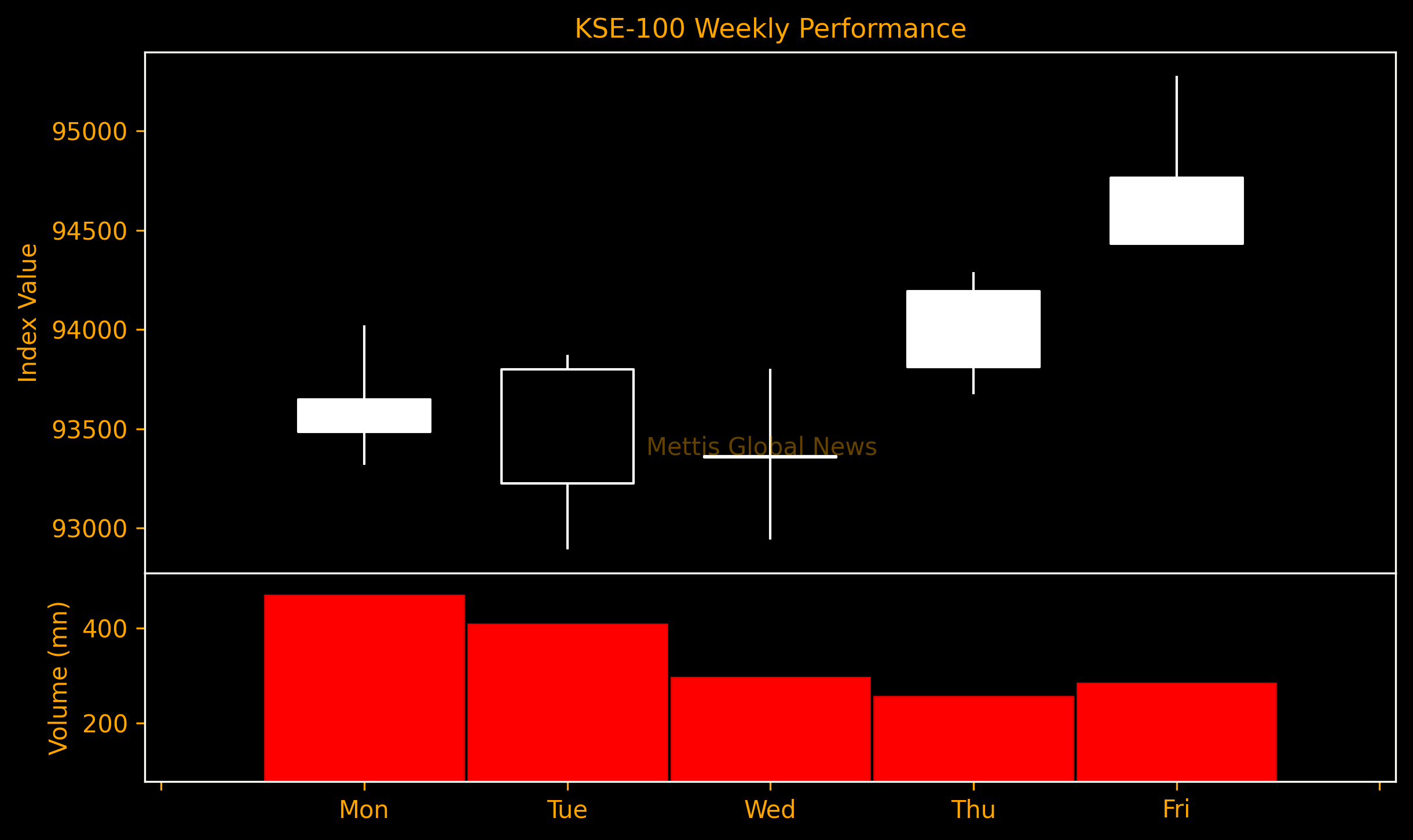

The stock benchmark notched its fourth consecutive weekly gain, the longest winning streak since April.

KSE-100 Index jumped 1,472 points or 1.6% in both PKR and USD terms to close at 94,764.

Throughout the week, KSE-100 traded in a range of 2,385 points, between a high of 95,278 (+1,987) and a low of 92,893 (-399) points.

Pakistan stock market's average traded volume rose 19.6% WoW to 878.54 million shares. Traded value also increased 10.1% WoW to Rs32.66 billion.

Market capitalization increased by $836.35m or 1.9% to $43.96bn over the week. In PKR terms, market capitalization stood at Rs12.21 trillion.

In economic news, Pakistan's short-term inflation eased significantly to 4.16% over the prior year, the lowest annual gain since October 2018 when a different base was used.

In another positive sign for the economy, the central government's total debt saw its first decline since February, which fell by Rs792.1bn or 1.1% to Rs69.57 trillion at the end of September.

That was the largest monthly drop since September last year, State Bank of Pakistan (SBP) reported Monday.

As a percentage of Gross Domestic Product (FY25B), it dropped to around 56%, the lowest level since May 2023.

Meanwhile, the country’s economic activity remains sluggish. Large-scale manufacturing (LSM) sector recorded a decline of 1.92% in September 2024 compared to last year. In the first quarter of fiscal year 2024-25, LSM contracted 0.76% year-on-year.

SBP conducted two auctions during the week, picking up Rs776bn through T-bills, and Rs540bn through floating rate PIBs.

The government slashed the rate for three-month T-bills by 20bps to 13.69% while the yield on benchmark six-month tenor was kept unchanged at 13.5%.

Meanwhile, the yield on 12-month papers was increased by 10bps to 13.19%.

For the floating rate PIBs, the yield stood at 14.29% for the five-year bond and 14.82% for the ten-year bond.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (+478pts), Oil & Gas Exploration Companies (+473pts), Pharmaceuticals (+269pts), Oil & Gas Marketing Companies (+120pts), and Technology & Communication (+95pts).

Contrary to that, negative contributions came from Fertilizer (-186pts), Automobile Assembler (-68pts), Cement (-28pts), Automobile Parts & Accessories (-24pts), and Chemical (-9pts).

The best-performing stocks during the week were MARI (+381pts), UBL (+280pts), TRG (+138pts), LUCK (+124pts), and SEARL (+120pts).

Whereas, the worst-performing were FFC (-133pts), SYS (-48pts), MLCF (-41pts), FCCL (-38pts), and ENGRO (-35pts).

FIPI/LIPI

Foreign investors were net sellers during the week, dumping a significant $10.6m worth of equities.

Flow-wise, Mutual funds were the dominant buyers, with a net investment of $14.0m.

They allocated the majority of their capital, $5.0m, to Oil and Gas Exploration Companies, followed by Oil and Gas Marketing Companies at $4.6m, and Commercial Banks at $2.8m.

On the other hand, the leading sellers were Companies, with a net sale of $11m.

Their most substantial sales activity was in Oil and Gas Exploration Companies amounting to $6.7m, followed by Commercial Banks at $2.4m.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 125,627.31 258.99M |

1.00% 1248.25 |

| ALLSHR | 78,584.71 1,142.41M |

1.16% 904.89 |

| KSE30 | 38,153.79 69.25M |

0.63% 238.06 |

| KMI30 | 184,886.50 91.38M |

0.01% 13.72 |

| KMIALLSHR | 53,763.81 554.57M |

0.54% 290.61 |

| BKTi | 31,921.68 33.15M |

1.78% 557.94 |

| OGTi | 27,773.98 9.65M |

-0.40% -112.21 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 108,145.00 | 109,565.00 107,195.00 |

660.00 0.61% |

| BRENT CRUDE | 66.72 | 67.20 65.92 |

-0.08 -0.12% |

| RICHARDS BAY COAL MONTHLY | 97.00 | 97.00 97.00 |

1.05 1.09% |

| ROTTERDAM COAL MONTHLY | 107.65 | 107.65 105.85 |

1.25 1.17% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 |

0.00 0.00% |

| CRUDE OIL - WTI | 65.08 | 65.82 64.50 |

-0.44 -0.67% |

| SUGAR #11 WORLD | 16.19 | 16.74 16.14 |

-0.52 -3.11% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|