Weekly Market Roundup

Abdur Rahman | September 21, 2024 at 11:16 PM GMT+05:00

September 21, 2024 (MLN): Pakistani equities soared to a fresh record this week as declining bond yields and improving macroeconomic indicators boosted sentiments and helped offset substantial selling from foreign investors.

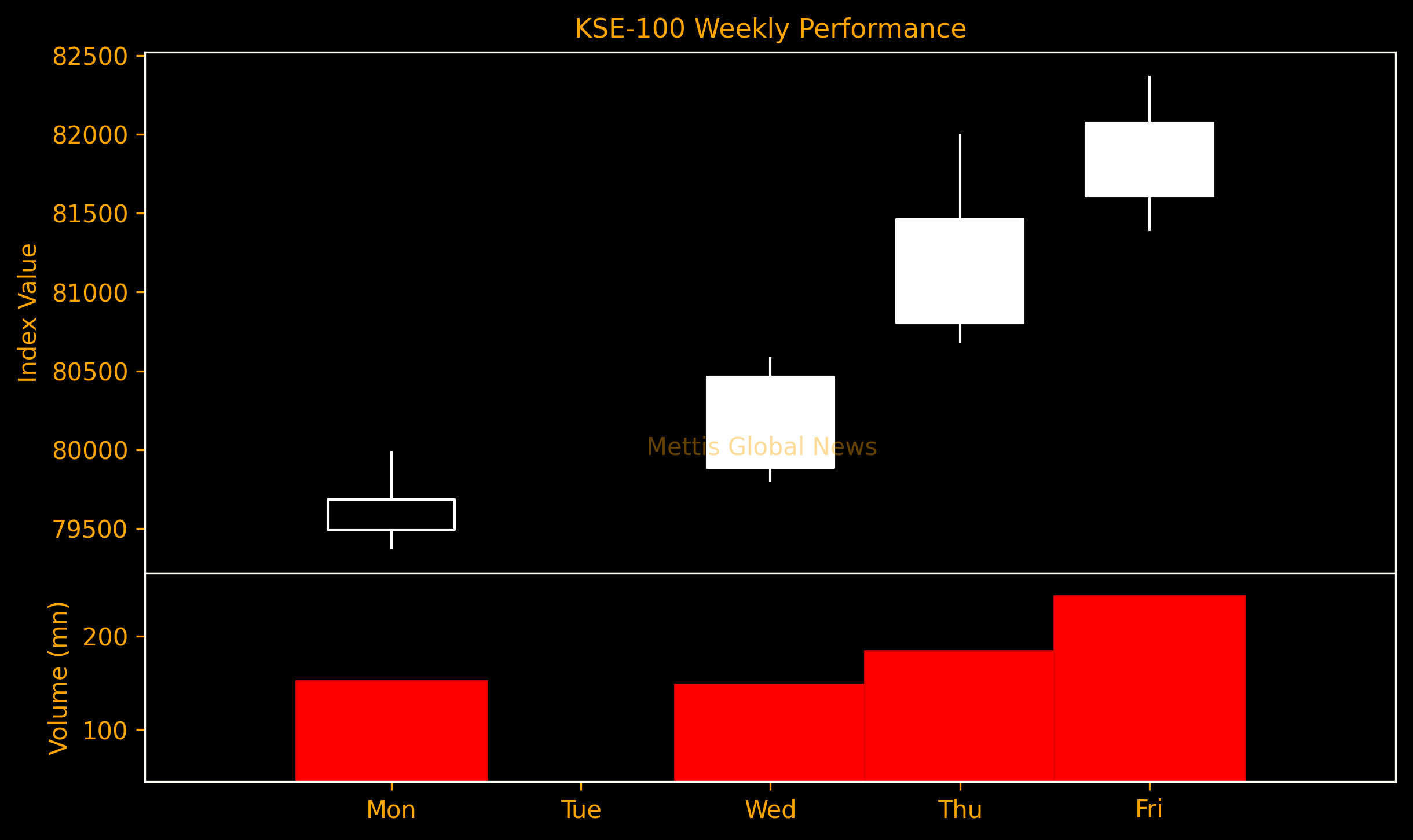

The stock benchmark KSE-100 Index closed at an all-time high of 82,074, a significant increase of 2,741 points or 3.5%. In USD terms, the KSE-100 increased 3.6% to post its biggest weekly gain since June.

Traders have ramped up bets for further outsized interest rate cuts by the central bank after the State Bank of Pakistan (SBP) slashed yields on Pakistan Investment Bonds (PIBs) by as much as 335bps in yesterday's auction.

Throughout the week, KSE-100 traded in a wide range range of 3,004 points, between a high of 82,372 (+3,039) and a low of 79,368 (+35) points.

Pakistan stock market's average traded volume slumped 22.6% to 469.45 million shares compared to last week. However, traded value rose 20.7% Rs18.4 billion.

The market capitalization increased by $693.02m or 1.8% to $38.59bn over the week. In PKR terms, market capitalization stood at Rs10.72 trillion.

The stock index is up a significant 19,623 points or 31.4% so far this year. Despite the rally, valuation metrics suggest stocks are still cheap compared to historic levels and its peers.

The country's current account posted a surplus of $75 million after three consecutive monthly deficits. In the first two months of current fiscal year, the deficit narrowed by 80.9% to $171m from $893m in 2MFY24.

The external account position improved largely due to home remittances despite upsurge in imports.

Pakistan's inflation rate fell to single digits in August after almost three years. The consumer price gains are expected to further slow in September to 7.5% over the prior year, according to MG Research calculations.

Globally, traders have been put in a bullish mood by the Federal Reserve's decision to go big on its first reduction since the start of the Covid pandemic, opting for 50 basis points instead of 25.

The US stock benchmark S&P 500 climbed 1.4% to all-time high weekly closing of 5,702.55, extending this year’s surge to about 20%.

FIPI/LIPI

Foreign investors dumped a significant $23.2 million of Pakistani equities this week, their biggest selling on a net basis in almost three years. That was also the third weekly net selling in a row.

The most substantial sales activity this week was in fertilizer stocks, as foreigners offloaded $9.83m worth of stocks, followed by oil and gas exploration companies with net sales of $6.14m, and commercial banks at $2.78m.

The leading sellers were Foreign Corporates as they offloaded $24.6m. While foreign individuals and overseas Pakistanis bought $1.41m on net basis.

Flow-wise, Mutual Funds were the dominant buyers during the week, with a net investment of $15.53m. They allocated the majority of their capital, $7.71m, to Fertilizer.

Top Index Movers

Sector-wise, top positive contributors were Commercial Banks (+1,139pts), Oil & Gas Exploration Companies (+637pts), Fertilizer (+631pts), Cement (+161pts), and Oil & Gas Marketing Companies (+74pts).

Contrary to that, negative contributions came from Refinery (-30pts), Engineering (-29pts), Glass & Ceramics, (-24pts), Automobile Parts & Accessories (-21pts), and Insurance (-21pts).

The best-performing stocks during the week were MARI (+567pts), FFC (+324pts), MEBL (+304pts), EFERT (+287pts), and MCB (+278pts).

Mari Petroleum (PSX: MARI) extended its rally further following a substantial 1,340% dividend and 800% bonus shares issuance.

Such a large bonus issue can help attract smaller investors as it reduces share price by redistributing the amount of equity across a larger number of shares. It is worth noting that it does not change the overall valuation of the company.

It also provides a psychological boost to investors.

Whereas, NBP, PPL, DGKC, FFBL, and TGL collectively took away 134 points from the index.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 139,978.17 121.39M | 1.13% 1565.92 |

| ALLSHR | 86,694.50 249.77M | 1.16% 991.54 |

| KSE30 | 42,780.30 67.96M | 1.24% 525.46 |

| KMI30 | 197,152.16 71.65M | 1.57% 3042.57 |

| KMIALLSHR | 57,531.58 127.28M | 1.44% 817.92 |

| BKTi | 38,174.12 8.45M | 0.91% 342.78 |

| OGTi | 28,485.88 32.59M | 3.81% 1045.25 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 119,590.00 | 119,605.00 117,905.00 | 1970.00 1.67% |

| BRENT CRUDE | 72.27 | 72.82 72.16 | -0.97 -1.32% |

| RICHARDS BAY COAL MONTHLY | 96.50 | 0.00 0.00 | 2.20 2.33% |

| ROTTERDAM COAL MONTHLY | 104.50 | 104.50 104.50 | -0.30 -0.29% |

| USD RBD PALM OLEIN | 998.50 | 998.50 998.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 69.90 | 70.41 69.80 | -0.10 -0.14% |

| SUGAR #11 WORLD | 16.46 | 16.58 16.37 | -0.13 -0.78% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

Consumer Confidence Survey

Consumer Confidence Survey