Weekly Market Roundup

Abdur Rahman | July 21, 2024 at 06:15 PM GMT+05:00

July 21, 2024 (MLN): Pakistan stocks ended a holiday-shortened week largely flat after some volatile sessions.

The stock market kicked off the short week on a bullish note after the nation secured a $7 billion loan deal from the International Monetary Fund, but then gave up much of its advance amid uncertainty over the political front.

The benchmark KSE-100 Index closed at 80,118 showing a marginal increase of 174 points or 0.2% WoW.

Throughout the week, KSE-100 traded in a range of 2,127 points, between a high of 81,940 (+1,996) and a low of 79,813 (-131) points.

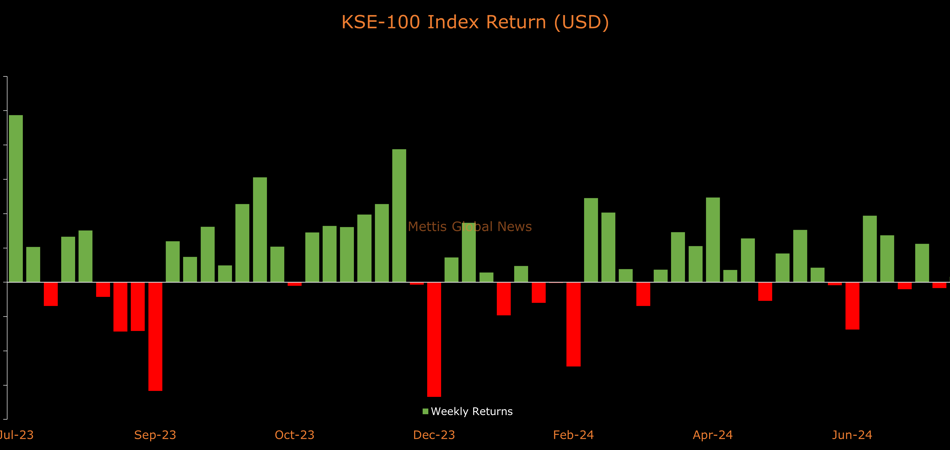

On the currency front, the Pakistani Rupee jumped 0.10% WoW. In USD terms, the KSE-100 index gained 0.3% this week.

PSX average traded volume was recorded at 463.55 million shares worth Rs26.81bn, marking an increase of 5.6% WoW in the number of shares and 29.1% WoW in traded value.

Meanwhile, the PSX market capitalization increased by $154.76m or 0.4% to $38.34bn over the week. In PKR terms, market capitalization stood at Rs10.66 trillion.

In an unexpected move, the government slashed the capital gains tax (CGT) rates for non-filers by half on securities acquired during the last two years.

The tax rates on capital gains for securities acquired between July 01, 2022, and June 30, 2024, have been reduced by 50% for all holding period categories for non-filers.

This reduction brings the tax rate for non-filers in line with that of investors appearing in the active taxpayer list (ATL). Previously, it was double.

In economic news, Pakistan's current account recorded its smallest deficit in 13 years amid robust growth in remittances and exports, which more than offset the uptick in imports.

Meanwhile, the cash-strapped nation attracted $1.52bn total foreign investment in FY24, up from $601m last year.

During the week, the government raised petrol and diesel prices by Rs9.99 and Rs6.18 per litre.

To note, the KSE-100 Index is up 2.1% so far this month and more than double since the IMF's $3bn loan deal.

Top Index Movers

Sector-wise, top positive contributors were Oil & Gas Exploration Companies (207pts), Technology & Communication (103pts), Fertilizer (85pts), Cement (83pts), and Automobile Parts & Accessories (57pts).

Contrary to that, negative contributions came from Power Generation & Distribution (252pts), Tobacco (51pts), Engineering, (47pts), Pharmaceuticals (45pts), and Commercial Banks (41pts).

The best-performing stocks during the week were POL (129pts), ENGRO (126pts), MCB (115pts), UBL (79pts), and LUCK (68pts).

Whereas, HUBC, HBL, FFC, NBP, and PKGP collectively took away 444 points from the index.

FIPI/LIPI

Foreign investors were net buyers during the week, acquiring $9.33m worth of equities.

Flow-wise, Foreign Corporates were the dominant buyers, with a net investment of $6.50m.

They allocated the majority of their capital, $3.46m, to Technology and Communication, while divesting from the Cement sector, amounting to $0.35m in sales.

On the other hand, the leading sellers were Insurance Companies, with a net sale of $7.66m.

Their most substantial sales activity was in All other Sectors, amounting to $2.93m, while they acquired $0.26m of equities in the Cement.

Copyright Mettis Link News

Related News

| Name | Price/Vol | %Chg/NChg |

|---|---|---|

| KSE100 | 174,333.17 234.93M | -0.08% -139.62 |

| ALLSHR | 104,743.79 494.02M | 0.09% 92.46 |

| KSE30 | 53,420.96 86.18M | -0.13% -69.55 |

| KMI30 | 249,567.76 95.16M | -0.04% -96.13 |

| KMIALLSHR | 68,073.54 284.09M | 0.05% 34.06 |

| BKTi | 48,264.51 15.77M | -0.21% -103.63 |

| OGTi | 35,024.86 9.11M | 0.45% 157.48 |

| Symbol | Bid/Ask | High/Low |

|---|

| Name | Last | High/Low | Chg/%Chg |

|---|---|---|---|

| BITCOIN FUTURES | 88,865.00 | 89,270.00 88,525.00 | 605.00 0.69% |

| BRENT CRUDE | 61.32 | 61.63 61.16 | -0.01 -0.02% |

| RICHARDS BAY COAL MONTHLY | 86.75 | 0.00 0.00 | -0.10 -0.12% |

| ROTTERDAM COAL MONTHLY | 96.75 | 96.75 96.30 | 0.45 0.47% |

| USD RBD PALM OLEIN | 1,027.50 | 1,027.50 1,027.50 | 0.00 0.00% |

| CRUDE OIL - WTI | 57.94 | 58.24 57.79 | -0.01 -0.02% |

| SUGAR #11 WORLD | 14.86 | 15.26 14.80 | -0.40 -2.62% |

Chart of the Day

Latest News

Top 5 things to watch in this week

Pakistan Stock Movers

| Name | Last | Chg/%Chg |

|---|

| Name | Last | Chg/%Chg |

|---|

National Accounts Q1 FY26

National Accounts Q1 FY26